2025-02-11 22:03

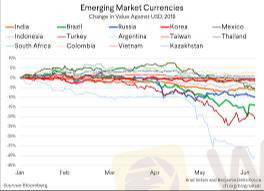

IndustryEMERGING MARKETS CURRENCIES.

#firstdealofthenewyearastylz#

RISKS AND OPPORTUNITIES.

The foreign exchange market is a vast and complex landscape, with numerous opportunities for investors to capitalize on currency fluctuations. Emerging markets (EM) currencies, in particular, have garnered significant attention in recent years due to their potential for high returns. However, investing in EM currencies also comes with unique risks that must be carefully considered.

Opportunities.

Emerging markets currencies offer several attractive opportunities for investors:

1. *High yields*: EM currencies often offer higher yields compared to developed market currencies, making them appealing to investors seeking returns in a low-interest-rate environment.

2. *Growth potential*: Emerging markets are home to some of the world's fastest-growing economies, which can lead to currency appreciation and increased investment opportunities.

3. *Diversification*: Investing in EM currencies can provide a diversification benefit, as their performance is often less correlated with developed market currencies.

*Risks*

While EM currencies offer attractive opportunities, they also come with significant risks:

1. *Volatility*: EM currencies are often more volatile than developed market currencies, which can result in rapid losses if not managed properly.

2. *Liquidity risk*: EM currencies may have lower liquidity, making it more difficult to buy or sell currencies quickly and at a fair price.

3. *Country risk*: EM countries may be more susceptible to economic and political instability, which can negatively impact their currencies.

4. *Regulatory risk*: EM countries may have less developed regulatory frameworks, which can increase the risk of investment.

*Key Emerging Markets Currencies*

Some of the most popular EM currencies include:

1. *Mexican Peso (MXN)*: As one of the most traded EM currencies, the Mexican Peso offers a high-yielding currency with a relatively stable economy.

2. *Brazilian Real (BRL)*: As the largest economy in Latin America, Brazil offers a high-growth potential currency, although it comes with higher volatility.

3. *South African Rand (ZAR)*: As one of the most liquid EM currencies, the South African Rand offers a high-yielding currency with a relatively stable economy.

4. *Indian Rupee (INR)*: As one of the fastest-growing major economies, India offers a high-growth potential currency, although it comes with higher volatility.

*Investment Strategies*

To navigate the risks and opportunities of EM currencies, investors can consider the following strategies:

1. *Diversification*: Spread investments across multiple EM currencies to minimize risk.

2. *Hedging*: Use derivatives, such as options or forwards, to hedge against potential losses.

3. *Active management*: Regularly monitor and adjust investments to respond to changing market conditions.

4. *Long-term approach*: Take a long-term view when investing in EM currencies, as they can be more volatile in the short term.

*Conclusion*

Emerging markets currencies offer attractive opportunities for investors seeking high returns and diversification. However, they also come with unique risks that must be carefully considered. By understanding the opportunities and risks, and employing effective investment strategies, investors can navigate the complex landscape of EM currencies and capitalize on their potential.

Like 0

De_.mola_.001

Broker

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

EMERGING MARKETS CURRENCIES.

Nigeria | 2025-02-11 22:03

Nigeria | 2025-02-11 22:03#firstdealofthenewyearastylz#

RISKS AND OPPORTUNITIES.

The foreign exchange market is a vast and complex landscape, with numerous opportunities for investors to capitalize on currency fluctuations. Emerging markets (EM) currencies, in particular, have garnered significant attention in recent years due to their potential for high returns. However, investing in EM currencies also comes with unique risks that must be carefully considered.

Opportunities.

Emerging markets currencies offer several attractive opportunities for investors:

1. *High yields*: EM currencies often offer higher yields compared to developed market currencies, making them appealing to investors seeking returns in a low-interest-rate environment.

2. *Growth potential*: Emerging markets are home to some of the world's fastest-growing economies, which can lead to currency appreciation and increased investment opportunities.

3. *Diversification*: Investing in EM currencies can provide a diversification benefit, as their performance is often less correlated with developed market currencies.

*Risks*

While EM currencies offer attractive opportunities, they also come with significant risks:

1. *Volatility*: EM currencies are often more volatile than developed market currencies, which can result in rapid losses if not managed properly.

2. *Liquidity risk*: EM currencies may have lower liquidity, making it more difficult to buy or sell currencies quickly and at a fair price.

3. *Country risk*: EM countries may be more susceptible to economic and political instability, which can negatively impact their currencies.

4. *Regulatory risk*: EM countries may have less developed regulatory frameworks, which can increase the risk of investment.

*Key Emerging Markets Currencies*

Some of the most popular EM currencies include:

1. *Mexican Peso (MXN)*: As one of the most traded EM currencies, the Mexican Peso offers a high-yielding currency with a relatively stable economy.

2. *Brazilian Real (BRL)*: As the largest economy in Latin America, Brazil offers a high-growth potential currency, although it comes with higher volatility.

3. *South African Rand (ZAR)*: As one of the most liquid EM currencies, the South African Rand offers a high-yielding currency with a relatively stable economy.

4. *Indian Rupee (INR)*: As one of the fastest-growing major economies, India offers a high-growth potential currency, although it comes with higher volatility.

*Investment Strategies*

To navigate the risks and opportunities of EM currencies, investors can consider the following strategies:

1. *Diversification*: Spread investments across multiple EM currencies to minimize risk.

2. *Hedging*: Use derivatives, such as options or forwards, to hedge against potential losses.

3. *Active management*: Regularly monitor and adjust investments to respond to changing market conditions.

4. *Long-term approach*: Take a long-term view when investing in EM currencies, as they can be more volatile in the short term.

*Conclusion*

Emerging markets currencies offer attractive opportunities for investors seeking high returns and diversification. However, they also come with unique risks that must be carefully considered. By understanding the opportunities and risks, and employing effective investment strategies, investors can navigate the complex landscape of EM currencies and capitalize on their potential.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.