2025-01-30 20:06

IndustryForex trading margin level.

#firstdealofthenewyearAKEEL

Margin level is a key concept in forex trading that helps traders manage risk and avoid margin calls. Understanding how it works can help you protect your account from unnecessary liquidation.

1. What is Margin Level in Forex?

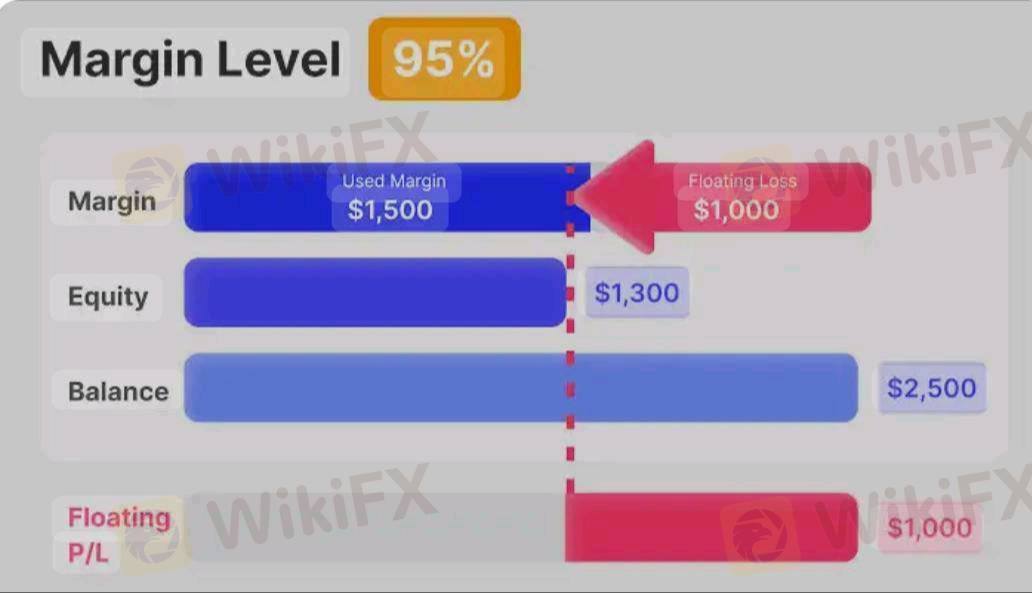

Margin level is the percentage ratio between your equity (account balance including profits/losses) and used margin (the amount held by the broker to keep trades open).

Formula:

\text{Margin Level} = \left(\frac{\text{Equity}}{\text{Used Margin}}\right) \times 100

Example:

Account Balance (Equity): $1,000

Used Margin: $200

Margin Level Calculation:

\left(\frac{1000}{200}\right) \times 100 = 500\%

2. Key Margin Level Thresholds

Note: Different brokers have different margin call and stop-out levels (e.g., some trigger margin calls at 80%, others at 100%).

3. How to Manage Your Margin Level Effectively

A. Use Low Leverage

High leverage (e.g., 1:500) can deplete margin quickly.

Safer leverage options: 1:10 to 1:50, especially for small accounts.

B. Monitor Your Free Margin

Free Margin = Equity – Used Margin

The more free margin you have, the more room for trades.

If free margin is low, avoid opening new positions.

C. Use Stop-Loss Orders

Protects your trades from hitting the stop-out level.

Helps maintain a stable margin level.

D. Avoid Overleveraging & Overtrading

Using too much margin can wipe out your account quickly.

Only risk 1-2% per trade to keep margin levels safe.

E. Add Funds if Needed

If margin level drops too low, consider depositing funds instead of letting trades close automatically.

4. Conclusion

Margin level is a crucial risk management tool in forex trading. Always monitor your margin, use stop-losses, and avoid excessive leverage to protect your account from margin calls and stop-outs.

Would you like help calculating margin for specific trades based on your account balance?

#firstdealofthenewyearAKEEL

Like 0

call me Ateeqq

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Forex trading margin level.

Nigeria | 2025-01-30 20:06

Nigeria | 2025-01-30 20:06#firstdealofthenewyearAKEEL

Margin level is a key concept in forex trading that helps traders manage risk and avoid margin calls. Understanding how it works can help you protect your account from unnecessary liquidation.

1. What is Margin Level in Forex?

Margin level is the percentage ratio between your equity (account balance including profits/losses) and used margin (the amount held by the broker to keep trades open).

Formula:

\text{Margin Level} = \left(\frac{\text{Equity}}{\text{Used Margin}}\right) \times 100

Example:

Account Balance (Equity): $1,000

Used Margin: $200

Margin Level Calculation:

\left(\frac{1000}{200}\right) \times 100 = 500\%

2. Key Margin Level Thresholds

Note: Different brokers have different margin call and stop-out levels (e.g., some trigger margin calls at 80%, others at 100%).

3. How to Manage Your Margin Level Effectively

A. Use Low Leverage

High leverage (e.g., 1:500) can deplete margin quickly.

Safer leverage options: 1:10 to 1:50, especially for small accounts.

B. Monitor Your Free Margin

Free Margin = Equity – Used Margin

The more free margin you have, the more room for trades.

If free margin is low, avoid opening new positions.

C. Use Stop-Loss Orders

Protects your trades from hitting the stop-out level.

Helps maintain a stable margin level.

D. Avoid Overleveraging & Overtrading

Using too much margin can wipe out your account quickly.

Only risk 1-2% per trade to keep margin levels safe.

E. Add Funds if Needed

If margin level drops too low, consider depositing funds instead of letting trades close automatically.

4. Conclusion

Margin level is a crucial risk management tool in forex trading. Always monitor your margin, use stop-losses, and avoid excessive leverage to protect your account from margin calls and stop-outs.

Would you like help calculating margin for specific trades based on your account balance?

#firstdealofthenewyearAKEEL

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.