Dhan Spreads, leverage, minimum deposit Revealed

Abstract:Dhan is an unregulated financial services platform based in India that offers a variety of trading instruments across different asset classes, including Stocks, Options, Futures, Commodities, Currencies, ETFs (Exchange-Traded Funds), Mutual Funds, and IPOs (Initial Public Offerings).

| Dhan Review Summary | |

| Registered Country/Region | India |

| Regulation | No Regulation |

| Market Instruments | Stocks, Options, Futures, Commodity, Currency, ETFS, Mutual Funds, IPO |

| Demo Account | Unavailable |

| Trading Platforms | Dhan App, Dhan web, Options Trader App, Options Trader Web, Dhan + TradingView, TradingView, DhanHQ |

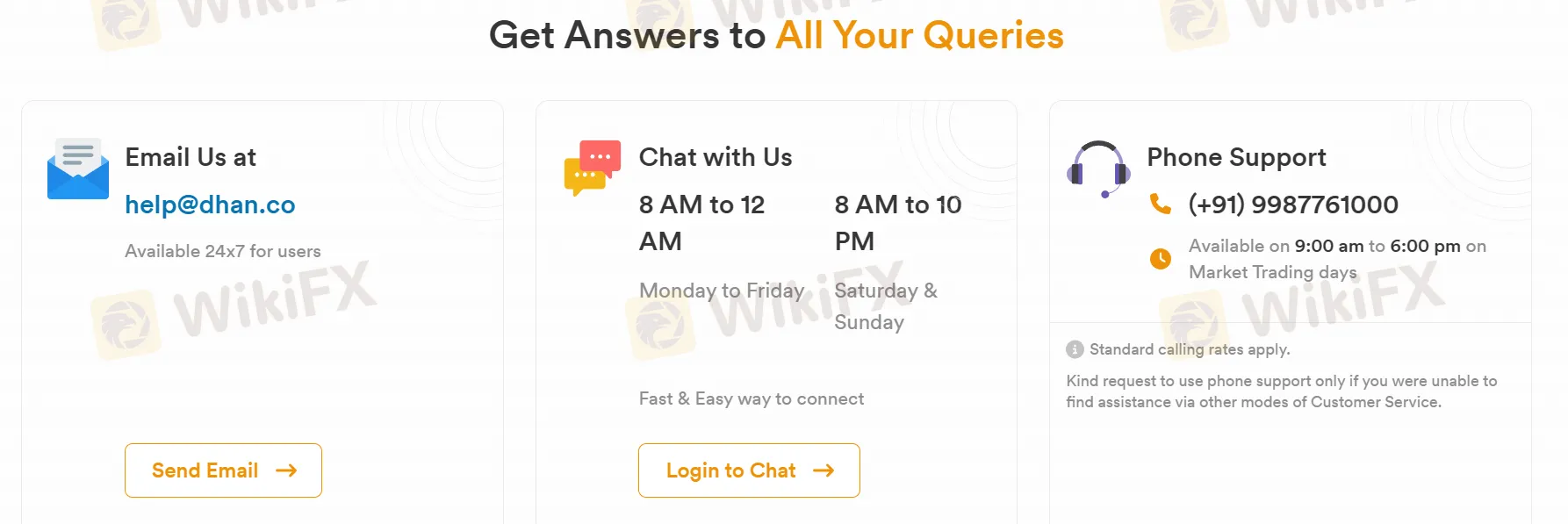

| Customer Support | Phone Number: (+91)9987761000 (Available on 9:00 am to 6:00 pm onMarket Trading days) |

| Email: help@dhan.co | |

| Address: 302, Western Edge l, Off Western Express Highway, Borivali East, Mumbai - 400066, Maharashtra, India. | |

| Twitter: https://twitter.com/DhanCares | |

| Live Chat (8 AM to 12 AM Monday to Friday, 8 AM to 10 PM Saturday & Sunday) | |

What is Dhan?

Dhan is an unregulated financial services platform based in India that offers a variety of trading instruments across different asset classes, including Stocks, Options, Futures, Commodities, Currencies, ETFs (Exchange-Traded Funds), Mutual Funds, and IPOs (Initial Public Offerings). The platform provides traders and investors with opportunities to engage in diverse markets. It is known for its user-friendly trading platforms, including the Dhan App & Web, Options Trader App & Web, Dhan + TradingView, TradingView, and DhanHQ.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

Pros:

No Account Opening or AMC Fees: ₹0 account opening charges and ₹0 Annual Maintenance Charge.

User-Friendly Trading Platforms: Platforms like Dhan App, Dhan Web, Options Trader, and DhanHQ cater to various trading needs.

Multiple Customer Support Channels: Dhan provides various customer support channels including phone, email, and Live Chat (8 AM to 12 AM Monday to Friday, 8 AM to 10 PM Saturday & Sunday), enhancing accessibility and assistance for clients.

Cons:

No Regulation: The lack of valid regulation raises significant safety and trust concerns, as regulatory oversight is crucial for ensuring customer protection and platform transparency. There are also reports of being unable to withdraw and scams, adding to the cons of the platform.

Is Dhan Safe or Scam?

Dhan currently lacks valid regulation, which raises significant concerns about its safety and legitimacy. Regulatory oversight is crucial for ensuring that a financial services provider operates within established standards and adheres to specific rules and requirements designed to protect investors and clients. Without proper regulation, there is an increased risk of fraudulent activities, scams, and inadequate consumer protection.

Market Instruments

Dhan provides an extensive range of trading instruments covering diverse asset classes.

Stocks: Invest in individual companies listed on stock exchanges.

Options: Trade contracts based on the future value of underlying assets like stocks.

Futures: Buy or sell contracts to buy or sell an asset at a specific price on a future date.

Commodities: Gain exposure to physical commodities like gold, oil, or agricultural products.

Currencies: Trade foreign exchange (forex) to speculate on currency movements.

ETFs (Exchange-Traded Funds): Invest in a basket of securities that track an underlying index.

Mutual Funds: Invest in professionally managed portfolios of various securities.

IPOs (Initial Public Offerings): Get access to newly issued shares of companies going public.

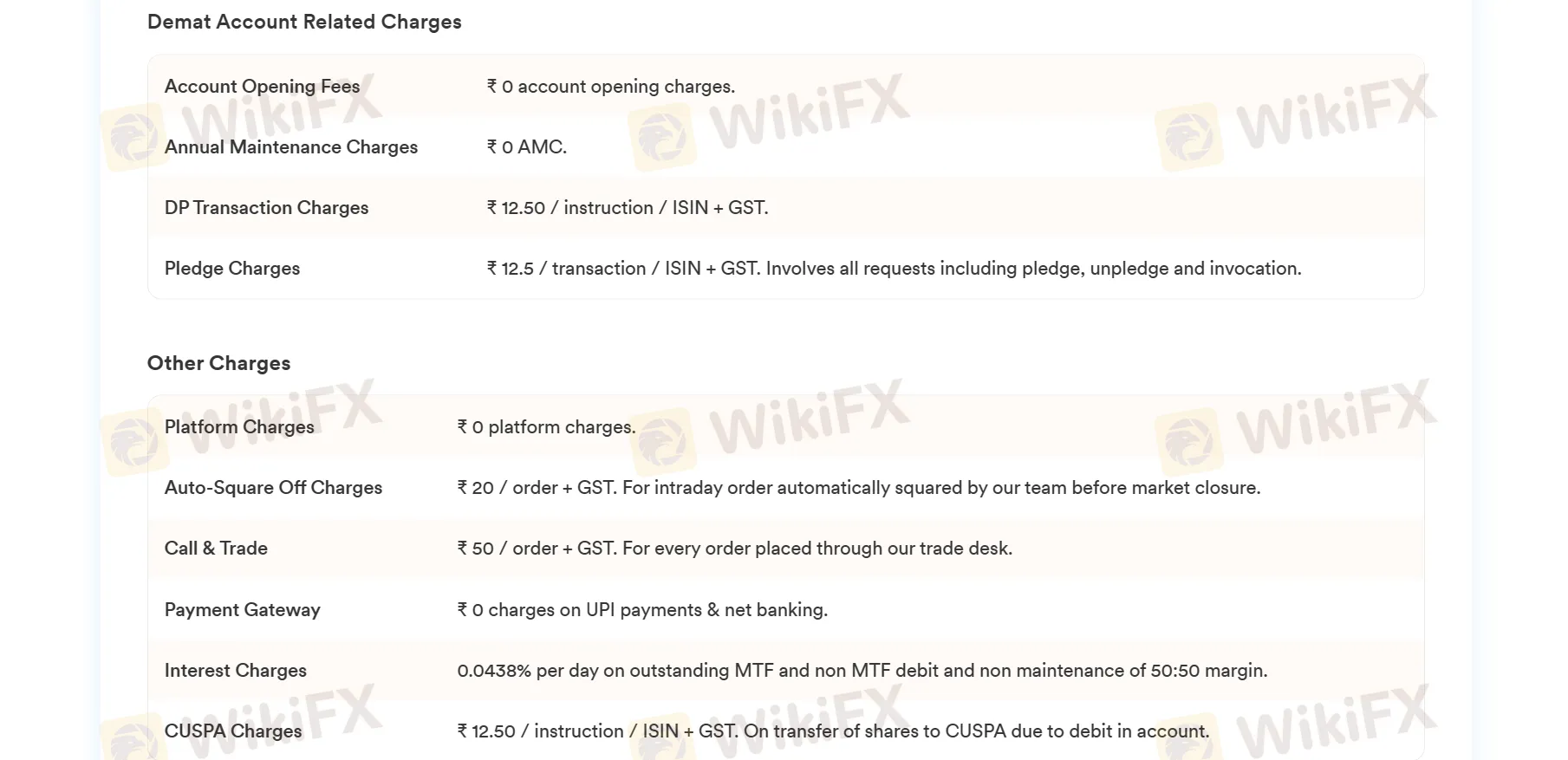

Demat Account

No Account Opening or Annual Maintenance Fees:

₹0 Account Opening Charge

₹0 Annual Maintenance Charge

Transaction Charges:

₹12.50 + GST per instruction/ISIN:

Demat & Pledge transactions (instructions like buy, sell, pledge, unpledge, invocation)

CUSPA Charges (transferring shares due to debit in account)

₹50 + GST per order: Call & Trade (orders placed through their trade desk)

Other:

₹0 Platform Charges

₹20 + GST per order: Auto-Square Off Charges (intraday orders automatically squared off before market closure)

0.0438% daily interest: On outstanding MTF and non-MTF debit, non-maintenance of 50:50 margin

₹0 charges: UPI payments & net banking

How to Open an Account?

Steps:

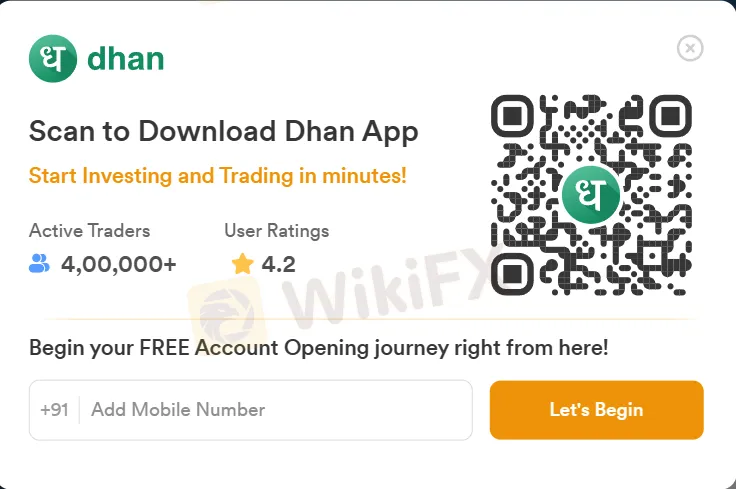

Click the button ''Open Account'' on the homepage.

Then click the button ''Start Now''.

Add your mobile number and follow the on-screen instructions to input your personal and contact details.

Set a secure password for your account.

Read and agree to the Terms and Conditions and any other policy as required.

Click on the ''Register'' option to finalize the creation of your account.

An email will typically be sent to your registered email address to verify your account. Ensure to check your inbox and spam folders.

Click on the link received in the verification email to activate your account.

Trading Platforms

Dhan caters to a variety of trading styles by offering multiple trading platforms.

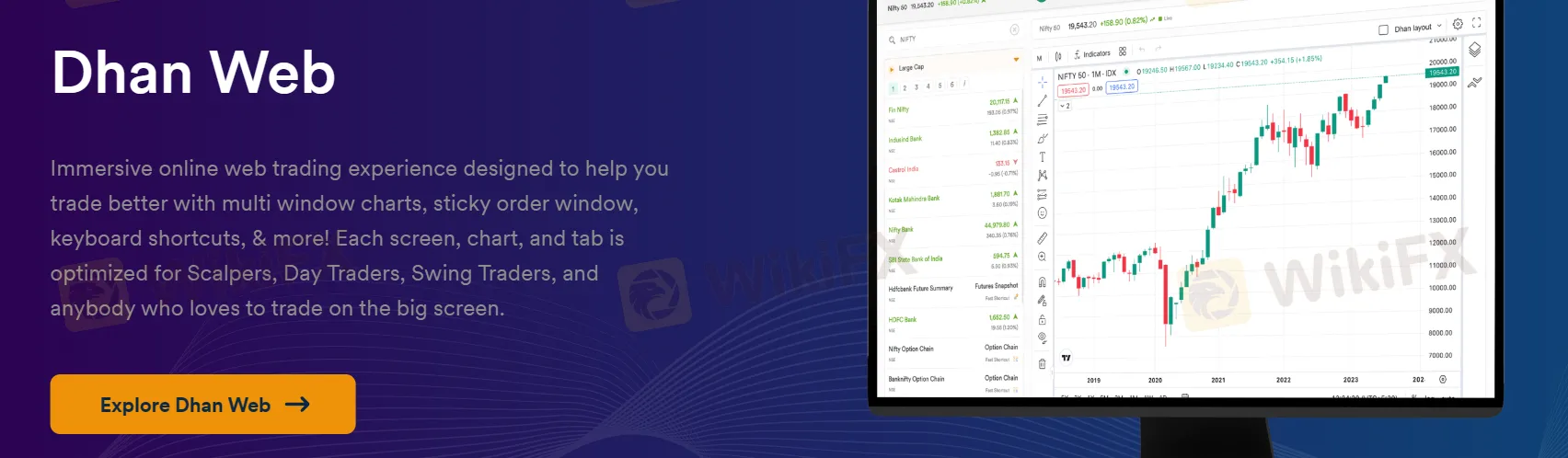

Dhan App & Dhan Web: All-in-one platforms for trading various assets on the go or from your desktop.

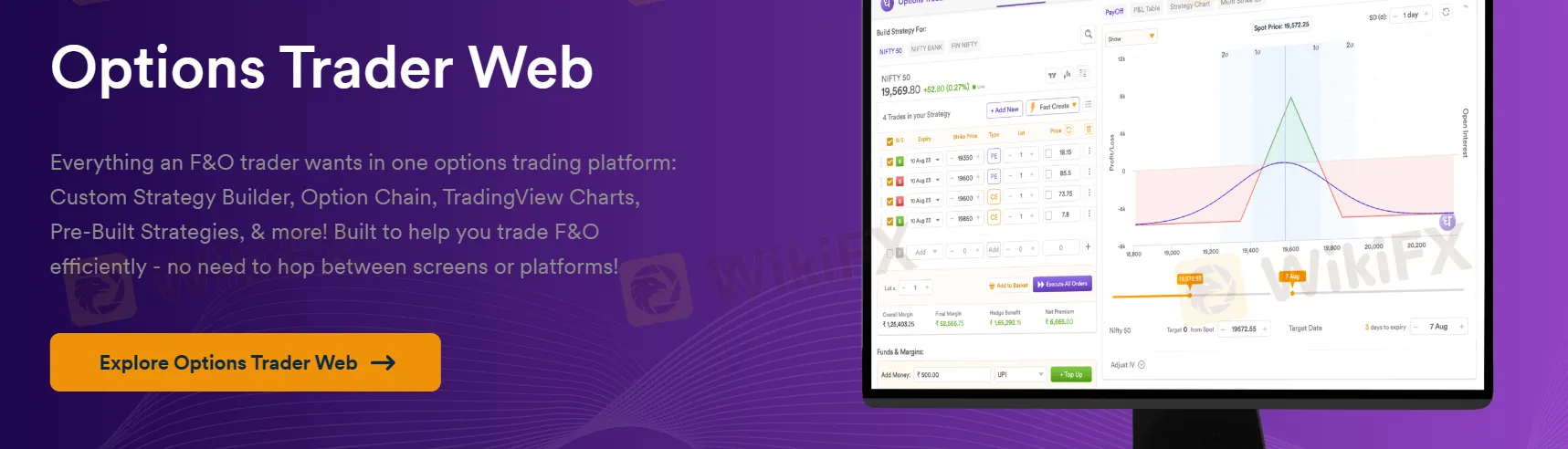

Options Trader App & Options Trader Web: Specialized platforms designed for options trading strategies.

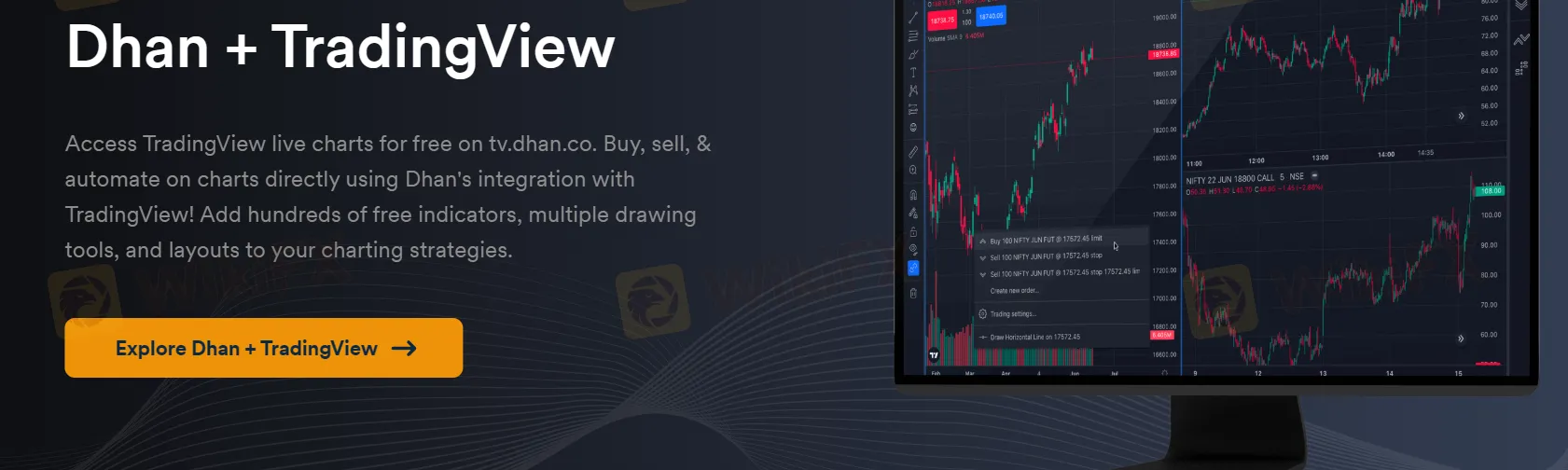

Dhan + TradingView: Integrate Dhan's trading functionalities with the powerful charting and analysis tools of TradingView.

DhanHQ: A comprehensive platform offering in-depth market data, research tools, and advanced order types for active traders.

Customer Service

Dhan provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Phone Number: (+91)9987761000 (Available on 9:00 am to 6:00 pm on market Trading days)

Email:help@dhan.co

Address: 302, Western Edge l, Off Western Express Highway, Borivali East, Mumbai - 400066, Maharashtra, India.

Twitter: https://twitter.com/DhanCares

Live Chat (8 AM to 12 AM Monday to Friday, 8 AM to 10 PM Saturday & Sunday)

Conclusion

In conclusion, Dhan offers an extensive range of trading instruments, a demat account, multiple trading platforms, and various customer support channels, making it an advantageous platform for various investors with varying investment styles and goals. However, the lack of valid regulation raises significant concerns about the safety and trustworthiness of the platform.

Frequently Asked Questions (FAQs)

| Q 1: | Is Dhan regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | Does Dhan offer demo accounts? |

| A 2: | No. |

| Q 3: | What trading platforms are offered by Dhan? |

| A 3: | Dhan App, Dhan web, Options Trader App, Options Trader Web, Dhan + TradingView, TradingView, DhanHQ. |

| Q 4: | What financial instruments can I trade with Dhan? |

| A 4: | Stocks, Options, Futures, Commodity, Currency, ETFS, Mutual Funds, IPO. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Latest News

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

FINMA Opens Bankruptcy Proceedings

$13M Pig Butchering Scam: Three Arrested for Money Laundering

FCA Issues Warning Against 14 Unregistered Financial Firms

Crypto Scam Exposed: 3 Arrested for Defrauding Investors

Nifty 50 Index Futures Now Available at Interactive Brokers

Grand Unveiling: The Core Reasons Behind the Yen’s Rise

Ethereum’s Shock Drop: What’s The Real Reason?

Rate Calc