User Reviews

More

User comment

6

CommentsWrite a review

2024-07-17 18:04

2024-07-17 18:04

2024-06-14 15:21

2024-06-14 15:21

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

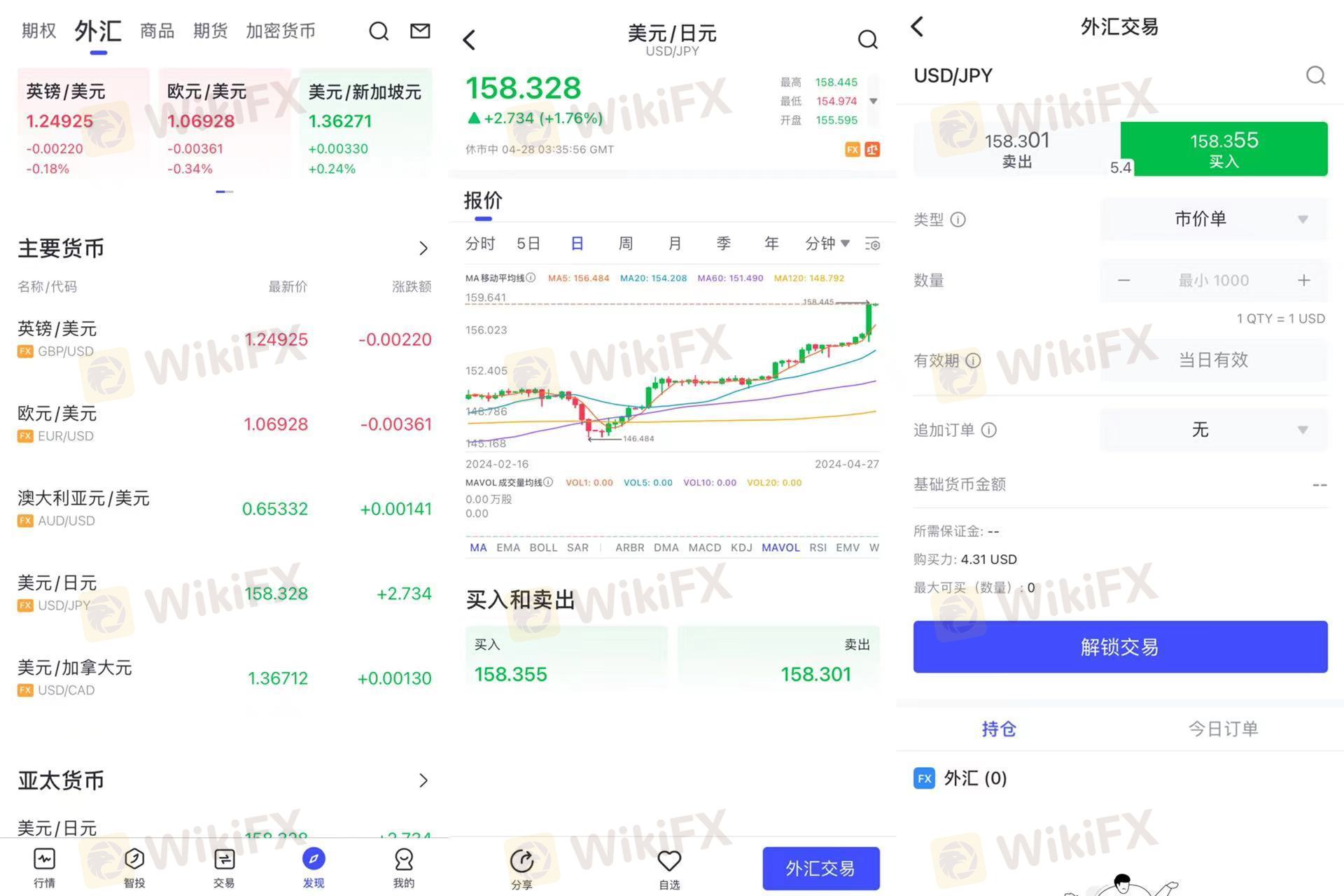

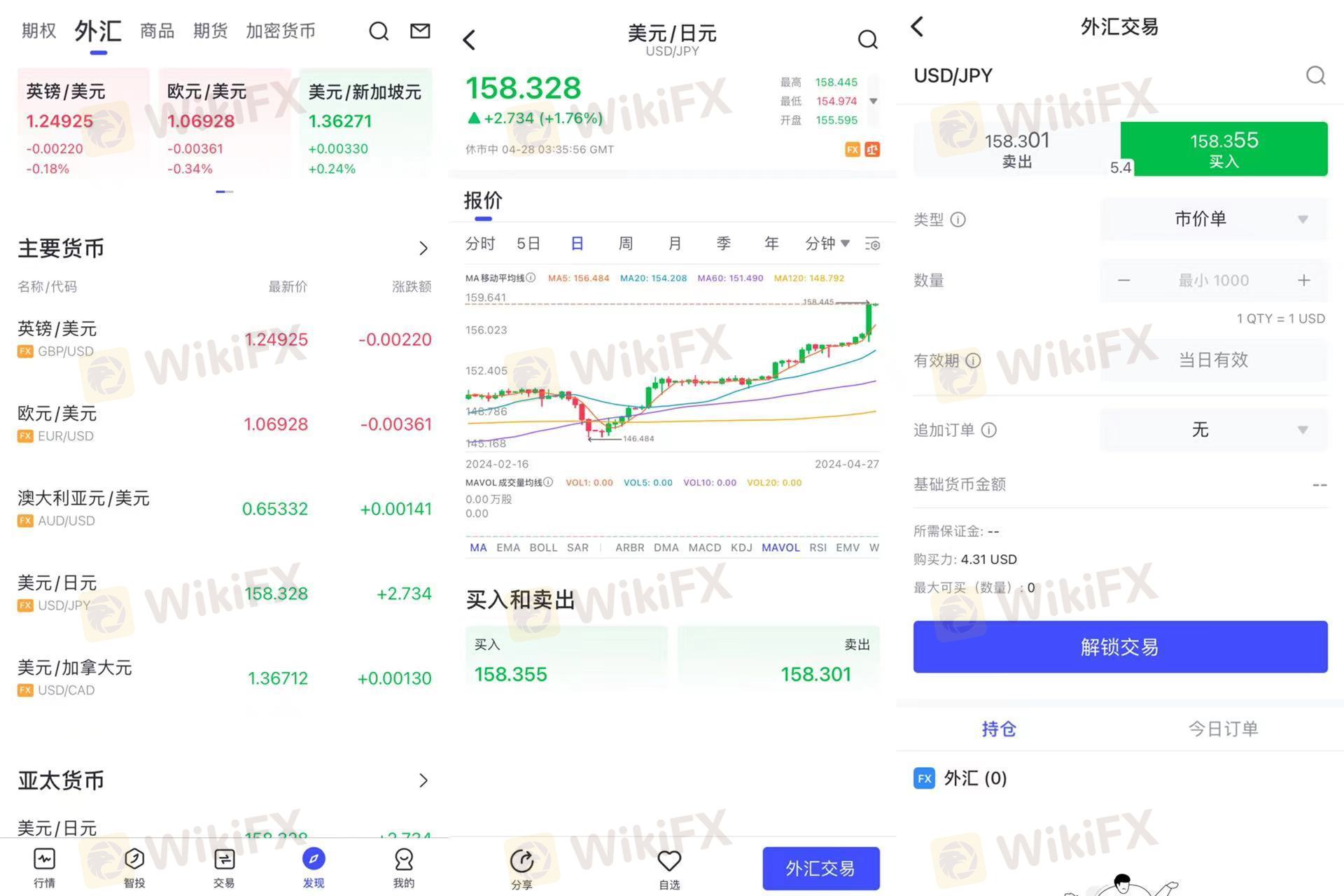

Regulatory Index0.00

Business Index6.02

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

GTCFx Markets

Company Abbreviation

GTCFx

Platform registered country and region

Saint Vincent and the Grenadines

Company website

Pyramid scheme complaint

Expose

More

User comment

6

CommentsWrite a review

2024-07-17 18:04

2024-07-17 18:04

2024-06-14 15:21

2024-06-14 15:21