Fake OANDA Spreads, leverage, minimum deposit Revealed

Abstract:OANDA is a forex broker in the financial trading industry. Founded within the past 2-5 years, it operates primarily in the United States. With a minimum deposit requirement of 1 GBP/USD/EUR, OANDA offers access to a variety of trading platforms, including OANDA Trade web, OANDA Trade mobile and tablet apps, MetaTrader4, and Trading View. These platforms cater to different trading preferences and provide users with comprehensive tools and features to facilitate their trading activities. OANDA allows traders to engage in FX trading and cryptocurrency trading, allowing users to invest in various cryptocurrencies such as Bitcoin. The company provides customer support through live chat and email. When it comes to deposit and withdrawal options, OANDA supports bank transfers, wire transfers, and Automated Clearing House transactions. To further support traders, OANDA offers educational resources such as forex news, an economic calendar, live market analysis, and a premium webinar series. The

| Aspect | Information |

| Company Name | OANDA |

| Registered Country/Area | United States |

| Founded Year | 2-5 years |

| Regulation | Lacks proper regulatory oversight |

| Minimum Deposit | 1 GBP/USD/EUR |

| Maximum Leverage | Not specified |

| Spreads | Not specified |

| Trading Platforms | OANDA Trade web, OANDA Trade mobile and tablet apps, MetaTrader4, Trading View |

| Tradable Assets | FX trading, Cryptocurrency trading |

| Account Types | Not specified |

| Customer Support | Live Chat Support, Email Support |

| Deposit & Withdrawal | Bank Transfer, Wire Transfer, Automated Clearing House |

| Educational Resources | Forex News, Economic Calendar, Live Market Analysis, Premium Webinar Series |

Overview of OANDA

OANDA is a forex broker in the financial trading industry. Founded within the past 2-5 years, it operates primarily in the United States. With a minimum deposit requirement of 1 GBP/USD/EUR, OANDA offers access to a variety of trading platforms, including OANDA Trade web, OANDA Trade mobile and tablet apps, MetaTrader4, and Trading View. These platforms cater to different trading preferences and provide users with comprehensive tools and features to facilitate their trading activities.

OANDA allows traders to engage in FX trading and cryptocurrency trading, allowing users to invest in various cryptocurrencies such as Bitcoin. The company provides customer support through live chat and email. When it comes to deposit and withdrawal options, OANDA supports bank transfers, wire transfers, and Automated Clearing House transactions.

To further support traders, OANDA offers educational resources such as forex news, an economic calendar, live market analysis, and a premium webinar series. These resources aim to enhance traders' knowledge and understanding of the market, empowering them to make informed trading decisions.

However, it is important to note that OANDA currently lacks proper regulatory oversight, which may pose potential risks for traders.

Is OANDA legit or a scam?

Please note that OANDA currently lacks proper regulatory oversight, posing potential risks. It is essential to exercise caution when dealing with unregulated entities as they may operate without adherence to established industry standards, potentially endangering your financial security.

Pros and Cons

OANDA offers multiple funding options. Furthermore, OANDA does not charge commission fees on CFD instruments and there are no fees for inactive accounts. OANDA also offers a range of payment methods and free educational resources, supporting traders in expanding their knowledge and improving their trading skills.

One of the major drawbacks of OANDA is the lack of proper regulatory oversight. Traders should be aware of this risk and exercise caution when dealing with unregulated platforms. OANDA may also impose fees for other types of trades and account levels, which can impact the overall cost of trading with the platform. The withdrawal fees with OANDA can vary depending on the chosen method, potentially leading to additional costs when accessing funds. There is a minimum deposit requirement of 1 GBP/USD/EUR when opening an account, which may be a barrier for some traders. OANDA's customer support options may be limited.

| Pros | Cons |

| Easy account opening process | Lack of regulatory oversight |

| Multiple funding options | Potential fees for other types of trades and account levels |

| No commission fees on CFD instruments | Varying withdrawal fees |

| No fee for inactive accounts | Minimum deposit requirement of 1 GBP/USD/EUR |

| No deposit fees | Potential higher minimum deposit f |

| Access to a range of payment methods | Risk of loss when trading with leverage |

| Free educational resources available | Limited customer support |

| Limited market instruments |

Market Instruments

FX trading

Forex is traded on margin, meaning you can gain a potentially higher market exposure by putting down just a small percentage of the full value of your trade. With forex trading, you can speculate when forex prices are rising as well as falling as compared to other currencies.

Cryptocurrency trading

Coins or tokens involve purchasing a specific amount or fraction of cryptocurrencies like Bitcoin and holding that investment, usually in a cryptocurrency exchange account, a digital wallet, or with a cryptocurrency custodian. The investment is retained until you decide to sell it. Cryptocurrencies are traded against the US dollar, similar to forex trading, where you buy or sell based on market movements. It's important to note that when trading cryptocurrencies with Paxos through the OANDA app, the digital assets are not stored in a digital wallet.

How to Open an Account?

To open an account with Oanda, follow these steps:

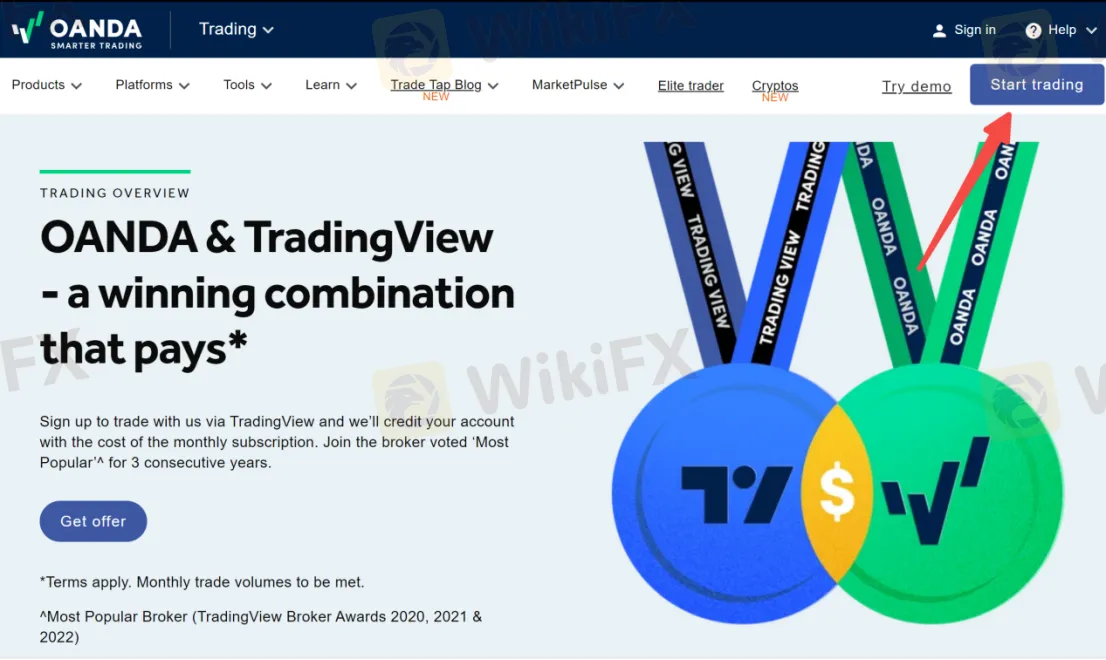

1. Visit the Oanda website: Go to the official Oanda website at https://www.oanda.com/.

2. Click on “Start trading”: On the homepage, locate the “Start trading” button, usually found at the top right corner or in the main navigation menu. Click on it to start the account opening process.

3. Choose your account type: Oanda offers various types of accounts. Select the account type that best suits your needs and click on it to proceed.

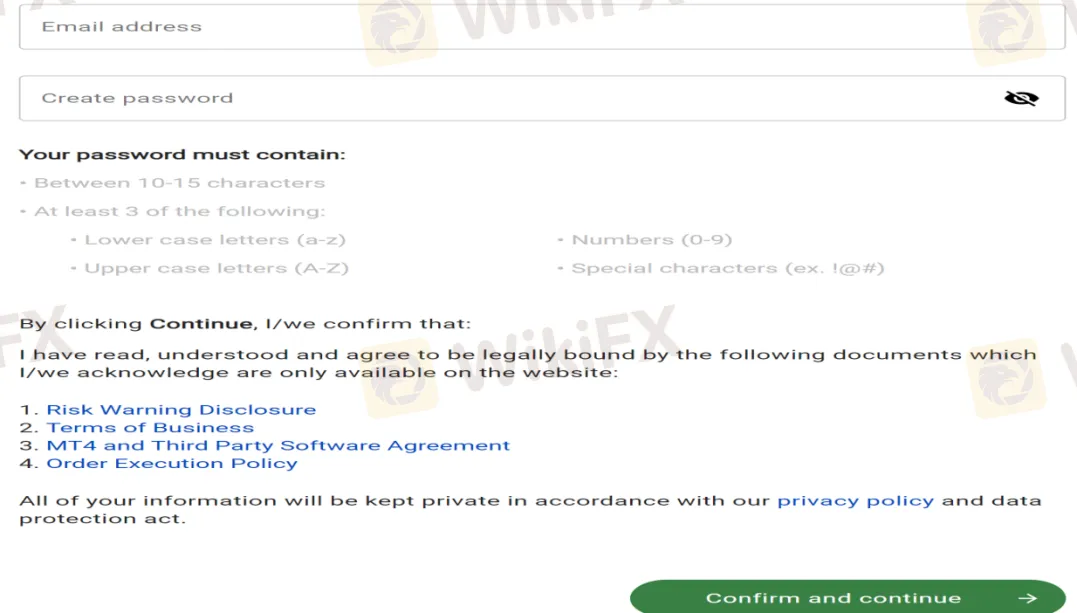

4. Fill in the application form: Provide the required information in the account application form. This typically includes personal details like your name, email address, phone number, and country of residence.

5. Agree to terms and conditions: Read and accept Oanda's terms and conditions, privacy policy, and any other legal agreements presented during the account opening process. Make sure to understand and agree to the terms before proceeding.

6. Complete verification process: Oanda may require you to verify your identity and address. Follow the instructions provided to submit the necessary documents, such as identification documents (passport, driver's license) and proof of address (utility bill, bank statement).

7. Fund your account: Once your account is approved and verified, you can fund it. Oanda offers multiple funding options, including bank transfers, credit/debit cards, and electronic payment methods.

8. Start trading: After your account is funded, you can log in to the Oanda trading platform using the credentials provided. Explore the platform, access market data, place trades, and manage your account.

Leverage

Trading financial instruments such as cryptocurrency and foreign currency markets involves high risk and is unsuitable for everyone. When trading on leverage, the potential for loss is significantly higher than when dealing with just your funds. Risky trading leverage allows you to control larger positions with less capital, increasing both the potential for profit and loss. You will be exposed to a high risk of loss regarding leverage and margin-based trading.

Furthermore, some off-exchange financial instruments and derivatives may offer varying leverage levels and may not be subject to the same regulatory protections as exchange-traded instruments. As a result, they may be subject to higher levels of market volatility and carry a higher degree of risk. Any investment involves the possibility of financial loss, and it is important to carefully consider your investment objectives, risk tolerance, and financial situation before making any investment decisions.

Spreads &Commissions

Oanda is known for not charging commission fees on CFD instruments. However, it's important to note that brokerage firms like Oanda may have different fee structures and charges in place. While Oanda may not charge commission fees on CFD trades, it's recommended to review their terms and conditions to gain a clear understanding of any applicable commission fees or charges for other types of trades and account levels. This will help traders assess the overall cost of trading with Oanda and make informed decisions based on their specific trading needs.

Fees

Oanda offers a variety of payment methods for withdrawals, and the withdrawal fees may vary depending on the chosen method. It's important to note that Oanda does not charge a fee for inactive accounts, which is a favorable aspect for traders. Additionally, Oanda does not charge any deposit fees, making it convenient for clients to fund their trading accounts without incurring extra costs. It's worth mentioning that as a modern broker, Oanda provides advanced online trading platforms, mobile apps, financial analysis tools, and educational resources. These services require significant investment on Oanda's part, and as a result, they may charge clients various fees for trading activities. It is essential to be mindful of these charges as they can impact the overall profitability of your trading with Oanda. By staying informed about the fee structure and understanding how these fees may affect your trading performance, you can make more informed decisions and manage your trading costs effectively.

Minimum Deposit

Oanda requires a minimum deposit of 1 GBP/USD/EUR when opening an Oanda trading account. A minimum deposit is the minimum amount of money required by Oanda to open a new online brokerage account with them. In the trading world, brokers like Oanda, have different minimum deposit requirements based on the target audience they are trying to attract. Some brokers may waive the minimum deposit requirement to attract new customers but may compensate for it by charging higher transaction commissions and trading fees. As the online trading market becomes more competitive, brokers have reduced their minimum deposit requirements to attract new clients. However, it's important to note that depending on your trading account type, some brokers may require a higher minimum deposit of up to 10,000 GBP/USD. Therefore, it's essential to research and compares different brokers to determine which best suits your trading needs and budget.

Trading Platform

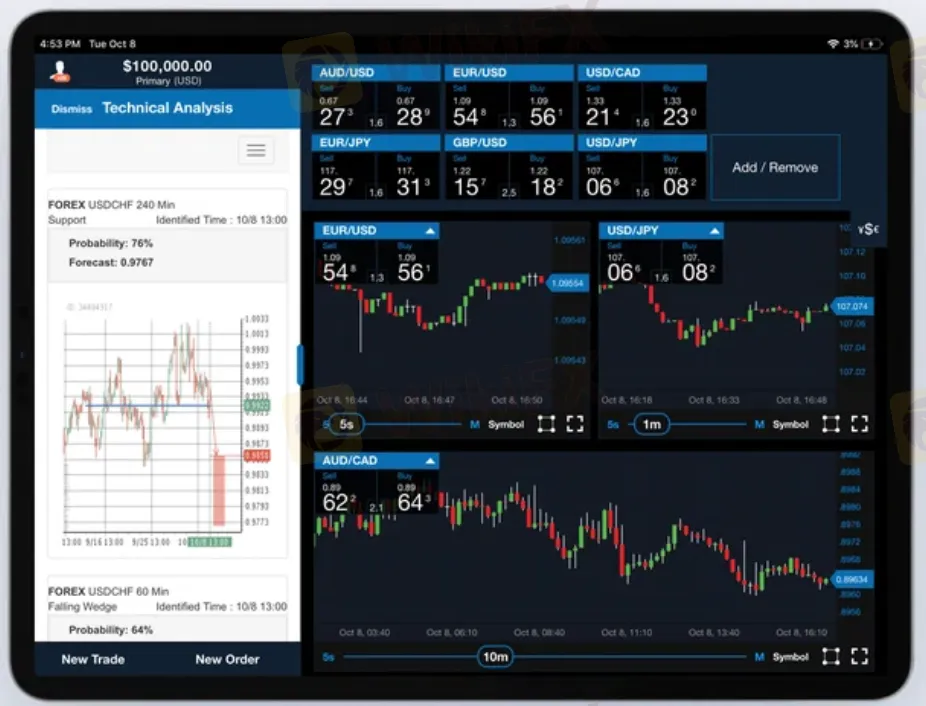

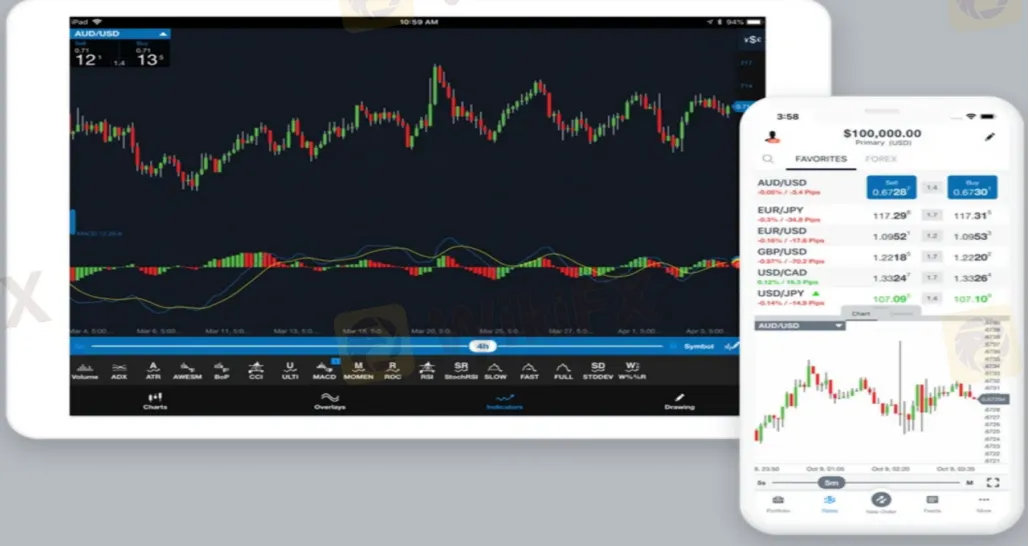

OANDA offers a diverse range of trading platforms, including OANDA Trade web, OANDA Trade mobile and tablet apps, MetaTrader4, Trading View.

OANDA Trade web offers several notable features. First, it provides comprehensive risk management tools, including stop-loss orders, and charting functionality powered by Trading View,. Traders can conveniently open and close trades, as well as add risk management orders, all within the charting interface. Furthermore, OANDA Trade web provides extensive market data coverage, including a currency strength heat map for monitoring major currency movements. These features provide traders with valuable information and analysis to make informed trading decisions.

The OANDA Trade mobile and tablet apps provide users with access to the full range of FX pairs on Android, iPhone, and tablet devices. These native apps offer the same functionality as the browser-based platform. With the mobile and tablet apps, users can execute trades, monitor market movements, access charts and indicators, manage their positions, and utilize risk management tools.

TradingView is an online trading platform that offers a range of features and tools for traders. This collaboration allows traders to benefit from Trading View's extensive community features, powerful charts, and analytical tools, while also leveraging OANDA's transparent pricing, fully-automated risk management systems, and reliable market data. By combining these resources, traders can access a comprehensive and intuitive trading experience that supports their decision-making process.

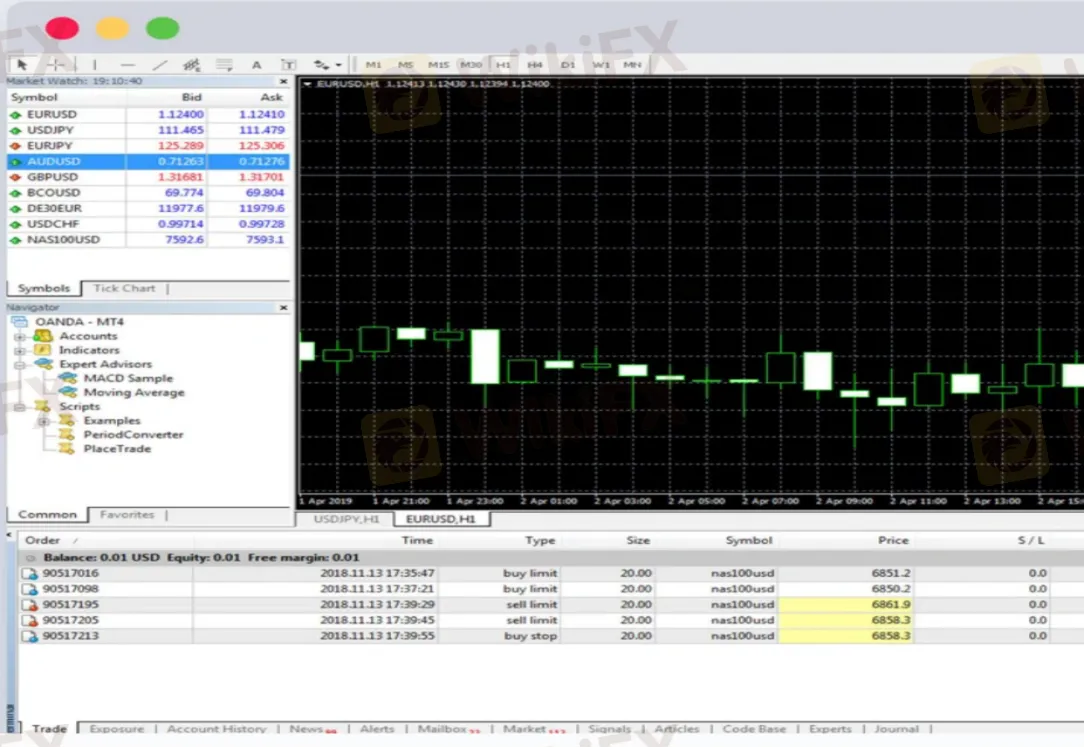

Most traders offer the popular MT4 trading platform. MT4 is widely recognized for its user-friendly interface, powerful charting capabilities, and the ability to automate trading with the use of Expert Advisors (EAs).

Deposit & Withdrawal

OANDA provides the following payment method, including Bank Transfer, Wire Transfer, Automated Clearing House.

Bank Transfer: Bank transfer is a payment method that allows funds to be transferred electronically from one bank account to another. This method usually requires the sender to provide the recipient's bank account details, including the account number and routing number or IBAN, depending on the country.

Wire Transfer: A wire transfer is a method of electronically transferring funds from one person or entity to another. It involves the sender initiating a transfer request through their bank, which then sends the funds directly to the recipient's bank. Wire transfers may incur fees, and the processing time can vary depending on the banks involved and the destination country.

Automated Clearing House (ACH): Automated Clearing House is a payment system that facilitates electronic funds transfers and direct deposits in the United States. This method is commonly used for various transactions, such as payroll direct deposits, bill payments, and online transfers. The sender needs to provide the recipient's bank account details, including the account number and routing number, to initiate an ACH payment.

Customer Support

Oanda provides excellent customer service options on their trading platform. The platform supports multiple languages, including English, Chinese, French, German, Japanese, Korean, Russian, and Spanish.

Live Chat Support: Oanda offers live chat support, and our experience was positive. We received a response within 30 seconds when contacting them through their app and website. The live chat support from Oanda was efficient and helpful.

Email Support: Oanda's email support also provided a positive experience. We sent 25 emails at different times and received responses within an average of 2 hours. The fastest response took less than 15 minutes, while the slowest response took 7 hours. Overall, their email support team was knowledgeable and addressed our queries effectively.

Educational Resources

Oanda provides a range of educational resources to support traders in their forex trading journey.

Forex News: Stay updated with the latest news and developments in the forex market. Oanda offers access to timely and relevant forex news to help traders make informed trading decisions.

Economic Calendar: The economic calendar provided by Oanda is a valuable tool for traders. It displays important economic events, such as interest rate announcements, GDP releases, and employment reports, along with their expected impact on the market. Traders can use this calendar to plan their trades and be aware of potential market volatility.

Live Market Analysis: Oanda offers live market analysis to help traders identify market trends in major forex trading instruments. This analysis provides insights into market dynamics, price movements, and potential trading opportunities. By staying updated with the latest market trends, traders can make more informed trading decisions.

Premium Webinar Series: Oanda provides a premium webinar series for traders. These webinars cover a range of topics, including trading strategies, technical analysis, and the use of technical tools and indicators. Traders can sign in with their Oanda live account to access these webinars and enhance their trading knowledge and skills.

Overall, Oanda's educational resources, including forex news, an economic calendar, live market analysis, and premium webinars, aim to empower traders with the knowledge and tools they need to navigate the forex market more effectively.

Conclusion

While OANDA has its strengths in terms of account opening convenience, multiple funding options, and free educational resources, its lack of proper regulatory oversight and limited information on spreads and account types may raise concerns for potential users. Traders should carefully consider these factors before deciding to engage with OANDA as a trading platform.

FAQs

Q: Is OANDA a trustworthy platform?

A: OANDA currently lacks proper regulatory oversight, which poses potential risks.

Q: What trading instruments are available on OANDA?

A: OANDA offers FX trading and cryptocurrency trading.

Q: Does OANDA charge commissions or spreads?

A: OANDA does not charge commission fees on CFD instruments. However, it is recommended to review their terms and conditions to understand any applicable commission fees or charges for other types of trades and account levels.

Q: What is the minimum deposit requirement for OANDA?

A: OANDA requires a minimum deposit of 1 GBP/USD/EUR when opening an account. However, some brokers may have higher minimum deposit requirements depending on the account type.

Q: What trading platforms does OANDA offer?

A: OANDA offers a variety of trading platforms, including OANDA Trade web, OANDA Trade mobile and tablet apps, MetaTrader4, and Trading View. These platforms cater to different trading preferences and provide comprehensive tools and features.

Q: What payment methods are available for deposit and withdrawal on OANDA?

A: OANDA supports payment methods such as bank transfers, wire transfers, and Automated Clearing House transactions for deposits and withdrawals.

Q: How is the customer support at OANDA?

A: OANDA provides customer support through live chat and email. Their live chat support is efficient and helpful, with quick response times. Email support also offers knowledgeable assistance, addressing queries effectively.

Latest News

Is $CORONA Memecoin a Legit Crypto Investment?

Is Pi Network the Next Big Crypto Opportunity?

Donald Trump’s Pro-Crypto Push Boosts PH Markets

Japan’s Shift in Crypto Policy and What It Means for Investors

Is Linkbex a Scam? SFC Warns of Virtual Asset Fraud in Hong Kong

5 Best Copy Trading Brokers: You Can Trust in 2025

3 EXCLUSIVE Ramadan Offers That Won’t Last Long! ACT NOW

The Next Crypto Giants: 5 Altcoins to Watch

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Rate Calc