2024-11-03 19:56

IndustryActof Market Conditions on Stop Loss Effectiveness

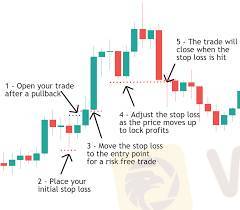

Market conditions and volatility greatly influence the effectiveness of stop loss orders. Key considerations include:

1. Volatility Adjustments: In volatile markets, traders may need to reposition stop losses to avoid premature triggers.

2. Slippage Risks: High volatility or low liquidity can lead to slippage, where execution prices differ from intended stop loss levels.

3. Whipsaw Movements: Erratic price fluctuations may trigger stop losses before the market reverses, necessitating adjustments to stop loss levels.

4. Execution Challenges: Delays in order execution and market depth can affect the ability to exit trades at desired prices.

5. Continuous Monitoring: Traders should adapt stop loss placements based on current market conditions, using tools like average true range (ATR) and technical indicators to enhance risk management.

In summary, effective risk management requires traders to account for market dynamics and continuously adjust their strategies.

Like 0

PBoy

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Actof Market Conditions on Stop Loss Effectiveness

| 2024-11-03 19:56

| 2024-11-03 19:56Market conditions and volatility greatly influence the effectiveness of stop loss orders. Key considerations include:

1. Volatility Adjustments: In volatile markets, traders may need to reposition stop losses to avoid premature triggers.

2. Slippage Risks: High volatility or low liquidity can lead to slippage, where execution prices differ from intended stop loss levels.

3. Whipsaw Movements: Erratic price fluctuations may trigger stop losses before the market reverses, necessitating adjustments to stop loss levels.

4. Execution Challenges: Delays in order execution and market depth can affect the ability to exit trades at desired prices.

5. Continuous Monitoring: Traders should adapt stop loss placements based on current market conditions, using tools like average true range (ATR) and technical indicators to enhance risk management.

In summary, effective risk management requires traders to account for market dynamics and continuously adjust their strategies.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.