2025-02-01 01:31

IndustryMacro and Fundamental trading in forex.

#firstdealofthenewyearAKEEL

Macro and fundamental trading focuses on the broader economic factors that influence currency prices. Traders using this approach typically analyze economic indicators, central bank policies, geopolitical events, and other macroeconomic trends to forecast currency movements.

1. Macro Trading in Forex

Macro trading involves looking at the big-picture economic conditions across different countries. Traders use this approach to take positions based on global economic trends and events. These could include:

Interest Rate Differentials:

Central banks control interest rates, and differences between rates in different countries often drive currency movements. For example, when the U.S. Federal Reserve raises interest rates, the USD generally strengthens as investors seek higher returns.

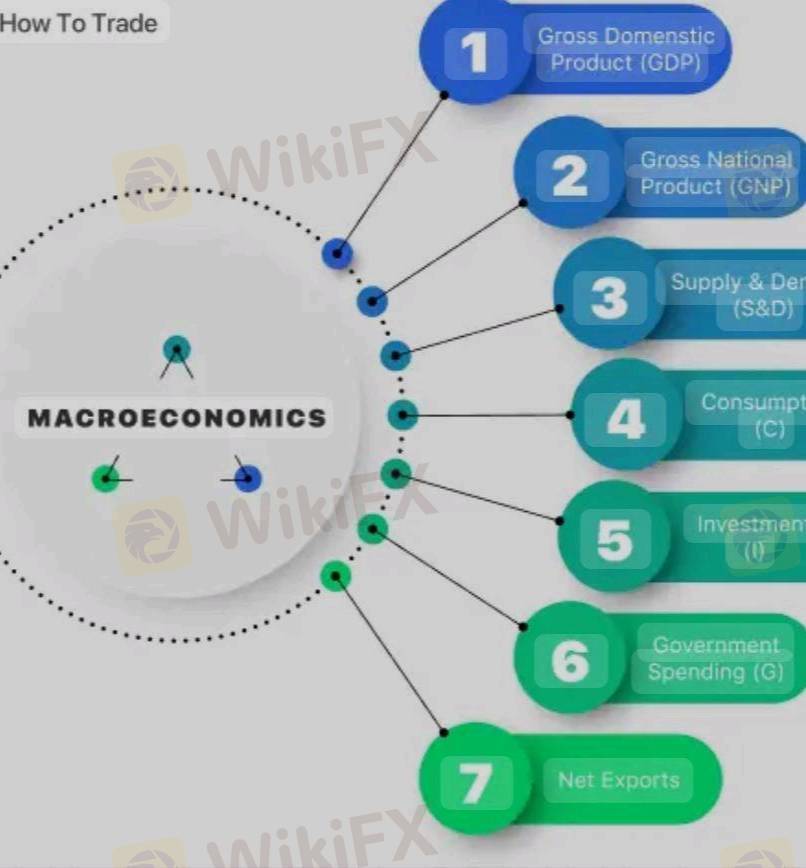

Economic Growth (GDP):

A country's GDP is a key indicator of economic health. Strong GDP growth typically strengthens a currency as it suggests a growing economy and more favorable business conditions.

Inflation Rates:

High inflation erodes purchasing power, which can lead to currency depreciation. Traders watch inflation reports like the Consumer Price Index (CPI) to gauge the potential for central banks to adjust interest rates.

Employment Data:

The Non-Farm Payrolls (NFP) report in the U.S. is a critical data point. Strong job creation can signal economic strength and influence the strength of the currency.

Geopolitical Events:

Political instability, wars, trade agreements, and elections can have a profound impact on a country's currency. For example, Brexit uncertainty led to significant volatility in GBP pairs.

2. Fundamental Trading in Forex.

Fundamental trading is the process of analyzing individual economic reports and data releases to predict how they will impact currency prices. Key indicators to focus on include:

A. Key Economic Indicators

Interest Rates:

Central banks set interest rates to control inflation and stabilize the economy. Higher interest rates tend to attract foreign capital, strengthening the currency. Conversely, lower rates can weaken a currency.

GDP Growth Rates:

Strong economic growth often leads to currency appreciation as investors are more likely to invest in a growing economy.

Inflation Reports:

CPI and Producer Price Index (PPI) are indicators of price changes in an economy. Central banks adjust their monetary policy based on inflation, so high inflation can lead to rate hikes, strengthening the currency.

Trade Balance:

The balance of trade reflects a country's exports vs. imports. A country running a trade surplus (exports > imports) may see its currency appreciate as demand for its goods and services increases.

Retail Sales:

Retail sales reports show consumer spending patterns, which are critical for assessing economic health. Strong retail sales may indicate economic growth, positively affecting the currency.

B. Central Bank Policies

Central banks play a significant role in forex markets through their control over monetary policy. Key central banks include:

Federal Reserve (U.S.)

European Central Bank (ECB)

Bank of Japan (BoJ)

Bank of England (BoE)

Traders focus on the central bank's stance on interest rates and quantitative easing, as these policies directly impact currency values.

C. Global Risk Sentiment

Safe-Haven Currencies:

In times of economic uncertainty or geopolitical risk, traders often flock to safe-haven currencies like the USD, CHF, or JPY.

Commodity Prices:

Currencies like AUD, CAD, and NZD are often correlated with commodity prices. For example, if oil prices rise, the Canadian Dollar (CAD) often strengthens due to Canada's large oil exports.

3. How to Trade Using Macro and Fundamental Analysis

Economic Calendar:

Use the economic calendar to track upcoming reports and events (like GDP

#firstdealofthenewyearAKEEL

Like 0

BGDBagauda

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Macro and Fundamental trading in forex.

Nigeria | 2025-02-01 01:31

Nigeria | 2025-02-01 01:31#firstdealofthenewyearAKEEL

Macro and fundamental trading focuses on the broader economic factors that influence currency prices. Traders using this approach typically analyze economic indicators, central bank policies, geopolitical events, and other macroeconomic trends to forecast currency movements.

1. Macro Trading in Forex

Macro trading involves looking at the big-picture economic conditions across different countries. Traders use this approach to take positions based on global economic trends and events. These could include:

Interest Rate Differentials:

Central banks control interest rates, and differences between rates in different countries often drive currency movements. For example, when the U.S. Federal Reserve raises interest rates, the USD generally strengthens as investors seek higher returns.

Economic Growth (GDP):

A country's GDP is a key indicator of economic health. Strong GDP growth typically strengthens a currency as it suggests a growing economy and more favorable business conditions.

Inflation Rates:

High inflation erodes purchasing power, which can lead to currency depreciation. Traders watch inflation reports like the Consumer Price Index (CPI) to gauge the potential for central banks to adjust interest rates.

Employment Data:

The Non-Farm Payrolls (NFP) report in the U.S. is a critical data point. Strong job creation can signal economic strength and influence the strength of the currency.

Geopolitical Events:

Political instability, wars, trade agreements, and elections can have a profound impact on a country's currency. For example, Brexit uncertainty led to significant volatility in GBP pairs.

2. Fundamental Trading in Forex.

Fundamental trading is the process of analyzing individual economic reports and data releases to predict how they will impact currency prices. Key indicators to focus on include:

A. Key Economic Indicators

Interest Rates:

Central banks set interest rates to control inflation and stabilize the economy. Higher interest rates tend to attract foreign capital, strengthening the currency. Conversely, lower rates can weaken a currency.

GDP Growth Rates:

Strong economic growth often leads to currency appreciation as investors are more likely to invest in a growing economy.

Inflation Reports:

CPI and Producer Price Index (PPI) are indicators of price changes in an economy. Central banks adjust their monetary policy based on inflation, so high inflation can lead to rate hikes, strengthening the currency.

Trade Balance:

The balance of trade reflects a country's exports vs. imports. A country running a trade surplus (exports > imports) may see its currency appreciate as demand for its goods and services increases.

Retail Sales:

Retail sales reports show consumer spending patterns, which are critical for assessing economic health. Strong retail sales may indicate economic growth, positively affecting the currency.

B. Central Bank Policies

Central banks play a significant role in forex markets through their control over monetary policy. Key central banks include:

Federal Reserve (U.S.)

European Central Bank (ECB)

Bank of Japan (BoJ)

Bank of England (BoE)

Traders focus on the central bank's stance on interest rates and quantitative easing, as these policies directly impact currency values.

C. Global Risk Sentiment

Safe-Haven Currencies:

In times of economic uncertainty or geopolitical risk, traders often flock to safe-haven currencies like the USD, CHF, or JPY.

Commodity Prices:

Currencies like AUD, CAD, and NZD are often correlated with commodity prices. For example, if oil prices rise, the Canadian Dollar (CAD) often strengthens due to Canada's large oil exports.

3. How to Trade Using Macro and Fundamental Analysis

Economic Calendar:

Use the economic calendar to track upcoming reports and events (like GDP

#firstdealofthenewyearAKEEL

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.