2024-12-25 21:09

IndustryGLOBAL ECONOMIC OUTLOOK AND MARKET TRENDS

#ANNUALINVESTMENTSHARINGMICHRICHES#

As of December 2024, the global economic landscape presents a mix of optimism and caution, with varying projections for 2025.

Global Growth Projections

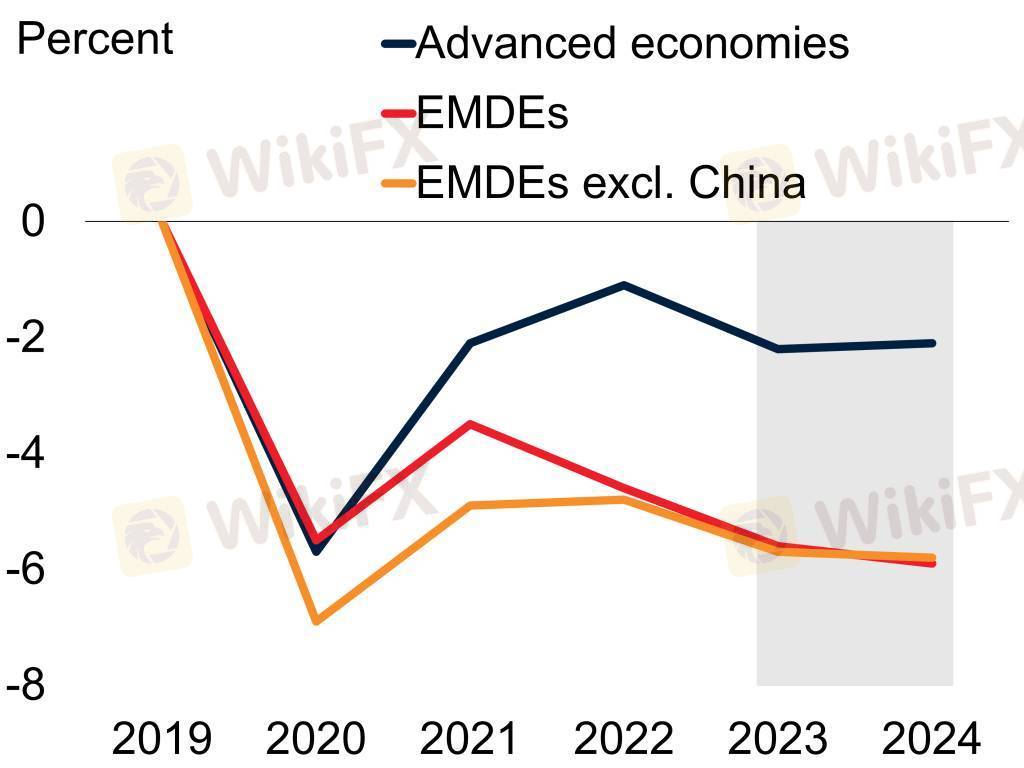

International Monetary Fund (IMF): The IMF forecasts a steady global growth rate of 3.2% for both 2024 and 2025, mirroring the pace of 2023. Advanced economies are expected to see a slight uptick, with growth rising from 1.6% in 2023 to 1.8% in 2025. In contrast, emerging markets and developing economies may experience a modest slowdown, with growth decreasing from 4.3% in 2023 to 4.2% in 2024 and 2025.

World Bank: Despite some near-term improvements, the World Bank notes that the global outlook remains subdued compared to historical standards. In 2024-2025, growth is projected to underperform the 2010s average in nearly 60% of economies, encompassing over 80% of the global population. Risks such as geopolitical tensions, trade fragmentation, sustained high interest rates, and climate-related disasters are predominant concerns.

Regional Insights

United States: The U.S. economy has demonstrated robust performance, with the S&P 500 rising by 24% in 2024, driven by significant gains in technology stocks and strong economic growth. This momentum is expected to continue into 2025, supported by policies under President-elect Donald Trump, including tax cuts, fiscal stimulus, and deregulation.

Europe: European markets have faced challenges, with the euro declining by 5.5% against the dollar in 2024. European stocks have underperformed compared to U.S. counterparts, and political gridlock in countries like Germany and France adds to the economic uncertainties for 2025.

China and Emerging Asia: China's economy is anticipated to benefit from government measures aimed at boosting consumer demand. However, U.S. trade tariffs on Chinese exports may pose challenges. Overall, Asia-Pacific growth is expected to be impeded by slower global demand and U.S. trade policies, with projections of 4.1% GDP growth in 2025 and 3.8% in 2026.

Sectoral Trends

Technology: The technology sector, particularly in the U.S., has been a significant driver of market gains in 2024. Companies like Nvidia and Tesla have seen substantial increases, contributing to the overall market rally.

Commercial Real Estate: The commercial real estate sector has faced challenges due to higher interest rates, oversupply, and increased costs. However, there is cautious optimism for 2025, with expectations of steady long-term interest rates and potential policy support from the Trump administration. The industrial market, benefiting from e-commerce growth, is expected to rebound as supply stabilizes and demand increases.

Risks and Considerations

Several risks could impact the global economic outlook for 2025:

Geopolitical Tensions: Ongoing conflicts in Ukraine and the Middle East, along with potential U.S. import tariffs, could disrupt trade and economic stability.

Inflation and Monetary Policy: While central banks have managed to lower interest rates, the disinflation process could face disruptions, preventing further monetary easing and adding challenges to fiscal policy and financial stability.

Trade Fragmentation: Rising protectionism and continued geoeconomic fragmentation could hinder global trade and economic growth.

In summary, while there are positive indicators for the global economy heading into 2025, significant risks and uncertainties remain. Policymakers and investors should closely monitor these developments to navigate the evolving economic landscape effectively.

Like 0

Kenny 6816

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

GLOBAL ECONOMIC OUTLOOK AND MARKET TRENDS

Nigeria | 2024-12-25 21:09

Nigeria | 2024-12-25 21:09#ANNUALINVESTMENTSHARINGMICHRICHES#

As of December 2024, the global economic landscape presents a mix of optimism and caution, with varying projections for 2025.

Global Growth Projections

International Monetary Fund (IMF): The IMF forecasts a steady global growth rate of 3.2% for both 2024 and 2025, mirroring the pace of 2023. Advanced economies are expected to see a slight uptick, with growth rising from 1.6% in 2023 to 1.8% in 2025. In contrast, emerging markets and developing economies may experience a modest slowdown, with growth decreasing from 4.3% in 2023 to 4.2% in 2024 and 2025.

World Bank: Despite some near-term improvements, the World Bank notes that the global outlook remains subdued compared to historical standards. In 2024-2025, growth is projected to underperform the 2010s average in nearly 60% of economies, encompassing over 80% of the global population. Risks such as geopolitical tensions, trade fragmentation, sustained high interest rates, and climate-related disasters are predominant concerns.

Regional Insights

United States: The U.S. economy has demonstrated robust performance, with the S&P 500 rising by 24% in 2024, driven by significant gains in technology stocks and strong economic growth. This momentum is expected to continue into 2025, supported by policies under President-elect Donald Trump, including tax cuts, fiscal stimulus, and deregulation.

Europe: European markets have faced challenges, with the euro declining by 5.5% against the dollar in 2024. European stocks have underperformed compared to U.S. counterparts, and political gridlock in countries like Germany and France adds to the economic uncertainties for 2025.

China and Emerging Asia: China's economy is anticipated to benefit from government measures aimed at boosting consumer demand. However, U.S. trade tariffs on Chinese exports may pose challenges. Overall, Asia-Pacific growth is expected to be impeded by slower global demand and U.S. trade policies, with projections of 4.1% GDP growth in 2025 and 3.8% in 2026.

Sectoral Trends

Technology: The technology sector, particularly in the U.S., has been a significant driver of market gains in 2024. Companies like Nvidia and Tesla have seen substantial increases, contributing to the overall market rally.

Commercial Real Estate: The commercial real estate sector has faced challenges due to higher interest rates, oversupply, and increased costs. However, there is cautious optimism for 2025, with expectations of steady long-term interest rates and potential policy support from the Trump administration. The industrial market, benefiting from e-commerce growth, is expected to rebound as supply stabilizes and demand increases.

Risks and Considerations

Several risks could impact the global economic outlook for 2025:

Geopolitical Tensions: Ongoing conflicts in Ukraine and the Middle East, along with potential U.S. import tariffs, could disrupt trade and economic stability.

Inflation and Monetary Policy: While central banks have managed to lower interest rates, the disinflation process could face disruptions, preventing further monetary easing and adding challenges to fiscal policy and financial stability.

Trade Fragmentation: Rising protectionism and continued geoeconomic fragmentation could hinder global trade and economic growth.

In summary, while there are positive indicators for the global economy heading into 2025, significant risks and uncertainties remain. Policymakers and investors should closely monitor these developments to navigate the evolving economic landscape effectively.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.