2024-12-31 02:49

Industry MONETARY POLICY SHIFTS AND STOCKS RALLIES

#Wherearethepost-holidayrallyopportunities?Michriches#

Monetary Policy Shifts and Their Impact on Rallying Stocks

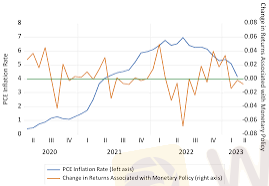

Monetary policy changes, such as interest rate adjustments or shifts in quantitative easing, significantly impact stock markets. When central banks like the Federal Reserve change their policies, it can either fuel or dampen stock rallies.

Interest Rate Cuts

Lower interest rates typically make borrowing cheaper, encouraging investment and consumer spending. This can lead to rising stock prices as investors anticipate higher profits and economic growth, often boosting stock market rallies.

Interest Rate Hikes

Conversely, higher interest rates can lead to higher borrowing costs and potentially lower corporate profits. This can lead to market corrections or slowdowns as investors adjust to the prospect of slower growth, potentially stalling rallies.

Quantitative Easing (QE)

When central banks increase the money supply through QE, it tends to lower yields on bonds and pushes investors toward stocks, thus supporting rallies.

Tightening Monetary Policy

Tightening measures, such as reducing the money supply or ending QE, can have the opposite effect, potentially leading to reduced market liquidity and lower stock prices.

Monetary policy shifts directly influence investor sentiment, capital flows, and market expectations, ultimately determining the direction of stock rallies.

Like 0

Tescy

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

MONETARY POLICY SHIFTS AND STOCKS RALLIES

Nigeria | 2024-12-31 02:49

Nigeria | 2024-12-31 02:49#Wherearethepost-holidayrallyopportunities?Michriches#

Monetary Policy Shifts and Their Impact on Rallying Stocks

Monetary policy changes, such as interest rate adjustments or shifts in quantitative easing, significantly impact stock markets. When central banks like the Federal Reserve change their policies, it can either fuel or dampen stock rallies.

Interest Rate Cuts

Lower interest rates typically make borrowing cheaper, encouraging investment and consumer spending. This can lead to rising stock prices as investors anticipate higher profits and economic growth, often boosting stock market rallies.

Interest Rate Hikes

Conversely, higher interest rates can lead to higher borrowing costs and potentially lower corporate profits. This can lead to market corrections or slowdowns as investors adjust to the prospect of slower growth, potentially stalling rallies.

Quantitative Easing (QE)

When central banks increase the money supply through QE, it tends to lower yields on bonds and pushes investors toward stocks, thus supporting rallies.

Tightening Monetary Policy

Tightening measures, such as reducing the money supply or ending QE, can have the opposite effect, potentially leading to reduced market liquidity and lower stock prices.

Monetary policy shifts directly influence investor sentiment, capital flows, and market expectations, ultimately determining the direction of stock rallies.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.