2025-01-29 16:30

IndustryHigh-Frequency Trading HFT

#firstdealofthenewyearFATEEMAH

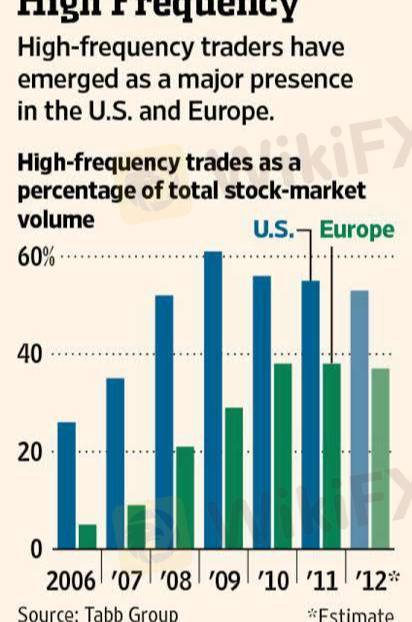

High-Frequency Trading (HFT) is a type of algorithmic trading that uses powerful computers to execute a large number of orders at extremely high speeds. It relies on complex algorithms to analyze market conditions and execute trades in fractions of a second.

Key Features of HFT:

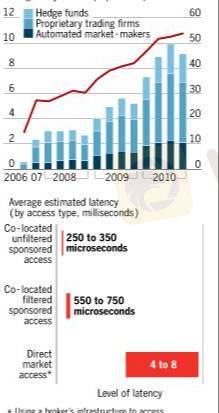

1. Speed – Trades are executed in microseconds or milliseconds.

2. Automation – Uses sophisticated algorithms to make trading decisions.

3. High Volume – Executes a large number of trades in a short period.

4. Low Latency – Requires ultra-fast network connections and co-location services (placing servers close to exchanges).

5. Market Making – Often provides liquidity by constantly placing and canceling buy/sell orders.

6. Arbitrage Strategies – Exploits small price differences across exchanges.

HFT Strategies:

Market Making – Providing liquidity by continuously placing buy and sell orders.

Statistical Arbitrage – Using mathematical models to identify short-term mispricings.

Latency Arbitrage – Taking advantage of small price differences by reacting faster than competitors.

Momentum Ignition – Creating artificial price movements to profit from market reactions.

Pros of HFT:

✔ Increases market liquidity.

✔ Reduces bid-ask spreads.

✔ Can improve market efficiency.

Cons of HFT:

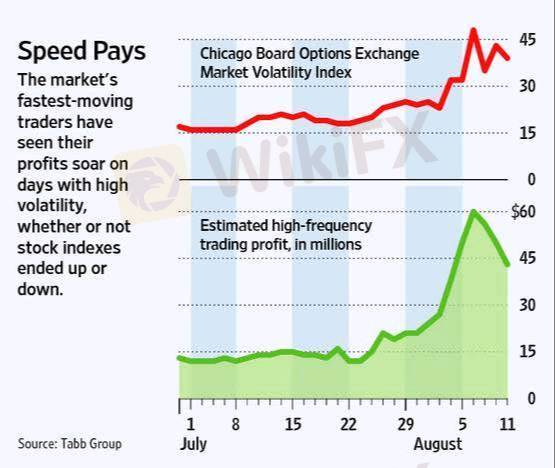

✖ Increases market volatility.

✖ Can lead to "flash crashes" (sudden, rapid price drops).

✖ Gives an unfair advantage to firms with better technology.

Like 0

FX1816125491

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

High-Frequency Trading HFT

Nigeria | 2025-01-29 16:30

Nigeria | 2025-01-29 16:30#firstdealofthenewyearFATEEMAH

High-Frequency Trading (HFT) is a type of algorithmic trading that uses powerful computers to execute a large number of orders at extremely high speeds. It relies on complex algorithms to analyze market conditions and execute trades in fractions of a second.

Key Features of HFT:

1. Speed – Trades are executed in microseconds or milliseconds.

2. Automation – Uses sophisticated algorithms to make trading decisions.

3. High Volume – Executes a large number of trades in a short period.

4. Low Latency – Requires ultra-fast network connections and co-location services (placing servers close to exchanges).

5. Market Making – Often provides liquidity by constantly placing and canceling buy/sell orders.

6. Arbitrage Strategies – Exploits small price differences across exchanges.

HFT Strategies:

Market Making – Providing liquidity by continuously placing buy and sell orders.

Statistical Arbitrage – Using mathematical models to identify short-term mispricings.

Latency Arbitrage – Taking advantage of small price differences by reacting faster than competitors.

Momentum Ignition – Creating artificial price movements to profit from market reactions.

Pros of HFT:

✔ Increases market liquidity.

✔ Reduces bid-ask spreads.

✔ Can improve market efficiency.

Cons of HFT:

✖ Increases market volatility.

✖ Can lead to "flash crashes" (sudden, rapid price drops).

✖ Gives an unfair advantage to firms with better technology.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.