2024-11-07 16:22

IndustryRisk Management

Risk management, also known as money management, refers to a number of trading techniques employed to lessen risk exposure. Being affected by various factors, currency rates may be quite volatile at times, thus protecting your account against adverse price fluctuations is an essential part of a trading strategy.

The core concept of money management is to avoid risking more than 1-2% of personal funds on any single trade. This principle may greatly reduce risk exposure: provided that only 1% of initial deposit is at risk, even after several losing trades you are likely to retain the majority of account balance.

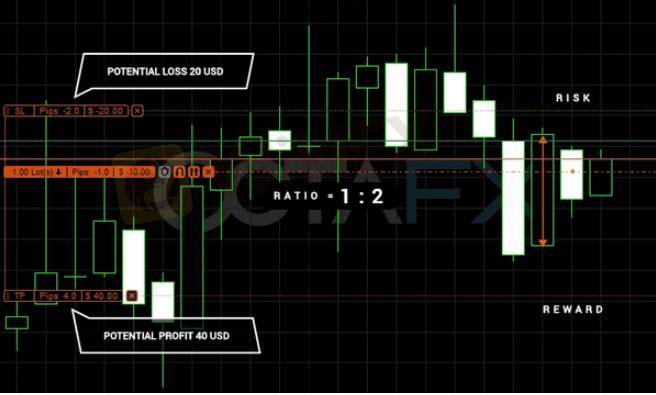

Risk to reward ratio denotes the potential profit in comparison to the amount you may lose for any given trade. For example, when you risk 100 USD on position to potentially gain 300 USD, the risk to reward ratio is1:3

Like 0

用生命在耍帅

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Risk Management

| 2024-11-07 16:22

| 2024-11-07 16:22Risk management, also known as money management, refers to a number of trading techniques employed to lessen risk exposure. Being affected by various factors, currency rates may be quite volatile at times, thus protecting your account against adverse price fluctuations is an essential part of a trading strategy.

The core concept of money management is to avoid risking more than 1-2% of personal funds on any single trade. This principle may greatly reduce risk exposure: provided that only 1% of initial deposit is at risk, even after several losing trades you are likely to retain the majority of account balance.

Risk to reward ratio denotes the potential profit in comparison to the amount you may lose for any given trade. For example, when you risk 100 USD on position to potentially gain 300 USD, the risk to reward ratio is1:3

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.