2025-02-11 23:50

IndustryThe impact of pandemics on forex markets

#firstdealofthenewyearastylz

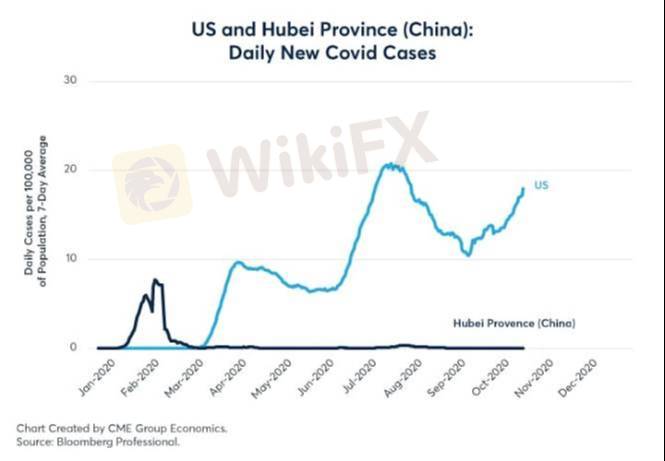

The impact of pandemics on forex markets is a fascinating topic. When a pandemic hits, it can have a significant effect on the global economy, and consequently, on forex markets. One of the key ways pandemics influence forex markets is through increased volatility. As governments and health organizations respond to the pandemic, economic uncertainty rises, leading to fluctuations in currency values.

For instance, during the COVID-19 pandemic, the US dollar did not exhibit its usual safe-haven characteristics, and instead, weakened against other currencies. This was largely due to investors seeking refuge in other currencies, such as the Japanese yen and the Canadian dollar. In fact, a study found that investing in these currencies and reducing exposure to European currencies could help minimize risk during the pandemic.

Pandemics can also lead to changes in trade patterns, as countries impose restrictions on imports and exports to slow the spread of the disease. This can disrupt global supply chains, affecting the value of currencies involved in international trade. Furthermore, central banks may respond to the economic downturn caused by a pandemic by implementing expansionary monetary policies, such as lowering interest rates or engaging in quantitative easing, which can impact currency values.

The performance of currency portfolios during pandemics is also worth noting. A study found that the volatility and non-parametric value-at-risk of three currency portfolios were extremely high during periods of high volatility in the FX markets, but the COVID-19 pandemic was not as risky as previous high-risk episodes, such as the Global Financial Crisis.

Overall, the impact of pandemics on forex markets is complex and multifaceted. Understanding these effects can help investors and policymakers navigate the challenges posed by pandemics and make more informed decisions.

Like 0

Aguero

Broker

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

The impact of pandemics on forex markets

Hong Kong | 2025-02-11 23:50

Hong Kong | 2025-02-11 23:50#firstdealofthenewyearastylz

The impact of pandemics on forex markets is a fascinating topic. When a pandemic hits, it can have a significant effect on the global economy, and consequently, on forex markets. One of the key ways pandemics influence forex markets is through increased volatility. As governments and health organizations respond to the pandemic, economic uncertainty rises, leading to fluctuations in currency values.

For instance, during the COVID-19 pandemic, the US dollar did not exhibit its usual safe-haven characteristics, and instead, weakened against other currencies. This was largely due to investors seeking refuge in other currencies, such as the Japanese yen and the Canadian dollar. In fact, a study found that investing in these currencies and reducing exposure to European currencies could help minimize risk during the pandemic.

Pandemics can also lead to changes in trade patterns, as countries impose restrictions on imports and exports to slow the spread of the disease. This can disrupt global supply chains, affecting the value of currencies involved in international trade. Furthermore, central banks may respond to the economic downturn caused by a pandemic by implementing expansionary monetary policies, such as lowering interest rates or engaging in quantitative easing, which can impact currency values.

The performance of currency portfolios during pandemics is also worth noting. A study found that the volatility and non-parametric value-at-risk of three currency portfolios were extremely high during periods of high volatility in the FX markets, but the COVID-19 pandemic was not as risky as previous high-risk episodes, such as the Global Financial Crisis.

Overall, the impact of pandemics on forex markets is complex and multifaceted. Understanding these effects can help investors and policymakers navigate the challenges posed by pandemics and make more informed decisions.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.