2025-01-29 00:45

IndustryPartial profit-taking in forex trading.

#firstdealofthenewyearAKEEL

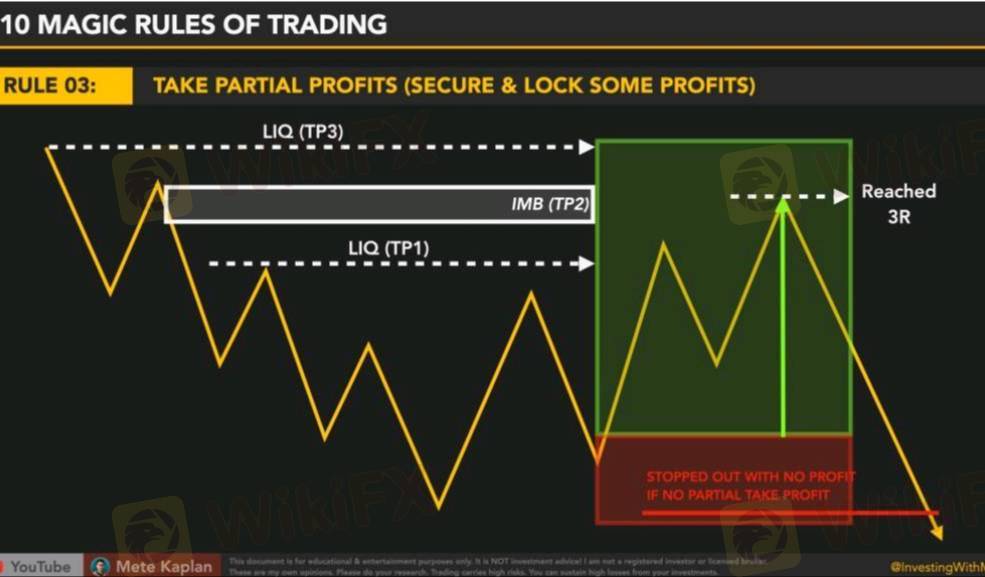

Partial profit-taking is a trading strategy where a trader closes a portion of their position to lock in some profits while keeping the rest of the trade open to capitalize on further potential gains.

How It Works

Open a Trade: Enter a position with a specific lot size (e.g., 1.0 lot).

Set a Target Zone: Identify a price level where partial profits will be taken, often based on technical analysis (e.g., support/resistance, Fibonacci levels).

Close Part of the Position: When the price reaches the target, close a portion of the trade (e.g., 0.5 lots) to secure profits.

Adjust Stop-Loss:

Move the stop-loss to breakeven (entry price) or a more favorable level to minimize risk on the remaining position.

This ensures the trade is risk-free or profitable overall.

Let the Rest Run: Allow the remaining position to run toward a higher target or until the market signals an exit.

Advantages of Partial Profit-Taking

Locks in Profits:

Reduces the emotional pressure of holding the entire position.

Secures gains even if the market reverses.

Balances Risk and Reward:

Ensures a reward while still participating in potential future market moves.

Creates a "win-win" scenario: some profit is guaranteed, and more can be earned.

Increases Flexibility:

Allows traders to adapt to changing market conditions without fully exiting the trade.

Improves Trade Psychology:

Reduces fear and greed, helping traders stick to their plan more effectively.

Disadvantages of Partial Profit-Taking

Reduces Overall Profit Potential:

By closing part of the position, the trader limits potential gains if the price continues moving in their favor.

Additional Execution Costs:

Closing trades in parts may result in higher transaction fees or spreads.

Requires Precise Planning:

Poor timing or incorrect partial exits can lead to suboptimal results.

When to Use Partial Profit-Taking

Volatile Markets:

When price movements are unpredictable, securing partial profits can be a safer strategy.

Uncertainty Near Key Levels:

When the price approaches major resistance or support zones where reversals are likely.

Scaling Out of Trades:

When the trade is highly profitable but hasn’t yet reached the final target, taking partial profits helps to lock in gains.

Long-Term Trades:

For swing or position traders, it’s a way to balance short-term gains while letting the remaining trade ride long-term trends.

Example of Partial Profit-Taking

Entry: Buy EUR/USD at 1.1000 with 1.0 lot size.

Partial Target: Close 0.5 lots at 1.1050 to secure 50 pips of profit.

Stop-Loss Adjustment: Move stop-loss to 1.1020 for the remaining 0.5 lots, ensuring a risk-free trade.

Final Target: Let the remaining 0.5 lots run toward 1.1100 or until a reversal signal.

Tips for Effective Partial Profit-Taking

Plan in Advance:

Set predefined levels for partial exits based on analysis, not emotions.

Use Risk-Reward Ratios:

Ensure the reward for both partial and full exits aligns with your risk tolerance.

Combine with Trailing Stops:

Use trailing stops to protect profits on the remaining position.

Monitor News Events:

Be cautious around high-impact news, which can cause unexpected reversals.

Partial profit-taking is a versatile strategy that allows traders to balance risk and reward effectively while maintaining psychological comfort.

#firstdealofthenewyearAKEEL

Like 0

Mky9196

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Partial profit-taking in forex trading.

Nigeria | 2025-01-29 00:45

Nigeria | 2025-01-29 00:45#firstdealofthenewyearAKEEL

Partial profit-taking is a trading strategy where a trader closes a portion of their position to lock in some profits while keeping the rest of the trade open to capitalize on further potential gains.

How It Works

Open a Trade: Enter a position with a specific lot size (e.g., 1.0 lot).

Set a Target Zone: Identify a price level where partial profits will be taken, often based on technical analysis (e.g., support/resistance, Fibonacci levels).

Close Part of the Position: When the price reaches the target, close a portion of the trade (e.g., 0.5 lots) to secure profits.

Adjust Stop-Loss:

Move the stop-loss to breakeven (entry price) or a more favorable level to minimize risk on the remaining position.

This ensures the trade is risk-free or profitable overall.

Let the Rest Run: Allow the remaining position to run toward a higher target or until the market signals an exit.

Advantages of Partial Profit-Taking

Locks in Profits:

Reduces the emotional pressure of holding the entire position.

Secures gains even if the market reverses.

Balances Risk and Reward:

Ensures a reward while still participating in potential future market moves.

Creates a "win-win" scenario: some profit is guaranteed, and more can be earned.

Increases Flexibility:

Allows traders to adapt to changing market conditions without fully exiting the trade.

Improves Trade Psychology:

Reduces fear and greed, helping traders stick to their plan more effectively.

Disadvantages of Partial Profit-Taking

Reduces Overall Profit Potential:

By closing part of the position, the trader limits potential gains if the price continues moving in their favor.

Additional Execution Costs:

Closing trades in parts may result in higher transaction fees or spreads.

Requires Precise Planning:

Poor timing or incorrect partial exits can lead to suboptimal results.

When to Use Partial Profit-Taking

Volatile Markets:

When price movements are unpredictable, securing partial profits can be a safer strategy.

Uncertainty Near Key Levels:

When the price approaches major resistance or support zones where reversals are likely.

Scaling Out of Trades:

When the trade is highly profitable but hasn’t yet reached the final target, taking partial profits helps to lock in gains.

Long-Term Trades:

For swing or position traders, it’s a way to balance short-term gains while letting the remaining trade ride long-term trends.

Example of Partial Profit-Taking

Entry: Buy EUR/USD at 1.1000 with 1.0 lot size.

Partial Target: Close 0.5 lots at 1.1050 to secure 50 pips of profit.

Stop-Loss Adjustment: Move stop-loss to 1.1020 for the remaining 0.5 lots, ensuring a risk-free trade.

Final Target: Let the remaining 0.5 lots run toward 1.1100 or until a reversal signal.

Tips for Effective Partial Profit-Taking

Plan in Advance:

Set predefined levels for partial exits based on analysis, not emotions.

Use Risk-Reward Ratios:

Ensure the reward for both partial and full exits aligns with your risk tolerance.

Combine with Trailing Stops:

Use trailing stops to protect profits on the remaining position.

Monitor News Events:

Be cautious around high-impact news, which can cause unexpected reversals.

Partial profit-taking is a versatile strategy that allows traders to balance risk and reward effectively while maintaining psychological comfort.

#firstdealofthenewyearAKEEL

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.