2025-02-05 19:45

IndustryHow to trade using candlestick formations

#firstdealofthenewyearchewbacca#

Trading using candlestick formations involves analyzing patterns in candlestick charts to predict potential market movements. Here’s a step-by-step guide to help you get started:

1. Understand Candlestick Basics

Each candlestick represents price movement within a specific time frame (e.g., 1 minute, 1 hour, 1 day). It shows four key pieces of information:

Open: The price at the start of the time frame.

Close: The price at the end of the time frame.

High: The highest price reached during the time frame.

Low: The lowest price reached during the time frame.

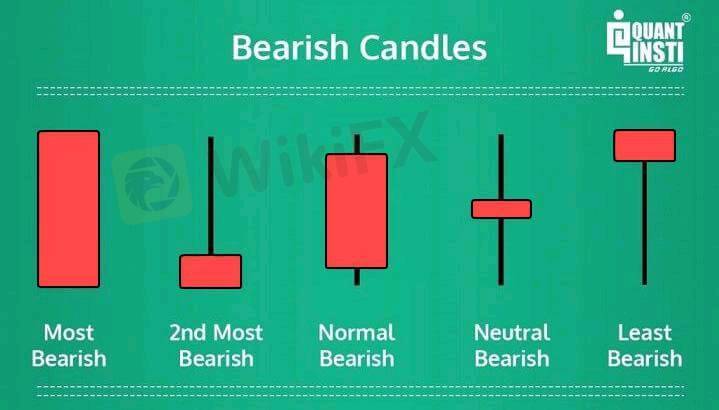

A bullish candle (price goes up) is usually green or white, while a bearish candle (price goes down) is typically red or black.

---

2. Learn Common Candlestick Patterns

Candlestick patterns can indicate reversals or continuations in price trends.

Reversal Patterns

Bullish Engulfing: A small red candle followed by a larger green candle that fully engulfs the previous one, suggesting a potential upward reversal.

Bearish Engulfing: A small green candle followed by a larger red candle, indicating a potential downward reversal.

Hammer: A small body with a long lower wick, often seen at the bottom of a downtrend, signaling a possible reversal up.

Shooting Star: A small body with a long upper wick, often found at the top of an uptrend, signaling a potential reversal down.

Continuation Patterns

Doji: The open and close prices are nearly equal, indicating market indecision. Its significance depends on the preceding trend.

Three White Soldiers: Three consecutive long green candles, suggesting strong bullish momentum.

Three Black Crows: Three consecutive long red candles, signaling strong bearish momentum.

---

3. Combine Candlestick Patterns with Other Tools

Candlestick formations are more effective when combined with other technical analysis tools:

Support and Resistance Levels: Identify key price levels where price tends to reverse or stall.

Trend Lines and Moving Averages: Confirm whether the market is trending or ranging.

Volume Analysis: High volume can validate candlestick patterns.

---

4. Set Up a Trading Plan

Entry Point: Enter the trade when a candlestick pattern forms near a key level (support, resistance, or trendline).

Stop-Loss: Place stop-loss orders below/above the candlestick pattern to manage risk.

Take Profit: Set realistic profit targets based on previous price action or risk-reward ratios.

---

5. Example Strategy

Bullish Engulfing Pattern at Support:

1. Identify a support level.

2. Look for a bullish engulfing pattern near that support.

3. Enter a buy position after the pattern is confirmed.

4. Set a stop-loss just below the support level.

5. Set a take-profit target based on the nearest resistance.

---

6. Practice and Refine

Start by practicing on demo accounts to get familiar with different candlestick patterns and how they work in various market conditions. Keep a trading journal to track your trades and improve your strategy over time.

Like 0

bossbaby6527

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

How to trade using candlestick formations

Nigeria | 2025-02-05 19:45

Nigeria | 2025-02-05 19:45#firstdealofthenewyearchewbacca#

Trading using candlestick formations involves analyzing patterns in candlestick charts to predict potential market movements. Here’s a step-by-step guide to help you get started:

1. Understand Candlestick Basics

Each candlestick represents price movement within a specific time frame (e.g., 1 minute, 1 hour, 1 day). It shows four key pieces of information:

Open: The price at the start of the time frame.

Close: The price at the end of the time frame.

High: The highest price reached during the time frame.

Low: The lowest price reached during the time frame.

A bullish candle (price goes up) is usually green or white, while a bearish candle (price goes down) is typically red or black.

---

2. Learn Common Candlestick Patterns

Candlestick patterns can indicate reversals or continuations in price trends.

Reversal Patterns

Bullish Engulfing: A small red candle followed by a larger green candle that fully engulfs the previous one, suggesting a potential upward reversal.

Bearish Engulfing: A small green candle followed by a larger red candle, indicating a potential downward reversal.

Hammer: A small body with a long lower wick, often seen at the bottom of a downtrend, signaling a possible reversal up.

Shooting Star: A small body with a long upper wick, often found at the top of an uptrend, signaling a potential reversal down.

Continuation Patterns

Doji: The open and close prices are nearly equal, indicating market indecision. Its significance depends on the preceding trend.

Three White Soldiers: Three consecutive long green candles, suggesting strong bullish momentum.

Three Black Crows: Three consecutive long red candles, signaling strong bearish momentum.

---

3. Combine Candlestick Patterns with Other Tools

Candlestick formations are more effective when combined with other technical analysis tools:

Support and Resistance Levels: Identify key price levels where price tends to reverse or stall.

Trend Lines and Moving Averages: Confirm whether the market is trending or ranging.

Volume Analysis: High volume can validate candlestick patterns.

---

4. Set Up a Trading Plan

Entry Point: Enter the trade when a candlestick pattern forms near a key level (support, resistance, or trendline).

Stop-Loss: Place stop-loss orders below/above the candlestick pattern to manage risk.

Take Profit: Set realistic profit targets based on previous price action or risk-reward ratios.

---

5. Example Strategy

Bullish Engulfing Pattern at Support:

1. Identify a support level.

2. Look for a bullish engulfing pattern near that support.

3. Enter a buy position after the pattern is confirmed.

4. Set a stop-loss just below the support level.

5. Set a take-profit target based on the nearest resistance.

---

6. Practice and Refine

Start by practicing on demo accounts to get familiar with different candlestick patterns and how they work in various market conditions. Keep a trading journal to track your trades and improve your strategy over time.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.