2025-02-12 00:30

IndustryThe Eurozone Debt Crisis and Its Long-Term Impact

The Eurozone Debt Crisis, which unfolded from 2009 to the mid-2010s, had a profound impact on EUR trends. The crisis was triggered by a combination of factors, including excessive borrowing by some Eurozone countries, weak economic growth, and a lack of fiscal policy coordination among member states

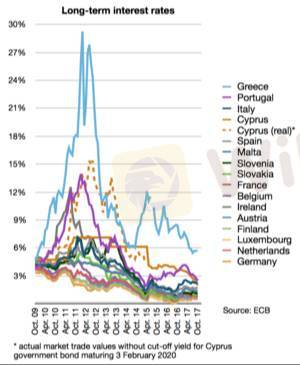

As the crisis deepened, several Eurozone countries, including Greece, Ireland, Portugal, and Cyprus, required bailouts from the European Union and the International Monetary Fund. The crisis led to a significant increase in borrowing costs for these countries, making it even harder for them to manage their debt.

The long-term impact of the Eurozone Debt Crisis on EUR trends has been significant. The crisis led to a decline in investor confidence in the Eurozone, causing the value of the euro to fluctuate wildly. The euro's value dropped sharply against other major currencies, such as the US dollar, in 2010 and 2011.

However, since then, the Eurozone has implemented various reforms aimed at strengthening its economic and monetary union. These reforms have helped to restore investor confidence, and the euro has recovered some of its lost value.

Today, the Eurozone continues to face challenges, including slow economic growth and high levels of debt in some member countries. However, the region's commitment to economic and monetary union remains strong, and the euro remains a widely held and widely traded currency.

Key Factors Affecting EUR Trends:

- Economic Growth: The Eurozone's economic growth rate has a significant impact on the value of the euro. Strong economic growth tends to boost investor confidence and increase demand for the euro.

- Inflation: The Eurozone's inflation rate also affects the value of the euro. High inflation can erode the purchasing power of the euro, making it less attractive to investors.

- Interest Rates: The European Central Bank's (ECB) interest rate decisions also impact the value of the euro. Lower interest rates tend to weaken the euro, while higher interest rates tend to strengthen it.

- Geopolitical Events: Geopolitical events, such as elections and trade tensions, can also affect the value of the euro. Uncertainty and instability tend to weaken the euro, while stability and cooperation tend to strengthen it.

Like 0

Nara4440

Brokers

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

The Eurozone Debt Crisis and Its Long-Term Impact

Hong Kong | 2025-02-12 00:30

Hong Kong | 2025-02-12 00:30The Eurozone Debt Crisis, which unfolded from 2009 to the mid-2010s, had a profound impact on EUR trends. The crisis was triggered by a combination of factors, including excessive borrowing by some Eurozone countries, weak economic growth, and a lack of fiscal policy coordination among member states

As the crisis deepened, several Eurozone countries, including Greece, Ireland, Portugal, and Cyprus, required bailouts from the European Union and the International Monetary Fund. The crisis led to a significant increase in borrowing costs for these countries, making it even harder for them to manage their debt.

The long-term impact of the Eurozone Debt Crisis on EUR trends has been significant. The crisis led to a decline in investor confidence in the Eurozone, causing the value of the euro to fluctuate wildly. The euro's value dropped sharply against other major currencies, such as the US dollar, in 2010 and 2011.

However, since then, the Eurozone has implemented various reforms aimed at strengthening its economic and monetary union. These reforms have helped to restore investor confidence, and the euro has recovered some of its lost value.

Today, the Eurozone continues to face challenges, including slow economic growth and high levels of debt in some member countries. However, the region's commitment to economic and monetary union remains strong, and the euro remains a widely held and widely traded currency.

Key Factors Affecting EUR Trends:

- Economic Growth: The Eurozone's economic growth rate has a significant impact on the value of the euro. Strong economic growth tends to boost investor confidence and increase demand for the euro.

- Inflation: The Eurozone's inflation rate also affects the value of the euro. High inflation can erode the purchasing power of the euro, making it less attractive to investors.

- Interest Rates: The European Central Bank's (ECB) interest rate decisions also impact the value of the euro. Lower interest rates tend to weaken the euro, while higher interest rates tend to strengthen it.

- Geopolitical Events: Geopolitical events, such as elections and trade tensions, can also affect the value of the euro. Uncertainty and instability tend to weaken the euro, while stability and cooperation tend to strengthen it.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.