2024-12-22 23:27

IndustryDXY Pullback: Long-Term Global Market Opportunity

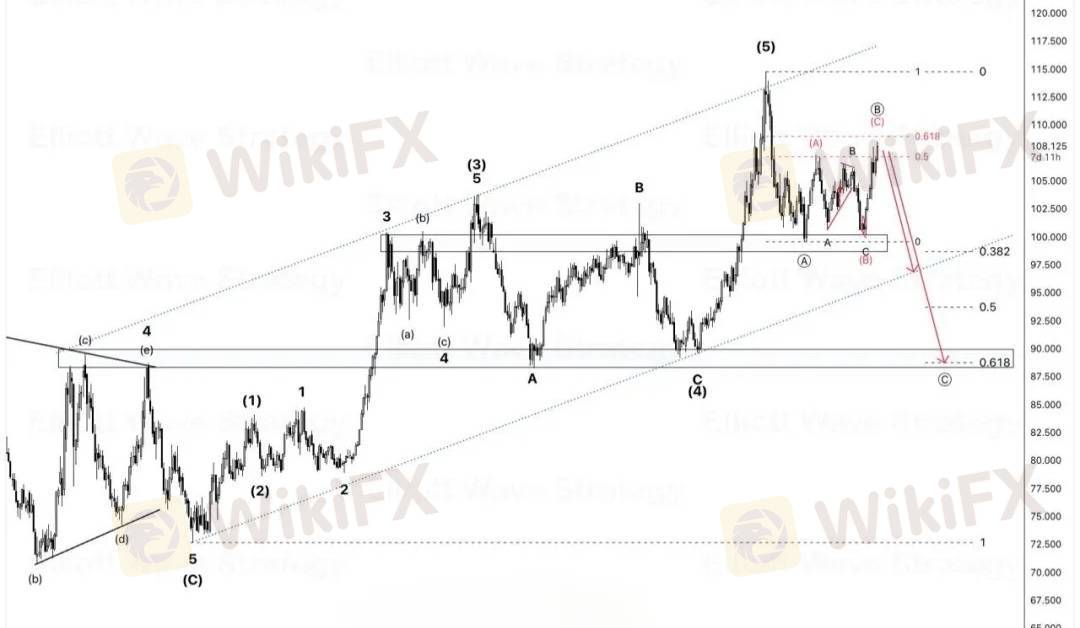

The long-term chart of the Dollar Index suggests a potential pullback. If the dollar weakens, its influence could extend beyond a single currency pair, potentially affecting global market capital flows and creating far-reaching impacts.

🔍 A Global Perspective Over Single-Market Focus

While many traders tend to focus on a single chart, movements in the Dollar Index can shape the direction of currencies, equities, and commodities. This broad influence means that focusing on just one market may lead to missed opportunities.

💡 Looking Ahead to 2025: Seizing Potential Opportunities

As the dollar approaches the end of 2024 with strong momentum, planning for 2025 becomes crucial. The current chart indicates a potential pullback, which could open the door to a series of new opportunities for traders.

Like 0

Kevin Cao

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

DXY Pullback: Long-Term Global Market Opportunity

Hong Kong | 2024-12-22 23:27

Hong Kong | 2024-12-22 23:27The long-term chart of the Dollar Index suggests a potential pullback. If the dollar weakens, its influence could extend beyond a single currency pair, potentially affecting global market capital flows and creating far-reaching impacts.

🔍 A Global Perspective Over Single-Market Focus

While many traders tend to focus on a single chart, movements in the Dollar Index can shape the direction of currencies, equities, and commodities. This broad influence means that focusing on just one market may lead to missed opportunities.

💡 Looking Ahead to 2025: Seizing Potential Opportunities

As the dollar approaches the end of 2024 with strong momentum, planning for 2025 becomes crucial. The current chart indicates a potential pullback, which could open the door to a series of new opportunities for traders.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.