Absolute Markets Spreads, leverage, minimum deposit Revealed

Abstract:Absolute Markets, a trading name of Absolute Markets LLC, is an online forex broker registered in Saint Vincent and the Grenadines, claiming to offer its clients access to massive financial markets through the leading MT4 trading platform. Absolute Markets offers four tiered trading accounts, with the maximum trading leverage up to 1:1000, insanely high.

Risk Warning

There is a level of danger that comes with trading on the financial markets. As sophisticated instruments, foreign exchange, futures, CFDs, and other financial contracts are typically traded using margin, which significantly increases the inherent risks involved. You can use the leverage to your benefit or detriment. Therefore, you should consider carefully whether or not this sort of investment activity is right for you. Please note the information contained in this article is for general information purposes only.

| Feature | Detail |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | General registration |

| Market Instrument | Forex pairs, Cryptos, Stocks CFDs on Shares, Metals, Indices, and Energies |

| Account Type | Micro, Variable, ECN, and VIP ECN |

| Demo Account | yes |

| Maximum Leverage | 1:1000 |

| Spread | Vary on the account type |

| Commission | Vary on the account type |

| Trading Platform | MT4 |

| Minimum Deposit | $1- $200 (vary on the method) |

| Deposit & Withdrawal Method | credit/debit cards, cryptocurrencies, Ecobank, Bank Transfers, PayRedeem, Mobile Money, Perfect Money, and Virtual Pay |

General Information

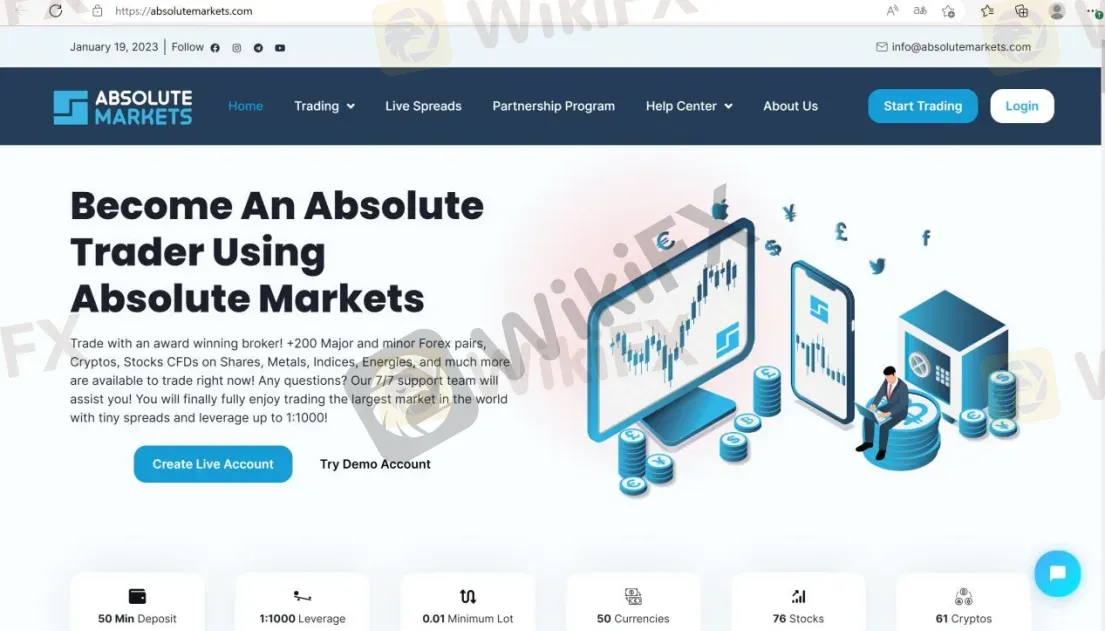

Absolute Markets, a trading name of Absolute Markets LLC, is an online forex broker registered in Saint Vincent and the Grenadines, claiming to offer its clients access to massive financial markets through the leading MT4 trading platform. Absolute Markets offers four tiered trading accounts, with the maximum trading leverage up to 1:1000, insanely high.

This broker offers various account types - Micro, Variable, ECN, and VIP ECN, each with distinct features regarding minimum deposits, spreads, and commissions. Additionally, Islamic swap-free accounts and demo accounts are available. Traders can access the markets through WebTrader and MetaTrader 4 platforms. The firm also provides a suite of trading tools such as an Economic Calendar, Trading Signals, Copy Trading, Algorithmic Trading, and PAMM accounts.

However, potential investors must exercise caution as the firms official website has been reported as non-operational. Furthermore, Absolute Markets is registered in St. Vincent and the Grenadines, but the registration authority, SVG FSA, is not a conventional financial regulator. This lack of rigorous oversight might pose risks regarding the safety of funds.

Customer support is available 24/7 via live chat and email, but not over the phone. While Absolute Markets doesn't offer educational materials, they do provide a Help Centre with information on account management and trading strategies.

In summary, Absolute Markets presents a wide range of trading options and account types, but the lack of stringent regulation and issues with website accessibility warrant careful consideration before investing.

Here is the home page of this brokers official site:

Regulation

Absolute Markets is a company registered in St. Vincent and the Grenadines. The registration certificate was issued by the Financial Services Authority of St. Vincent and the Grenadines (SVG FSA). However, it's important to note that the SVG FSA is not a financial regulator in the traditional sense. Instead, it primarily serves as a registry for international business companies and does not provide comprehensive oversight of the operations of these companies. Therefore, while Absolute Markets is registered with the SVG FSA, it does not mean that it is regulated in the same way as brokers overseen by more stringent regulatory bodies like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). This lack of robust regulation raises potential concerns about the safety of funds deposited with Absolute Markets.

Market Instruments

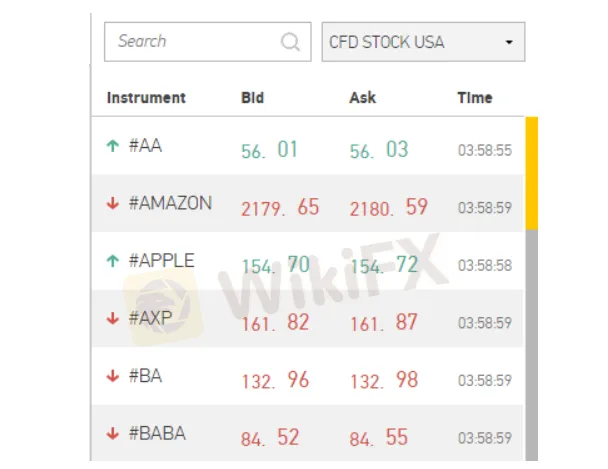

Absolute Markets boasts that investors with its platform can trade on various popular and mainstream financial markets, including 200+ major and minor Forex pairs, Cryptos, Stocks CFDs on Shares, Metals, Indices, and Energies. Investors have the greater flexibility to follow market trends and diversify their investment portfolios.

Absolute Markets offers a diverse range of market instruments that cater to different types of traders. These instruments span across various asset classes, providing traders with a wide array of options to diversify their trading portfolio.

One of the primary market instruments offered by Absolute Markets is Forex. This involves trading in various currency pairs, which is a popular choice among traders due to the high liquidity and 24/5 availability of the Forex market. Traders can take advantage of the fluctuations in currency exchange rates to make profits.

In addition to Forex, Absolute Markets also provides the opportunity to trade inContracts for Difference (CFDs). CFDs are derivative products that allow traders to speculate on the rising or falling prices of fast-moving global financial markets. This means traders can potentially profit from both bullish and bearish market conditions.

Furthermore, Absolute Markets has embraced the digital age by offering digital currencies as part of their market instruments. This allows traders to participate in the highly volatile cryptocurrency market, which can offer significant profit opportunities due to its rapid price movements.

Lastly, for professional traders, Absolute Markets offers futures contracts. These are legal agreements to buy or sell a particular commodity or asset at a predetermined price at a specified time in the future. Futures contracts are often used for hedging risk or for speculative purposes.

In conclusion, Absolute Markets provides a comprehensive suite of market instruments that cater to both novice and experienced traders. Whether you're interested in traditional Forex trading, want to delve into the world of cryptocurrencies, or prefer the strategic approach of futures contracts, Absolute Markets has the tools and resources to facilitate your trading needs.

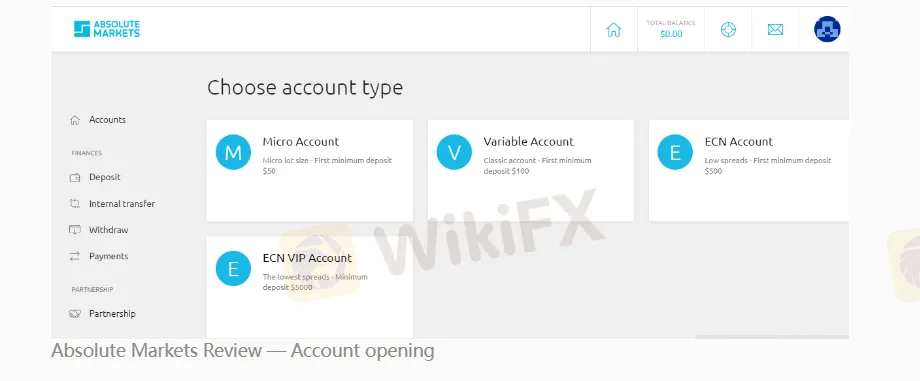

Account Types

Apart from demo accounts, four live trading accounts are designed for both retail and professional traders, namely Micro, Variable, ECN, and VIP ECN accounts. The minimum initial deposits required by the Absolute Markets seem reasonable, and the Micro account, for example, requires only $50 to start trading, seemingly friendly to novices. The Variable account asks for a minimum deposit of $100, and the last two accounts, ECN and VIP ECN require $500 and $5,000 to start trading.

Micro Account: The minimum deposit for a Micro account is $50 which is higher than that of the competitors. The Micro account operates with cent lots, allowing traders to gain real trading experience with lower risk. The spreads start from 1.4 pips, and there is no commission per lot.

Variable Account: The Variable account is suitable for more experienced traders. It offers more competitive spreads starting from 1.2 pips. Like the Micro account, the Variable account does not charge a commission per lot. The minimum deposit requirement for this account type is $100.

ECN Account: The ECN account is designed for professional and experienced traders who require the best trading conditions. This account type offers the tightest spreads starting from 0.1 pips, but it charges a commission per lot. The minimum deposit requirement for an ECN account is $500.

Although these accounts are set with different features, they share some basic account services in common, such as Scalping /EA allowed, 7x7 online support, and more.

Swap-free accounts are optional and the Variable, ECN and VIP ECN all come with a certain amount of bonuses.

How to Open an Account?

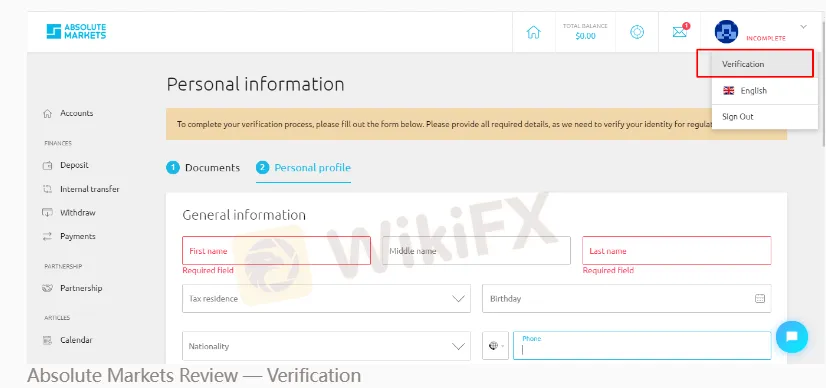

Step 1: Visit the official website of Absolute Markets and click on “Start Trading” at the top of the screen.

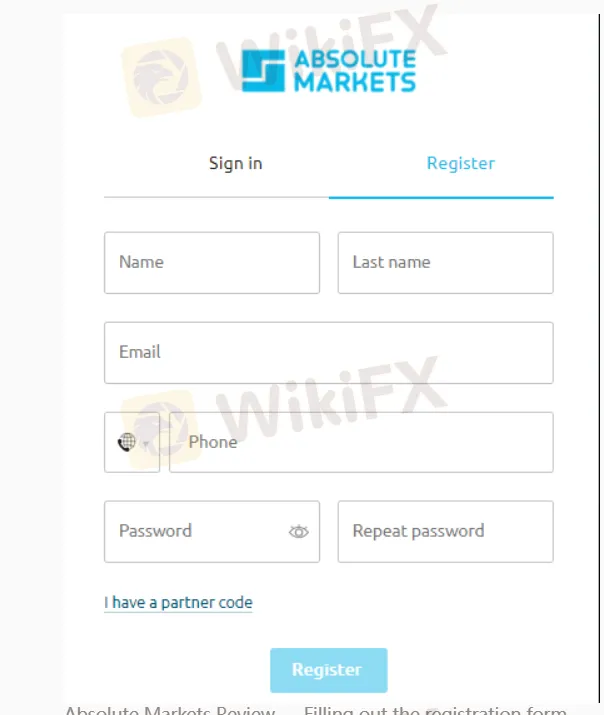

Step 2: Fill out the registration form. Provide your First Name, Last Name, Email, and your Phone. Create a secure password to protect your account against unauthorized access. If you are registering upon the invitation of a client of Absolute Markets, enter the referral code.

Step 3: Open a real account. Select the account type, currency, and maximum leverage.

Step 4: Pass verification.

Leverage

The maximum trading leverage offered by Absolute Markets is insanely high, reaching up to 1:1000, with leverage for cryptos trading as high as 1:100, which is much above the appropriate amount considered by most regulatory authorities. Leverage can amplify your gains as well as your losses, therefore, traders need to choose the proper amount that they feel most at ease.

Spreads & Commissions

Firstly, the spreads and commissions are determined by trading accounts. The more equity in your account, the more competitive spreads you can enjoy. The Micro and the Variable accounts offer a commission-free trading environment, accompanied by average spreads. The ECN and VIP ECN account offers raw spreads, as low as 0.0 pips, with commissions of $10 per round turn lot and $7 per round turn lot charged, respectively.

Besides, you can also check out some real-time spreads listed on the homepage of Absolute Markets, with the spread on the EUR/USD pair floating around 0 pips. Please note prices are indicative and may be delayed.

Other Fees:

Overnight Interest Fees (Swap Fees): If a position is rolled over to the next trading day, the broker charges a Swap fee. The specific amount is not mentioned in the source.

Deposit Fees: The broker does not charge a deposit fee.

Withdrawal Fees: The withdrawal fee depends on the payment system used. The specific amounts are not mentioned in the source.

Inactivity Fees: There is a 5 USD/EUR/GBP inactivity fee charged after six months of inactivity

Trading Platform

As an unregulated forex broker, Absolute Markets still offers its clients the leading MT4 trading platform, which can be accessed through Desktop, Web, and Mobile devices. MT4 offers easy-to-read, interactive charts that allow you to monitor and analyze the markets in real time. Youll also have access to more than 30 technical indicators which can help you identify market trends and signals for entry and exit points. Some features and functionalities offered by MT4 include its powerful security system and multiple-device functionality, which enable you to trade with complete confidence at your convenience.

Trading tools:

Absolute Markets equips its traders with a suite of powerful trading tools designed to enhance their trading experience and increase their potential for success. These tools include:

Economic Calendar: Available on the WebTrader platform, the Economic Calendar provides traders with a comprehensive schedule of significant financial events that could influence market movements, helping them plan their trading strategies accordingly.

Trading Signals: Absolute Markets offers trading signals for specific currency pairs based on the Moving Average indicator. These signals, available in 1, 5, and 15-minute timeframes, provide buy and sell recommendations to assist traders in making informed trading decisions.

Copy Trading on MT4: Through the MQL5.community, traders can choose to follow the strategies of successful traders. By subscribing to a chosen trader's strategy for a fee, the trader's positions are automatically copied to the subscriber's account, allowing them to potentially benefit from the chosen trader's expertise and success.

Algorithmic Trading: Absolute Markets supports algorithmic trading through the use of Expert Advisors. These are specialized software programs configured to respond to specific asset price fluctuations, enabling automated trading based on predefined strategies.

PAMM Accounts: With Absolute Markets, clients have the opportunity to become both investors and managers through the use of PAMM accounts. In this arrangement, the transactions made by the PAMM manager are copied to the accounts of connected investors. Profits generated from these transactions are then distributed proportionally to the investors based on their deposits.

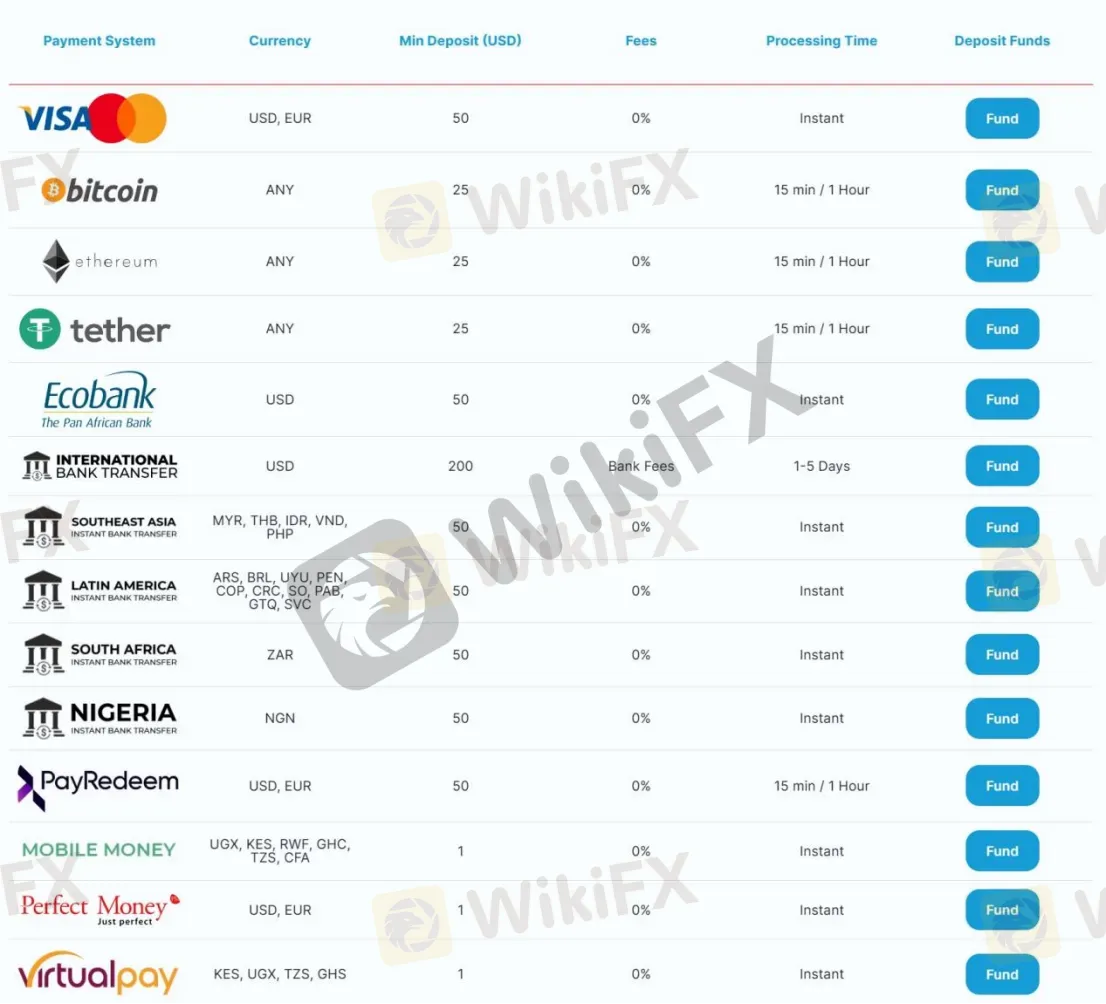

Deposit & Withdrawal

The minimum deposit required to start investing varies depending on payment options, ranging from $1 to $200. Absolute Markets allows investors to deposit through credit/debit cards like Visa and MasterCard, cryptocurrencies such as Bitcoin, Ethereum and Tether, Ecobank, Bank Transfers, PayRedeem, Mobile Money, Perfect Money, and Virtual Pay. International Bank Transfer deposits may occur some fees, while other payment methods are free of charge. Processing time varies depending on different payment methods.

Withdrawal can be made through International Bank Transfers, Load, Bitcoin, Ethereum, Tether, and Perfect Money. The withdrawal amount is typical $25, yet $1 via Perfect Money and $100 via International Bank Transfer. 1-5 days for International Bank Transfer withdrawals, while 24 hours for other withdrawals.

If you request to withdraw your funds after no trading activity, it will charge you the equivalent amount of any banking fees incurred, or 3% of the total withdrawal amount.

Bonuses & Fees

Absolute Markets claims to offer a 30% Welcome Bonus for all account types except for Micro accounts.

When an account has been deemed inactive (no trading activity) for 6 months, it will apply an inactivity fee of $/€/£5.

Customer Support

Absolute Markets relies heavily on its Frequently Asked Questions section and Chatbot to assist customers. The multilingual support staff is available via phone and email whenever the markets are open.

Here are some contact details:

Tel: (+61)0493 516 132

Email: info@absolutemarkets.com

A contact Form

Online Communication

Or you can also follow this brokerage through some popular social media platforms, such as Facebook, Instagram, Telegram, and YouTube.

Company address: Suite 305 Griffith Corporate Centre Kingstown Saint Vincent and the Grenadines.

Educational Resources:

Absolute Markets does not provide its own educational materials. However, they do offer a Help Centre which includes useful information on how to start trading with Absolute Markets and all available channels of communication with customer support operators. The Help Centre covers topics such as:

Creating and managing an account

Trading psychology

How to deposit funds into your account and how to request a withdrawal

Analysis of basic trading strategies

Rules of placing orders on MT4 and WebTrader

Forex glossary

Removal of issues related to registration, verification, depositing of funds, signing into your account and platforms

Fundamentals of technical and fundamental analysis

In addition to the Help Centre, Absolute Markets also offers a demo account. This is a type of account with a virtual deposit that clients can use to practice, test trading strategies, expert advisors, etc. This demo account is the only instrument for learning trading skills provided by Absolute Markets.

| Pros | Cons |

| • Multiple trading assets, account types and funding options | • FCA license is just generally registered |

| • Demo accounts available | |

| • Low minimum deposit | |

| • MT4 supported |

Frequently Asked Questions (FAQs)

| Q 1: | Is Absolute Markets regulated? |

| A 1: | Absolute Markets holds a generally registered Financial Conduct Authority - FCA license. |

| Q 2: | Does Absolute Markets offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does Absolute Markets offer the industry-standard MT4 & MT5? |

| A 3: | Yes. Absolute Markets supports MT4. |

| Q 4: | What is the minimum deposit for Absolute Markets? |

| A 4: | The minimum initial deposit at Absolute Markets to open a Micro account is $50. |

| Q 5: | Is Absolute Markets a good broker for beginners? |

| A 5: | Yes. Absolute Markets is a good choice for beginners because it offers a wide variety of trading instruments with low trading costs on the industry-standard MT4 platform. Also, it offers a demo account that allows traders to practice trading without risking any real money. |

Latest News

How Do You Make Money in the Forex Market in March 2025

Europe’s High-Stakes Gamble: Can It Bridge the U.S.-Ukraine Divide?

Crypto Trading: New Trend among Indian Youth

Botbro Creator, Lavish Chaudhary Unveils New Project

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

First UK Criminal Conviction for Unregistered Crypto ATMs Involves Over £2.5 Million

Consob Exercises MICAR Authority for the First Time, Shutting Down Unregistered Crypto Website

TD Bank Appoints Guidepost Solutions for AML Compliance Oversight

Rate Calc