User Reviews

More

User comment

3

CommentsWrite a review

2023-10-20 20:03

2023-10-20 20:03

2022-11-29 10:43

2022-11-29 10:43

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.51

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

ACEFX LIMITED

Company Abbreviation

Ace Forex

Platform registered country and region

South Korea

Company website

Company summary

Pyramid scheme complaint

Expose

| Ace Forex Review Summary in 10 Points | |

| Founded | 2-5 years |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Not regulated |

| Market Instruments & Financial services | Forex, CFDs, Commodities, Binary Option |

| Demo Account | Available |

| Leverage | Up to 1:500 |

| Spread | Start from 0.6 pips |

| Trading Platforms | MT5, Ace Forex Lite, Ace Multi- Terminal |

| Minimum Deposit | USD 50 |

| Customer Support | Phone, Email, Fax, Address, Contact us form, FAQ |

Ace Forex is a global brokerage firm based in Saint Vincent and the Grenadines while operates in Seoul. It provides traders with access to market instruments including Share Forex, CFDs, Commodities, Binary Option. However, it is important to note Ace Forex is currently not regulated by any recognized financial authorities which raises concerns when trading.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

| Pros | Cons |

| • Multiple account types | • Not regulated |

| • Multiple customer support channels | • Not accept clients from the US |

| • Demo account available | |

| • Multiple trading tools available | |

| • Acceptable minimum deposit | |

| • MT5 trading platform | |

| • No deposit and withdrawal fees | |

| • Free commission | |

| • Flexible leverage ratios |

There are many alternative brokers to Ace Forex depending on the specific needs and preferences of the trader. Some popular options include:

TeleTrade - TeleTrade offers a diverse range of trading instruments and educational resources, making it suitable for both beginners and experienced traders.

UFX - UFX provides a user-friendly trading platform with a focus on customer support, making it a good option for traders seeking a supportive trading environment.

Just2Trade- Just2Trade offers a variety of account types and access to multiple markets, making it a versatile choice for traders looking to diversify their investments.

When considering the safety of a brokerage like Ace Forex or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: Its been verified that the broker is currently not regulated by any recognized financial authorities, which means that there is no guarantee that it is a safe platform to trade with.

User feedback: Read reviews and feedback from other clients to get an understanding of their experiences with the company. Look for reviews on reputable websites and forums.

Ultimately, the decision of whether or not to trade with Ace Forex is a personal one. You should weigh the risks and benefits carefully before making a decision.

Ace Forex provides a versatile trading platform with a comprehensive selection of market instruments, catering to the diverse needs and preferences of traders.

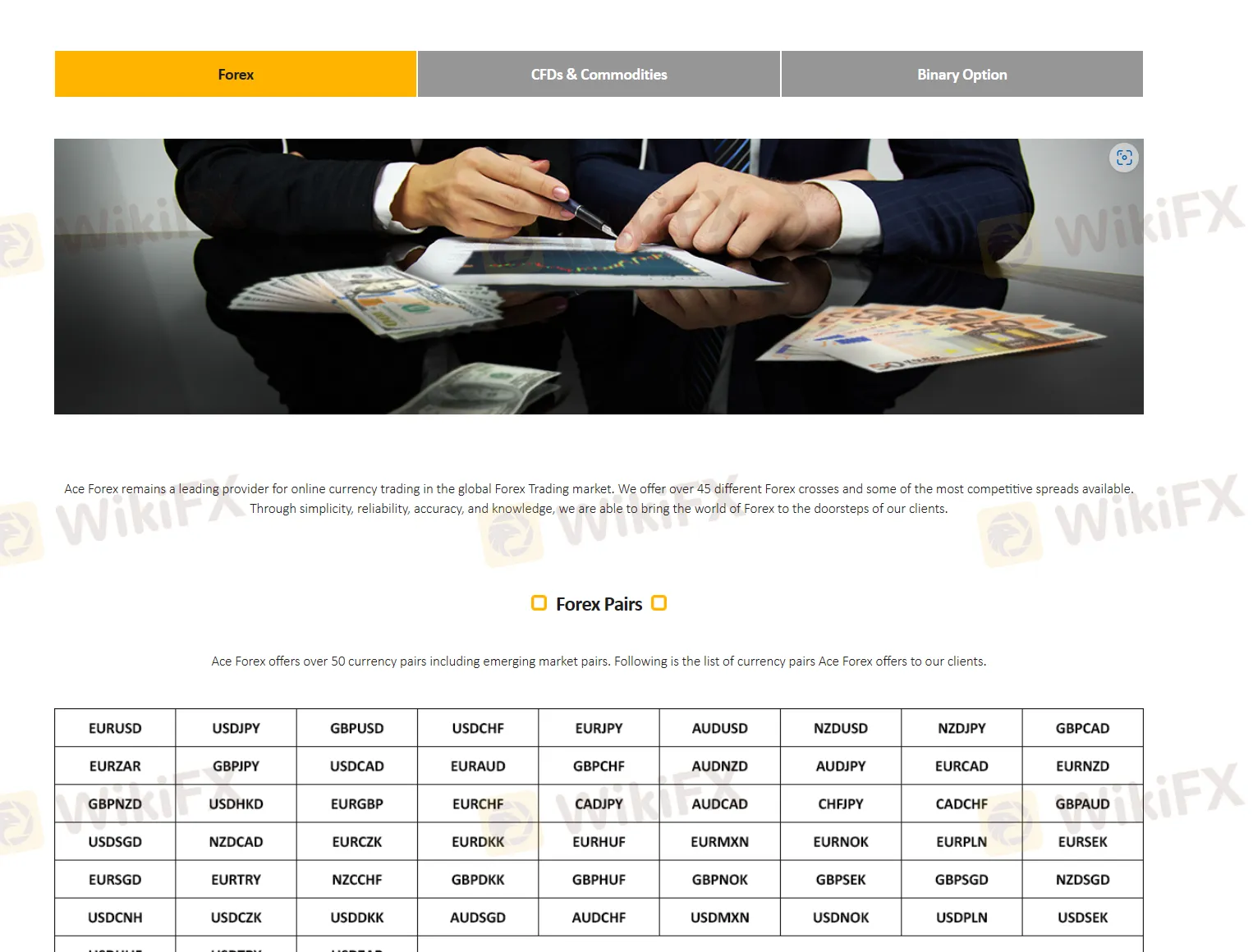

Forex enthusiasts can engage in currency trading across 57 pairs, including major currencies like EUR/USD and GBP/USD, as well as exotic pairs for those seeking unique opportunities.

Furthermore, Ace Forex offers Contracts for Difference (CFDs), enabling traders to speculate on the price movements of various assets like stocks, indices, and commodities without owning the underlying assets.

Traders interested in commodities can access a range of options, including precious metals like gold and silver, as well as commodities like crude oil, allowing them to participate in the dynamic commodities market.

Additionally, for those seeking simplicity and fixed returns, Ace Forex offers Binary Options, providing a straightforward way to speculate on price movements.

Ace Forex provides a diverse range of account options tailored to accommodate traders with varying experience levels and financial preferences.

For those looking to dip their toes into the world of trading or test their strategies risk-free, Ace Forex offers a demo account, allowing traders to practice with virtual funds before committing real capital.

For beginners and traders with limited resources, the Micro Account, with its low minimum deposit of USD 50, offers an accessible entry point into live trading.

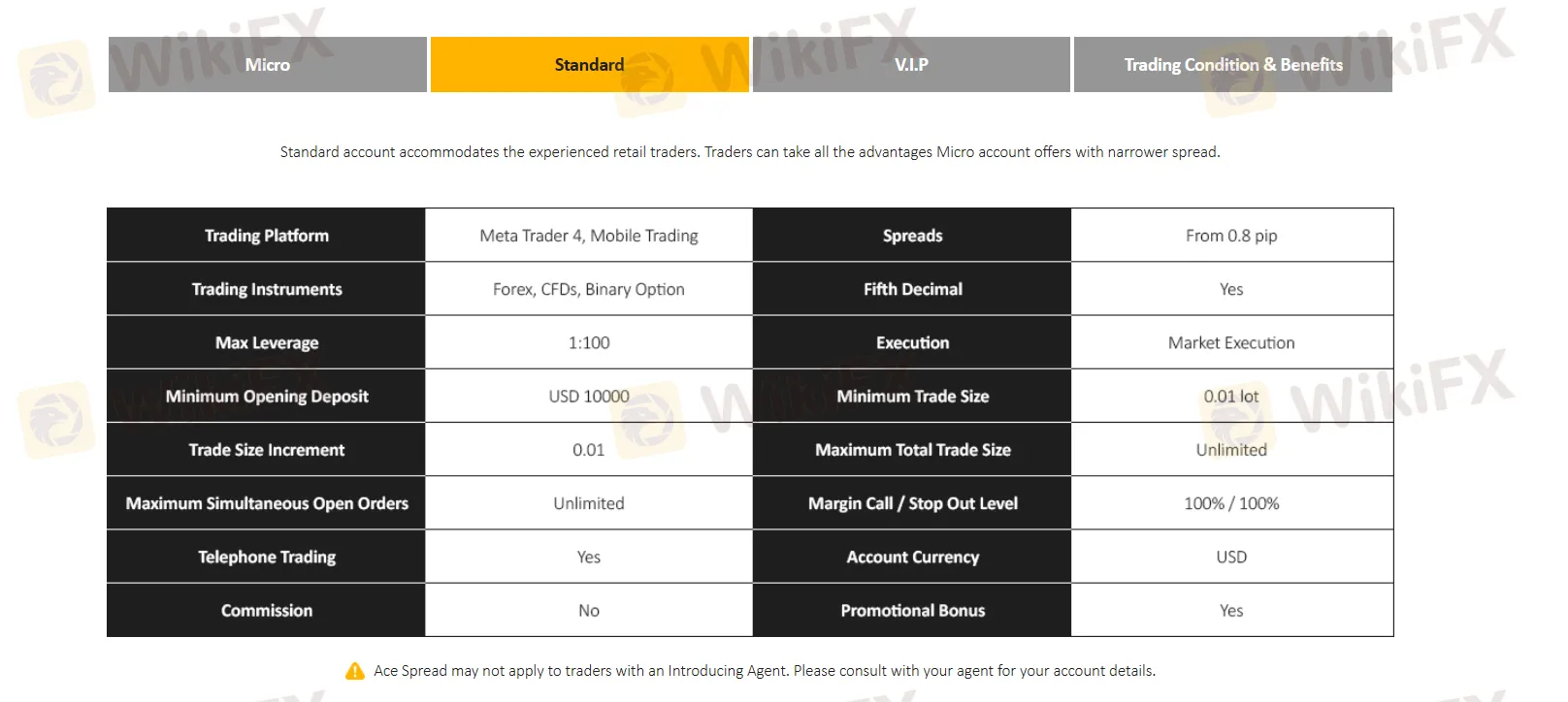

Those seeking a more comprehensive trading experience can opt for the Standard Account, requiring a minimum deposit of USD 10,000, which provides access to a wider array of features and instruments.

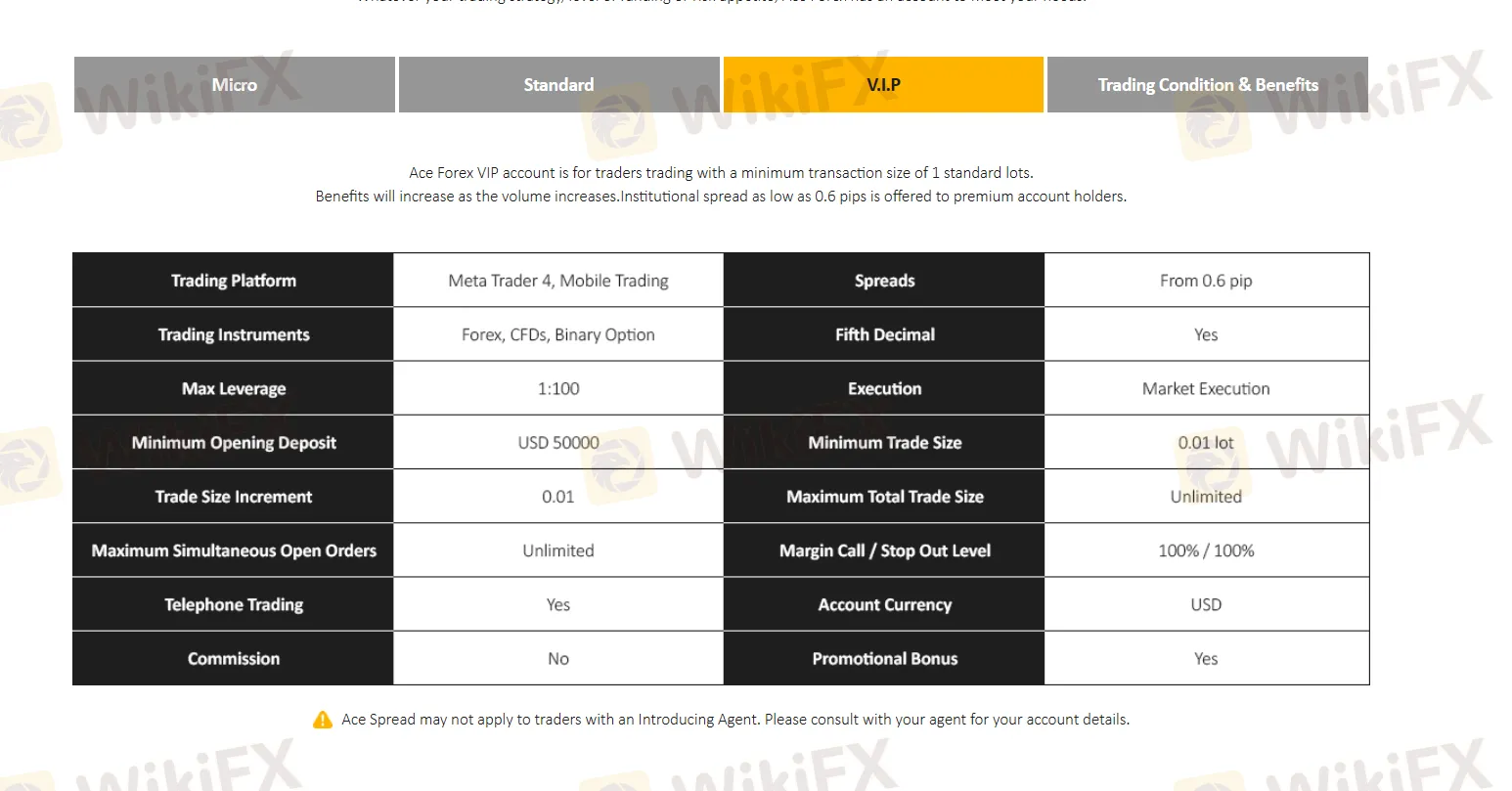

Finally, for high-net-worth individuals or experienced traders, the VIP Account, requiring a minimum deposit of USD 50,000, offers exclusive perks, personalized support, and premium trading conditions.

Ace Forexs each account type has different leverage levels to accommodate the trading preferences and risk tolerance of its clients.

The Micro Account provides a high leverage of 1:500, which can be appealing to traders who want to amplify their positions with a smaller capital outlay.

The Standard Account and the VIP Account, on the other hand, offers same leverage of 1:100, providing a balanced approach between risk and opportunity, suitable for many traders with moderate risk tolerance.

However, while higher leverage can enhance trading power, it also increases risk significantly. Traders should exercise caution, employ risk management strategies, and fully understand the implications of leveraged trading before using such high leverage levels. It's crucial to ensure that leverage is used wisely and in accordance with one's risk tolerance and trading experience to mitigate the potential for substantial losses.

Ace Forexs account options suit diverse trading preferences of its clients, each offering competitive spreads and a commission-free structure.

The Micro Account boasts a spread as low as 1.0 pips, making it an attractive choice for traders who value cost-effective trading with smaller position sizes.

The Standard Account takes it a step further with a tighter spread of just 0.8 pips, appealing to traders seeking enhanced pricing transparency and efficiency in their trades.

For those who demand the utmost in trading precision, the VIP Account offers an even narrower spread of 0.6 pips, ideal for experienced traders and those executing larger trades.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commissions |

| Ace Forex | From 0.6 pips | No commissions |

| TeleTrade | 0.2 pips | Variable (depending on account) |

| UFX | Vary on the account type and asset class | Not disclosed |

| Just2Trade | From 0.0 pips | Variable (depending on account) |

Please keep in mind that spread values can vary depending on market conditions, account type, and other factors. Commission structures may also differ based on the broker's pricing model and the type of account being used. It's important to review the official websites or contact the brokers directly for the most accurate and up-to-date information on spreads and commissions.

Ace Forex presents a versatile array of trading platforms available on PC, mobile devices and web browser, catering to the diverse needs and preferences of its clients.

The MetaTrader 5 (MT5) platform is a powerful and widely acclaimed choice, offering an extensive range of tools and features for traders of all levels, from beginners to advanced professionals.

For those seeking a simpler and more streamlined trading experience, the Ace Forex Lite platform provides an accessible and user-friendly option, ensuring a smooth onboarding process.

The Ace Multi-Terminal is designed for traders managing multiple accounts, offering efficiency and convenience for those overseeing various portfolios simultaneously.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Ace Forex | MT5, Ace Forex Lite, Ace Multi- Terminal |

| TeleTrade | MT4, MT5 |

| UFX | Web, mobile, MT4, MT5 |

| Just2Trade | MT4/5, CQG, Sterling Trader Pro |

Ace Forex offers a robust suite of trading tools designed to empower traders and enhance their trading experience.

First and foremost, the inclusion of an economic calendar allows traders to stay informed about upcoming economic events and announcements that can significantly impact financial markets. This tool enables traders to make well-informed decisions by understanding the potential market volatility associated with these events.

Additionally, Ace Forex provides traders with the flexibility to use trailing stops, allowing for automatic adjustments of stop-loss orders as market conditions change. This helps traders protect their profits and manage risk effectively.

Moreover, Ace Forex supports the use of Expert Advisors (EAs), which are automated trading algorithms that can execute trades on behalf of traders based on predefined criteria.

These tools collectively offer traders the means to stay informed, manage risk, and implement trading strategies efficiently.

Ace Forex offers a variety of convenient funding methods to cater to the diverse preferences of its clients.

One of the primary options is bank wire transfer, which allows traders to transfer funds directly from their bank accounts to their Ace Forex trading accounts. Bank wire transfers are known for their reliability and security.

Additionally, Ace Forex accepts Visa and Mastercard payments, making it convenient for traders to fund their accounts using credit or debit cards. This method offers a straightforward and widely accepted way to deposit funds, providing flexibility and ease of use.

An overwhelming advantage of this broker is that it does not charge any deposit or withdrawal fees, making it a cost-effective choice for traders looking to manage their funds without incurring additional expenses.

Ace Forex provides multiple customer service options to assist its clients. Customers can reach out to Ace Forex through various channels to address their queries and concerns as below:

Phone: +8225017570

Fax: +8205041716786

Email:support@acefx24.com.

Address: A-608, Seochodaero 397 Bout ique Monaco, 397, Seocho-daero, Seocho-gu, Seoul.

Moreover, traders can submit inquiries via a convenient “Contact Us” form to address their questions.

In addition, Ace Forex also provides a helpful FAQ page as an additional resource for customer support, addressing common questions and inquiries.

According to available information, Ace Forex is a non-regulated Saint Vincent and the Grenadines -based brokerage firm who also operates in Jakarta. It offers a range of market instruments such as Forex, CFDs, Commodities, Binary Option as market instruments to traders. However, it is important to consider certain factors such as non-regulated status that might raise concerns.

It is critical that potential clients exercise caution, conduct thorough research and seek up-to-date information directly from Ace Forex before making any investment decisions.

| Q 1: | Is Ace Forex regulated? |

| A 1: | No, it‘s been verified the broker is currently under no valid regulations. |

| Q 2: | Does Ace Forex offer the industry leading MT4 & MT5? |

| A 2: | Yes, it offers MT5 on PC and mobile devices. |

| Q 3: | Is Ace Forex a good broker for beginners? |

| A3: | No, it’s not a good broker for beginners because it‘s not properly regulated. |

| Q 4: | Does Ace Forex offer demo accounts? |

| A 4: | Yes. |

| Q 5: | At Ace Forex, are there any regional restrictions for traders? |

| A 5: | Yes. Ace Forex does not accept clients/investors from the US. |

| Q 6: | What’s the minimum deposit of Ace Forex? |

| A 6: | Minimum deposit of this broker is USD 50. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

More

User comment

3

CommentsWrite a review

2023-10-20 20:03

2023-10-20 20:03

2022-11-29 10:43

2022-11-29 10:43