FDFX Spreads, leverage, minimum deposit Revealed

Abstract:Based in New Zealand, FDFX is an unregulated forex broker that was established in 2001. FDFX offers trading in Forex, Stocks, Futures, Options, Gold & Silver, Oil & Gas, Fixed Income, and Energy Derivatives via the MT4 and MT5 platforms. Demo accounts are available and the minimum deposit requirement to open a live account is as high as USD 500.

| FDFX Review Summary | |

| Founded | 2001 |

| Registered Country/Region | New Zealand |

| Regulation | Unregulated |

| Market Instruments | Forex, Stocks, Futures, Options, Gold & Silver, Oil & Gas, Fixed Income, Energy Derivatives |

| Demo Account | ✅ |

| Leverage | 1:200 |

| Spread | From 2 pips (Retail account) |

| From 1 pip (Institutional account) | |

| Trading Platform | MT4/5 |

| Min Deposit | $500 |

| Customer Support | Contact form |

| Email: info@fdfx.com | |

| Address: PWC Tower 188 Quay Street Auckland 1010, Rome Eur Viale Luca Gaurico 9/11 Rome 00143, Paseo de la Castellana 95-15, Madrid Financial District - Torre Europa, Madrid | |

Based in New Zealand, FDFX is an unregulated forex broker that was established in 2001. FDFX offers trading in Forex, Stocks, Futures, Options, Gold & Silver, Oil & Gas, Fixed Income, and Energy Derivatives via the MT4 and MT5 platforms. Demo accounts are available and the minimum deposit requirement to open a live account is as high as USD 500.

Pros and Cons

| Pros | Cons |

| Various trading options | Not regulated |

| Demo accounts | High minimum deposit |

| MT4 and MT5 supported | |

| Limited payment options | |

| Multiple contact channels |

Is FDFX Legit?

No, FDFX is not regulated by any reputable financial body. Please be aware of the risk!

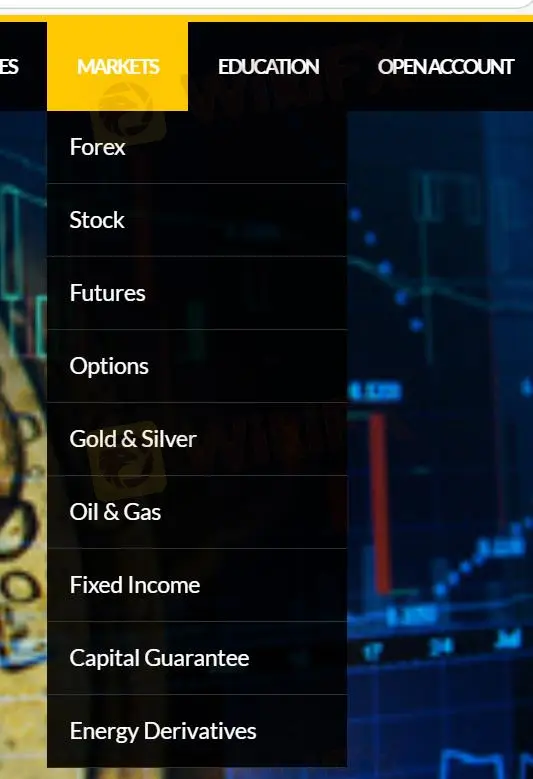

What Can I Trade on FDFX?

FDFX offers various trading options, including Forex, Stocks, Futures, Options, Gold & Silver, Oil & Gas, Fixed Income, and Energy Derivatives.

Forex: On-line trade in 150 currency pairs.

Stocks: Trade stocks on 22 of the world's largest exchanges.

Futures: Includes and not limited to metals, energy, petroleum, financial instruments, foreign currencies, stock indexes, and agricultural products.

Fixed Income: Commercial Paper (CP and ECP), Government Bonds, Repurchase (Repo) and Structured Products.

Energy Derivatives: Brent Crude: 0.2 Gasoil, ULSD, Jet, Fuel Oil. WTI Crude: Gasoline, Heating Oil.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Stocks | ✔ |

| Futures | ✔ |

| Options | ✔ |

| Gold & Silver | ✔ |

| Oil & Gas | ✔ |

| Fixed Income | ✔ |

| Energy Derivatives | ✔ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| ETFs | ❌ |

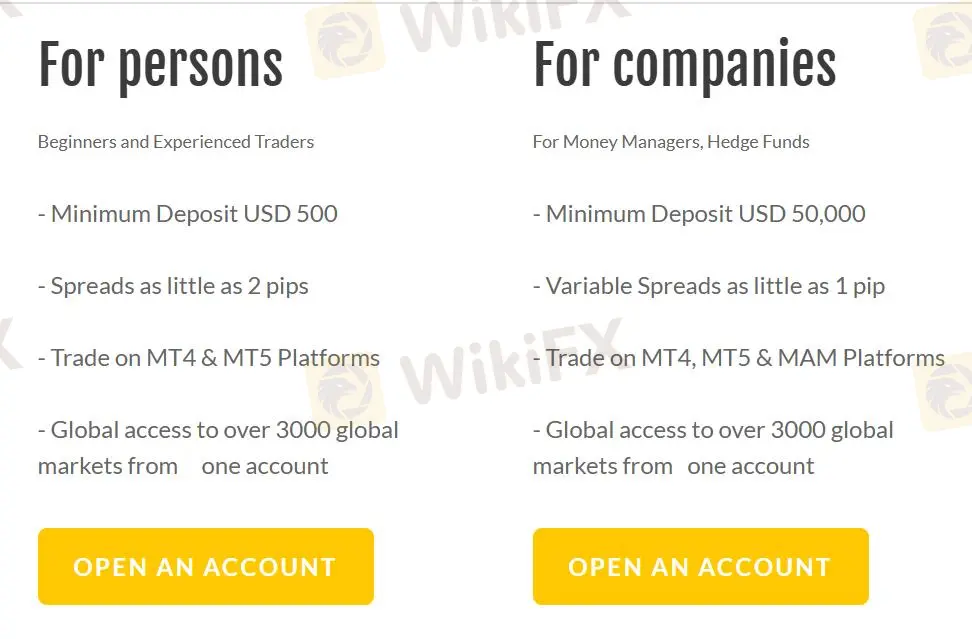

Account Type

FDFX not only provides live accounts but also sets up demo accounts for traders to practice their trading strategies. The minimum deposit to open a real account is $500.

| Account Type | Min Deposit | Suitable for |

| For persons | USD 500 | Beginners and experienced traders |

| For companies | USD 50,000 | Money managers, hedge funds |

Leverage

| Asset Class | Max Leverage |

| Major currency pairs | 1:200 |

| Minor currency pairs | 1:100 |

| Metals | 1:50 |

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spread

| Account Type | Spread |

| For persons | 2 pips |

| For companies | 1 pip |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web, Desktop, Android, iOS | Beginners |

| MT5 | ✔ | Windows, Android, iOS | Experienced traders |

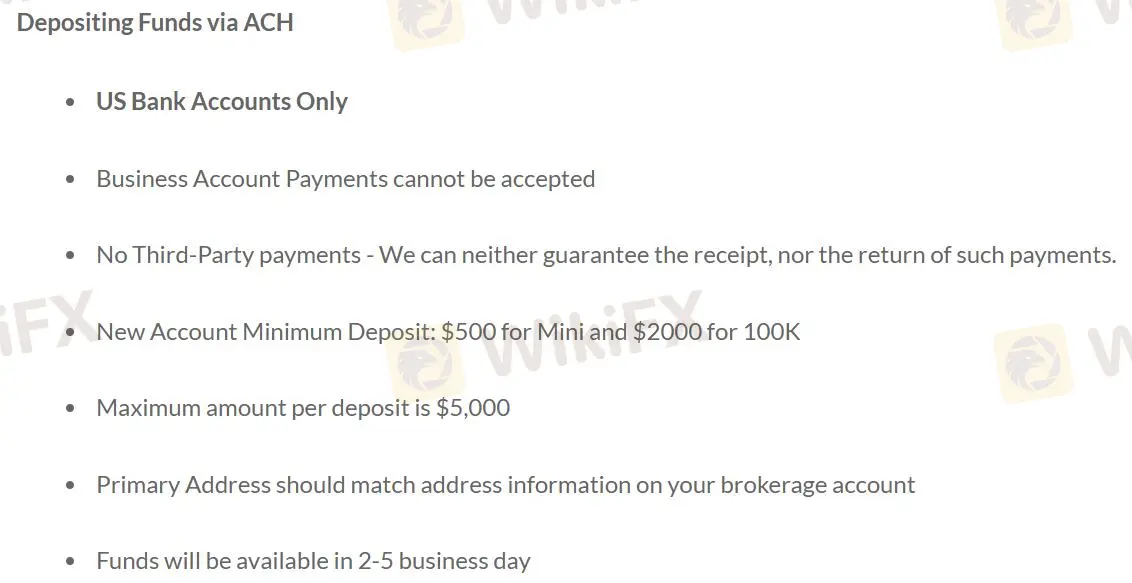

Deposit and Withdrawal

Deposit

FDFX accepts bank wire transfer, e-payments and ACH as payment methods for deposit.

Bank wire transfer: USD, EUR, GBP, CAD, JPY, HKD, SGD to the following banks: HSBC, BARCLAYS and Rietumu Banka

E-payments: PayPal, WebMoney, echeck (for verified clients of payment systems only)

| Deposit Option | Min Deposit |

| Bank wire transfer | $500 |

| E-payments | $500 |

| ACH | $500 for Mini and $2 000 for 100K |

Withdrawal

FDFX only accepts withdrawals via International Wire Transfer. To withdraw funds, FDFX provides the Withdrawal Form to fill out and sign. Any requests to withdraw funds will be processed within 2 business days.

Latest News

Plunging Oil Prices Spark Market Fears

Celebrate Ramadan 2025 with WelTrade & YAMarkets

WikiFX App Version 3.6.4 Release Announcement

Indian Watchdog Approves Coinbase Registration in India

SILEGX: Is This a New Scammer on the Block?

How Can Fintech Help You Make Money?

Good News for Nigeria's Stock Market: Big Gains for Investors!

IIFL Capital Faces SEBI's Regulatory Warning

Why Is OKX Crypto Exchange Under EU Probe After Bybit $1.5B Heist?

Gold Trading Insights: Prepare for Moves Above $2,900 Post-CPI

Rate Calc