2024-12-22 11:00

Industry Dividend Yields vs. Leverage Costs

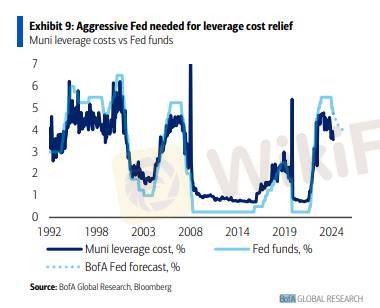

Recently, higher distribution yields have played a key role in narrowing market discounts. However, these distribution increases are essentially a gamble on favorable market conditions—namely, lower leverage costs and/or higher long-term bond yields.

If the Federal Reserve halts rate cuts at 4%, as economists predict, the decline in leverage costs may fall short of fund managers' expectations. In such a scenario, the sustainability of elevated distributions could face challenges, requiring investors to carefully weigh potential returns against underlying risks.

This uncertainty in the market environment serves as a reminder that relying solely on the narrowing of discounts driven by higher yields may lead to unexpected drawdowns. Therefore, prudent management of leverage and return expectations is more important than ever.

Like 0

Kevin Cao

โบรกเกอร์

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Dividend Yields vs. Leverage Costs

Hong Kong | 2024-12-22 11:00

Hong Kong | 2024-12-22 11:00Recently, higher distribution yields have played a key role in narrowing market discounts. However, these distribution increases are essentially a gamble on favorable market conditions—namely, lower leverage costs and/or higher long-term bond yields.

If the Federal Reserve halts rate cuts at 4%, as economists predict, the decline in leverage costs may fall short of fund managers' expectations. In such a scenario, the sustainability of elevated distributions could face challenges, requiring investors to carefully weigh potential returns against underlying risks.

This uncertainty in the market environment serves as a reminder that relying solely on the narrowing of discounts driven by higher yields may lead to unexpected drawdowns. Therefore, prudent management of leverage and return expectations is more important than ever.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.