2025-01-30 22:25

IndustryInter market analysis with forex

#firstdealofthenewyearAKEEL

Inter-market analysis in Forex involves studying the relationships between different financial markets—such as equities, commodities, bonds, and currencies—to identify potential trends and opportunities in the Forex market. By understanding how these markets interact, traders can gain insights into price movements and better predict the direction of a currency pair.

Here are the key steps in conducting inter-market analysis with Forex:

1. Understand Market Correlations:

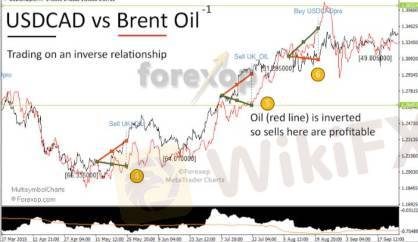

Currency and Commodity Correlations: For example, the price of oil often has a strong correlation with currencies like the Canadian Dollar (CAD) or the Russian Ruble (RUB), since those countries are major oil exporters. If oil prices rise, the CAD could strengthen.

Currency and Equity Correlations: The performance of stock markets can also affect currencies. A strong stock market might signal a growing economy, which could strengthen the local currency.

Currency and Bond Market Correlations: Interest rate differentials and bond yields can influence currency prices. If U.S. Treasury yields rise, for example, it could attract foreign investment, strengthening the USD.

2. Use of Leading and Lagging Indicators:

Some markets may lead, while others may lag. For example, commodity prices can lead movements in currencies, especially for countries reliant on exports. Conversely, bond markets may lag as they reflect investor sentiment over a longer period.

3. Impact of Economic Data:

Data from one market can often have a ripple effect on others. For example, strong employment data from the U.S. can boost the USD while also driving demand for commodities and influencing global equity markets.

4. Chart Analysis Across Markets:

Analyzing charts from multiple markets (e.g., commodity prices, stocks, bonds, and Forex pairs) helps identify converging trends. For example, if global equity markets are showing bullish trends, this could suggest a higher risk appetite, potentially supporting risk-on currencies like the AUD or NZD.

5. Sentiment and Global Events:

News such as geopolitical events, central bank policies, or macroeconomic shifts (like a global recession) can affect multiple markets simultaneously. Forex traders use this information to gauge the potential effect on currencies, often adjusting positions based on broader market sentiment.

6. Example of Inter-Market Analysis:

Oil and CAD: If oil prices are rising due to supply constraints, the Canadian Dollar (CAD) may strengthen since Canada is a major oil exporter. Traders could use this to anticipate movements in the USD/CAD pair.

USD and Bond Yields: Rising U.S. bond yields (due to higher inflation expectations) could signal strength in the USD, which would help in predicting price movements in pairs like EUR/USD or GBP/USD.

By blending information from various markets, inter-market analysis enables Forex traders to understand broader economic trends and make more informed trading decisions.

#firstdealofthenewyearAKEEL

Like 0

MOMEH001

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Inter market analysis with forex

Hong Kong | 2025-01-30 22:25

Hong Kong | 2025-01-30 22:25#firstdealofthenewyearAKEEL

Inter-market analysis in Forex involves studying the relationships between different financial markets—such as equities, commodities, bonds, and currencies—to identify potential trends and opportunities in the Forex market. By understanding how these markets interact, traders can gain insights into price movements and better predict the direction of a currency pair.

Here are the key steps in conducting inter-market analysis with Forex:

1. Understand Market Correlations:

Currency and Commodity Correlations: For example, the price of oil often has a strong correlation with currencies like the Canadian Dollar (CAD) or the Russian Ruble (RUB), since those countries are major oil exporters. If oil prices rise, the CAD could strengthen.

Currency and Equity Correlations: The performance of stock markets can also affect currencies. A strong stock market might signal a growing economy, which could strengthen the local currency.

Currency and Bond Market Correlations: Interest rate differentials and bond yields can influence currency prices. If U.S. Treasury yields rise, for example, it could attract foreign investment, strengthening the USD.

2. Use of Leading and Lagging Indicators:

Some markets may lead, while others may lag. For example, commodity prices can lead movements in currencies, especially for countries reliant on exports. Conversely, bond markets may lag as they reflect investor sentiment over a longer period.

3. Impact of Economic Data:

Data from one market can often have a ripple effect on others. For example, strong employment data from the U.S. can boost the USD while also driving demand for commodities and influencing global equity markets.

4. Chart Analysis Across Markets:

Analyzing charts from multiple markets (e.g., commodity prices, stocks, bonds, and Forex pairs) helps identify converging trends. For example, if global equity markets are showing bullish trends, this could suggest a higher risk appetite, potentially supporting risk-on currencies like the AUD or NZD.

5. Sentiment and Global Events:

News such as geopolitical events, central bank policies, or macroeconomic shifts (like a global recession) can affect multiple markets simultaneously. Forex traders use this information to gauge the potential effect on currencies, often adjusting positions based on broader market sentiment.

6. Example of Inter-Market Analysis:

Oil and CAD: If oil prices are rising due to supply constraints, the Canadian Dollar (CAD) may strengthen since Canada is a major oil exporter. Traders could use this to anticipate movements in the USD/CAD pair.

USD and Bond Yields: Rising U.S. bond yields (due to higher inflation expectations) could signal strength in the USD, which would help in predicting price movements in pairs like EUR/USD or GBP/USD.

By blending information from various markets, inter-market analysis enables Forex traders to understand broader economic trends and make more informed trading decisions.

#firstdealofthenewyearAKEEL

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.