2024-12-17 22:08

IndustryBrazil's Central Bank Acts as Real Hits Record Low

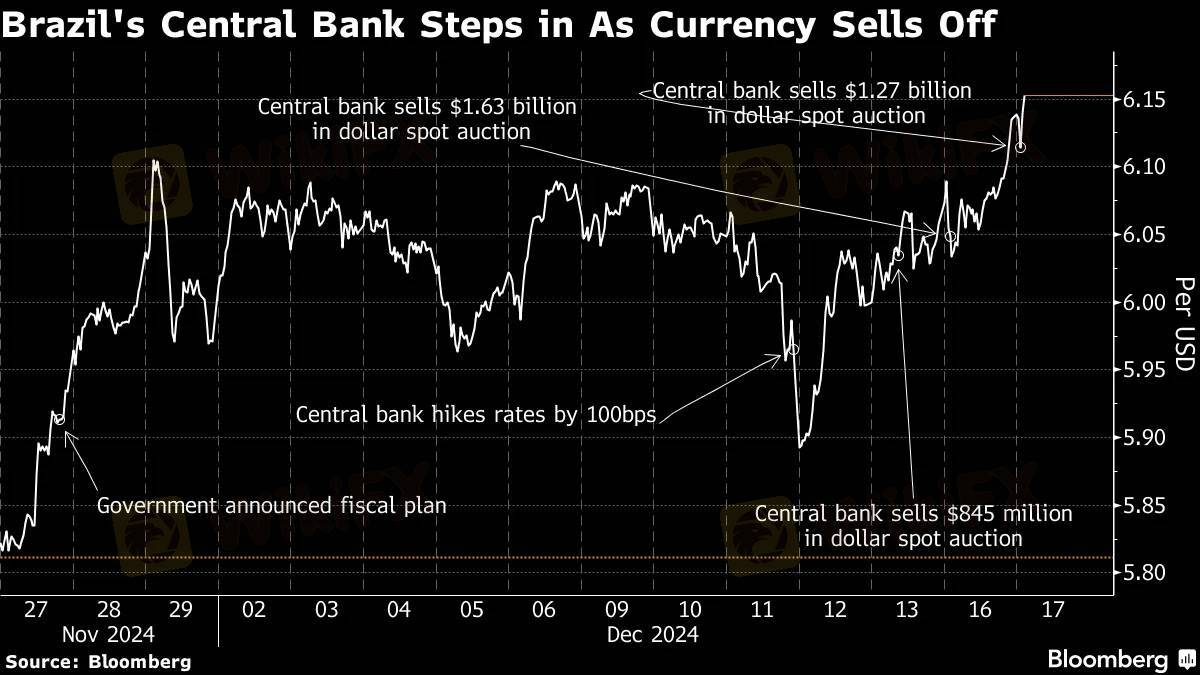

Brazil's central bank sold $1.27B in the spot market Tuesday, marking its 3rd intervention in a week to support the struggling real (BRL). Despite an initial 0.6% rise, the BRL reversed gains, falling 0.5% against the USD, cementing its status as 2024's worst-performing major currency (-21%).

With volatility fueled by fiscal deficit fears, President Lula's recent tax breaks and modest spending cuts failed to assure investors. Analysts argue that central bank interventions alone won't stabilize the BRL without stronger fiscal reforms.

The BCB recently raised rates to 12.25% and signaled further hikes, but concerns over rising inflation persist. Market attention now shifts to the government’s next move to restore fiscal credibility.

#Forex #BRL #Brazil #USD

Like 0

Gamma Squeezer

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Brazil's Central Bank Acts as Real Hits Record Low

| 2024-12-17 22:08

| 2024-12-17 22:08Brazil's central bank sold $1.27B in the spot market Tuesday, marking its 3rd intervention in a week to support the struggling real (BRL). Despite an initial 0.6% rise, the BRL reversed gains, falling 0.5% against the USD, cementing its status as 2024's worst-performing major currency (-21%).

With volatility fueled by fiscal deficit fears, President Lula's recent tax breaks and modest spending cuts failed to assure investors. Analysts argue that central bank interventions alone won't stabilize the BRL without stronger fiscal reforms.

The BCB recently raised rates to 12.25% and signaled further hikes, but concerns over rising inflation persist. Market attention now shifts to the government’s next move to restore fiscal credibility.

#Forex #BRL #Brazil #USD

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.