2024-12-24 03:02

IndustryPRATICAL STRATEGY IN TRADING

#reducingvsclosingpositionsaroundchrismasmichriches#

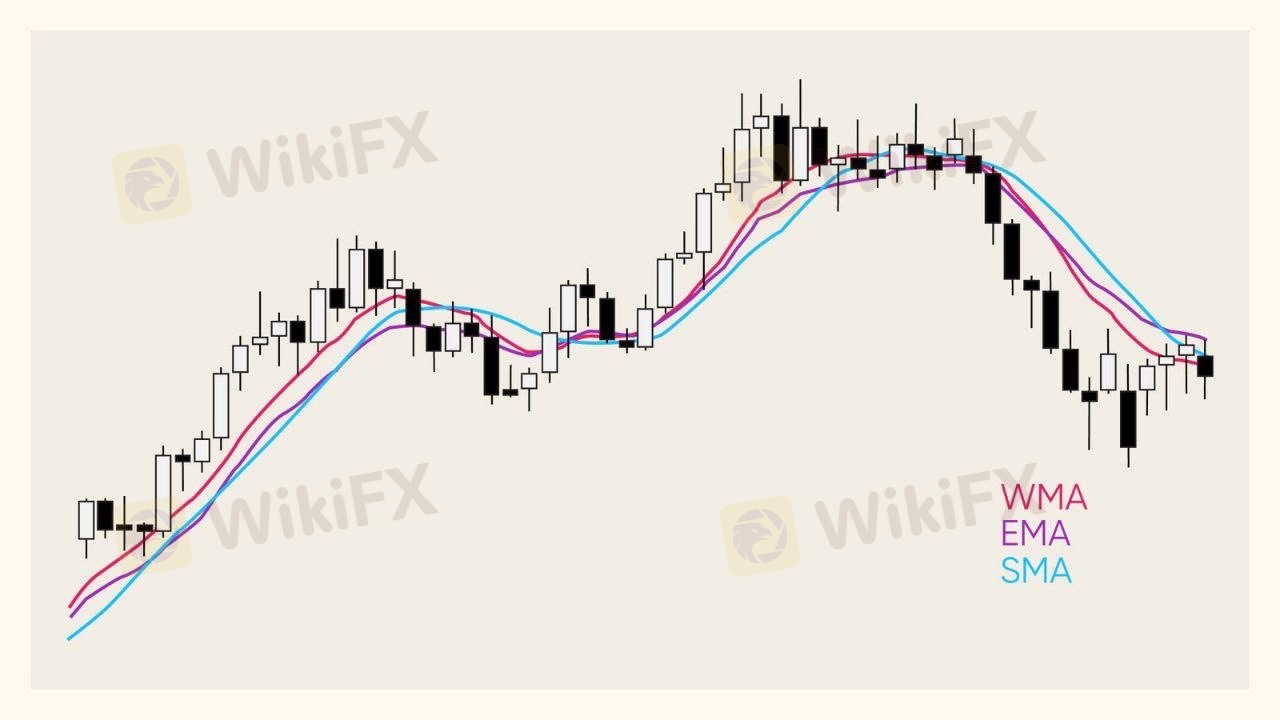

Using moving averages to determine whether to reduce or close positions is a practical strategy in trading, as they help to identify trends and potential reversal points. Here’s how you can apply moving averages to make these decisions:

1. Identify Trend Direction

• Bullish Trend: If the price is above a key moving average (e.g., 50-day or 200-day), it suggests the market is in an uptrend. You may want to maintain or add to positions, but keep an eye on any signs of weakening momentum.

• Bearish Trend: If the price is below a key moving average, the market is in a downtrend. You may want to reduce or close positions to avoid further losses.

Example: If you’re holding a long position, and the price drops below the 50-day moving average, this could signal weakening momentum, suggesting it’s time to reduce or close the position.

2. Crossovers for Entry or Exit Signals

• Golden Cross (Bullish Crossover): When a short-term moving average (e.g., 50-day) crosses above a long-term moving average (e.g., 200-day), it’s a bullish signal. You might hold or add to your positions if you’re long, or consider entering a new trade.

• Death Cross (Bearish Crossover): When a short-term moving average crosses below a long-term moving average, it signals a bearish trend. If you’re holding a position, this could indicate it’s time to reduce or close your position.

Example: A 50-day moving average crosses below the 200-day moving average (Death Cross), and you’re holding a long position. This could be a signal to close or reduce your exposure to prevent losses.

3. Moving Average Convergence Divergence (MACD)

• The MACD is a trend-following momentum indicator that uses the relationship between short-term and long-term moving averages (usually 12-day and 26-day). When the MACD line crosses above the signal line, it’s a bullish signal; when it crosses below, it’s bearish.

• Reduce or Close: If you’re holding a position and the MACD turns bearish (MACD line crosses below the signal line), it may be time to close or reduce your position.

4. Support and Resistance Levels Using Moving Averages

• Moving averages can also act as dynamic support or resistance levels. For example, the 200-day moving average is often seen as a strong level of support in an uptrend or resistance in a downtrend.

• Reduce or Close: If the price approaches a moving average that has been acting as resistance (e.g., 50-day) and begins to reverse, it could be a signal to reduce or close long positions. Similarly, if a support level is breached, consider reducing or closing short positions.

5. Using Moving Averages for Trailing Stops

• You can use moving averages as a dynamic trailing stop. For example, if the price is above a 50-day moving average, you could move your stop-loss just below it to lock in profits as the trend progresses. If the price falls below the moving average, this could signal the end of the trend and prompt you to close or reduce your position.

6. Moving Average Slopes and Steepness

• The slope of the moving average can indicate the strength of the trend. A steep slope indicates strong momentum, while a flat or turning slope suggests weakening momentum.

• Reduce or Close: If the moving average flattens or begins to slope downward after a period of upward movement, it could indicate a reversal is coming, suggesting it might be time to close or reduce positions.

Summary:

• Trend Confirmation: If the price is above a moving average, stay long; if it’s below, consider reducing or closing positions.

• Crossover Signals: Use golden and death crosses to confirm trend changes, signaling when to enter, reduce, or close positions.

• MACD: A turning MACD may help decide when to exit or reduce positions.

• Support/Resistance: Watch for price reactions to moving averages that act as support or resistance.

• Trailing Stops: Moving averages can also act as dynamic stops to lock in profits.

By using moving averages effectively, you can make more informed decisions about when to reduce or close positions, helping to manage risk and optimize trading outcomes.

Like 0

OLUWAPELUMI

ट्रेडर

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

PRATICAL STRATEGY IN TRADING

Nigeria | 2024-12-24 03:02

Nigeria | 2024-12-24 03:02#reducingvsclosingpositionsaroundchrismasmichriches#

Using moving averages to determine whether to reduce or close positions is a practical strategy in trading, as they help to identify trends and potential reversal points. Here’s how you can apply moving averages to make these decisions:

1. Identify Trend Direction

• Bullish Trend: If the price is above a key moving average (e.g., 50-day or 200-day), it suggests the market is in an uptrend. You may want to maintain or add to positions, but keep an eye on any signs of weakening momentum.

• Bearish Trend: If the price is below a key moving average, the market is in a downtrend. You may want to reduce or close positions to avoid further losses.

Example: If you’re holding a long position, and the price drops below the 50-day moving average, this could signal weakening momentum, suggesting it’s time to reduce or close the position.

2. Crossovers for Entry or Exit Signals

• Golden Cross (Bullish Crossover): When a short-term moving average (e.g., 50-day) crosses above a long-term moving average (e.g., 200-day), it’s a bullish signal. You might hold or add to your positions if you’re long, or consider entering a new trade.

• Death Cross (Bearish Crossover): When a short-term moving average crosses below a long-term moving average, it signals a bearish trend. If you’re holding a position, this could indicate it’s time to reduce or close your position.

Example: A 50-day moving average crosses below the 200-day moving average (Death Cross), and you’re holding a long position. This could be a signal to close or reduce your exposure to prevent losses.

3. Moving Average Convergence Divergence (MACD)

• The MACD is a trend-following momentum indicator that uses the relationship between short-term and long-term moving averages (usually 12-day and 26-day). When the MACD line crosses above the signal line, it’s a bullish signal; when it crosses below, it’s bearish.

• Reduce or Close: If you’re holding a position and the MACD turns bearish (MACD line crosses below the signal line), it may be time to close or reduce your position.

4. Support and Resistance Levels Using Moving Averages

• Moving averages can also act as dynamic support or resistance levels. For example, the 200-day moving average is often seen as a strong level of support in an uptrend or resistance in a downtrend.

• Reduce or Close: If the price approaches a moving average that has been acting as resistance (e.g., 50-day) and begins to reverse, it could be a signal to reduce or close long positions. Similarly, if a support level is breached, consider reducing or closing short positions.

5. Using Moving Averages for Trailing Stops

• You can use moving averages as a dynamic trailing stop. For example, if the price is above a 50-day moving average, you could move your stop-loss just below it to lock in profits as the trend progresses. If the price falls below the moving average, this could signal the end of the trend and prompt you to close or reduce your position.

6. Moving Average Slopes and Steepness

• The slope of the moving average can indicate the strength of the trend. A steep slope indicates strong momentum, while a flat or turning slope suggests weakening momentum.

• Reduce or Close: If the moving average flattens or begins to slope downward after a period of upward movement, it could indicate a reversal is coming, suggesting it might be time to close or reduce positions.

Summary:

• Trend Confirmation: If the price is above a moving average, stay long; if it’s below, consider reducing or closing positions.

• Crossover Signals: Use golden and death crosses to confirm trend changes, signaling when to enter, reduce, or close positions.

• MACD: A turning MACD may help decide when to exit or reduce positions.

• Support/Resistance: Watch for price reactions to moving averages that act as support or resistance.

• Trailing Stops: Moving averages can also act as dynamic stops to lock in profits.

By using moving averages effectively, you can make more informed decisions about when to reduce or close positions, helping to manage risk and optimize trading outcomes.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.