2024-09-13 21:59

IndustryBEARISH EUR/USD

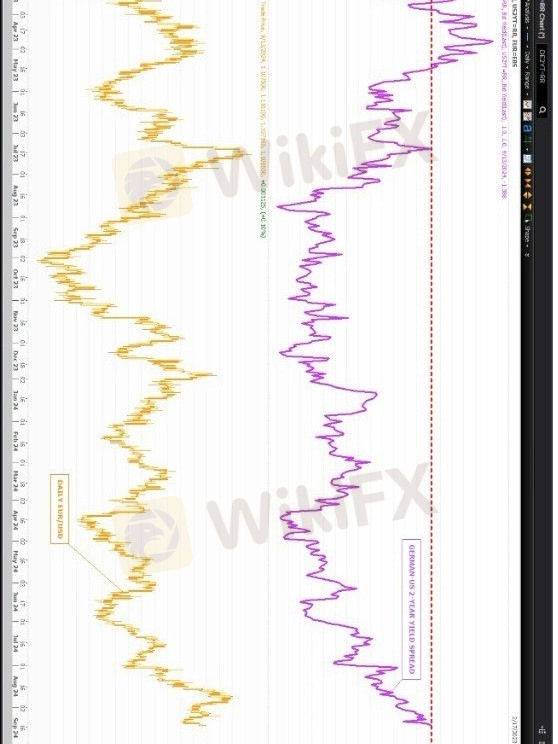

The EUR/USD market trend is currently characterized as a strong downtrend, with a bearish momentum dominating the market. The price has been declining steadily, forming a series of lower highs and lower lows, indicating a weakening Euro (EUR) against the US Dollar (USD).

The trend is driven by fundamental factors such as:

1. Interest rate differentials: The US Federal Reserve's(FED) hawkish stance and rate hikes contrast with the European Central Bank's dovish approach.

2. Economic growth: The US economy shows resilience, while the Eurozone faces growth concerns and inflationary pressures.

3. Geopolitical tensions: Ongoing conflicts and political uncertainty in Europe weigh on the Euro.

Technical indicators confirm the downtrend:

1. Moving Averages: The 50-day and 100-day MAs are trending downwards, with the price below both.

2. Relative Strength Index (RSI): The RSI is in oversold territory, indicating potential for further downside.

3. Support and Resistance: Key support levels at 1.0800 and 1.0600 have been broken, with resistance at 1.1000 and 1.1200.

Traders are short-selling, expecting further EUR weakness, with potential targets at 1.0500 and 1.0400. However, a reversal could occur if the price breaks above resistance levels or if fundamental drivers shift.

Like 0

FATEEMAH1

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

BEARISH EUR/USD

Nigeria | 2024-09-13 21:59

Nigeria | 2024-09-13 21:59The EUR/USD market trend is currently characterized as a strong downtrend, with a bearish momentum dominating the market. The price has been declining steadily, forming a series of lower highs and lower lows, indicating a weakening Euro (EUR) against the US Dollar (USD).

The trend is driven by fundamental factors such as:

1. Interest rate differentials: The US Federal Reserve's(FED) hawkish stance and rate hikes contrast with the European Central Bank's dovish approach.

2. Economic growth: The US economy shows resilience, while the Eurozone faces growth concerns and inflationary pressures.

3. Geopolitical tensions: Ongoing conflicts and political uncertainty in Europe weigh on the Euro.

Technical indicators confirm the downtrend:

1. Moving Averages: The 50-day and 100-day MAs are trending downwards, with the price below both.

2. Relative Strength Index (RSI): The RSI is in oversold territory, indicating potential for further downside.

3. Support and Resistance: Key support levels at 1.0800 and 1.0600 have been broken, with resistance at 1.1000 and 1.1200.

Traders are short-selling, expecting further EUR weakness, with potential targets at 1.0500 and 1.0400. However, a reversal could occur if the price breaks above resistance levels or if fundamental drivers shift.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.