2025-01-30 20:53

IndustryFOREX TRADE POLICY

#firstdealofthenewyearFateema:

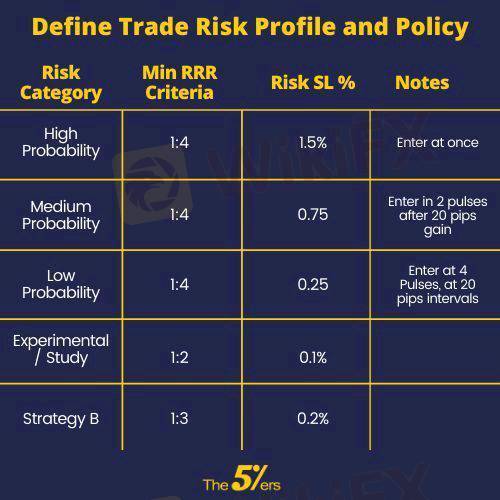

A Forex trade policy refers to the set of rules, guidelines, and strategies that a trader, broker, or financial institution follows when engaging in currency trading. It outlines how trades are executed, managed, and closed, focusing on risk management, compliance, and overall trading goals. Key elements typically include:

1. Risk Management: Establishing guidelines for position sizing, leverage, stop-loss orders, and risk-to-reward ratios to protect capital.

2. Trade Execution: Rules for entering and exiting trades, including using specific strategies like scalping, day trading, or swing trading.

3. Leverage and Margin: Defining acceptable levels of leverage, margin requirements, and the use of margin calls to avoid excessive risk exposure.

4. Compliance with Regulations: Adhering to financial regulations in the trader’s country or region (e.g., SEC, FCA) to ensure legal and ethical trading practices.

5. Trading Hours and Instruments: Determining which currency pairs to trade and when, and managing orders based on the most liquid times of the Forex market.

A well-defined Forex trade policy helps traders maintain discipline, manage risks effectively, and avoid impulsive decisions that can lead to significant losses .

Like 0

FX9759221232

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

FOREX TRADE POLICY

Nigeria | 2025-01-30 20:53

Nigeria | 2025-01-30 20:53#firstdealofthenewyearFateema:

A Forex trade policy refers to the set of rules, guidelines, and strategies that a trader, broker, or financial institution follows when engaging in currency trading. It outlines how trades are executed, managed, and closed, focusing on risk management, compliance, and overall trading goals. Key elements typically include:

1. Risk Management: Establishing guidelines for position sizing, leverage, stop-loss orders, and risk-to-reward ratios to protect capital.

2. Trade Execution: Rules for entering and exiting trades, including using specific strategies like scalping, day trading, or swing trading.

3. Leverage and Margin: Defining acceptable levels of leverage, margin requirements, and the use of margin calls to avoid excessive risk exposure.

4. Compliance with Regulations: Adhering to financial regulations in the trader’s country or region (e.g., SEC, FCA) to ensure legal and ethical trading practices.

5. Trading Hours and Instruments: Determining which currency pairs to trade and when, and managing orders based on the most liquid times of the Forex market.

A well-defined Forex trade policy helps traders maintain discipline, manage risks effectively, and avoid impulsive decisions that can lead to significant losses .

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.