2025-02-12 05:30

IndustryForex scalping: strategies and risks

#Firstdealofthenewyearastylz

What is Forex Scalping?

Forex scalping is a trading strategy focused on making small, quick profits from small price movements. Traders typically open and close positions within a very short timeframe (from a few seconds to minutes). The aim is to exploit tiny price changes, leveraging large amounts of capital to maximize profits on each small move.

Common Scalping Strategies:

1. Momentum Scalping:

- This strategy focuses on trading in the direction of short-term trends. Traders look for a strong momentum signal (using indicators like RSI, MACD, or moving averages) and enter trades that align with the prevailing market movement.

2. Range Scalping:

- Range scalpers capitalize on periods where the market is moving sideways (range-bound). They buy at the support level and sell at the resistance level, repeating this process as long as the price remains within the range.

3. News Scalping:

- Scalpers also capitalize on market volatility caused by economic news releases or geopolitical events. They enter trades immediately after news is released, aiming to profit from the sudden price movement caused by the news.

4. Scalping with Indicators:

- Common indicators used in scalping include Bollinger Bands, moving averages, and the stochastic oscillator. These tools help traders identify overbought or oversold conditions or signals of trend reversals that can be traded quickly.

5. Price Action Scalping:

- This strategy does not rely on indicators. Instead, traders use raw price movements and chart patterns (like candlestick formations) to predict short-term market direction.

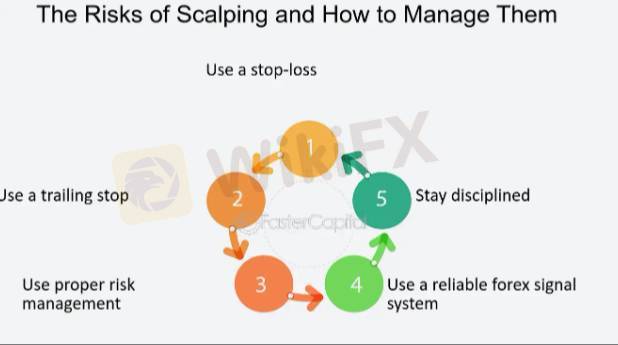

Risk Factors of Forex Scalping:

1. High Transaction Costs:

- Scalping typically involves many trades in a short period, which can accumulate high transaction costs (spreads and commissions). If the cost of trading is too high, it can erode the small profits made from each trade

2. Market Noise:

- Forex markets often experience a lot of "noise" — random fluctuations that can confuse or mislead traders. Scalpers rely on precision, and market noise can result in false signals or losses.

3. Leverage Risks:

- Scalpers typically use leverage to amplify their trades. While this can enhance profits, it also increases potential losses. If a small move goes against the trader, losses can be significant, especially when using high leverage.

4. Emotional Stress:

- Scalping requires intense focus and quick decision-making. The fast-paced nature of the strategy can lead to stress and emotional exhaustion, potentially causing traders to make hasty decisions.

5. Liquidity Issues:

- Forex scalping relies on the ability to enter and exit trades quickly. If liquidity is low in a specific currency pair, the trader may face slippage, meaning they cannot execute their trades at the expected price, leading to potential losses.

6. Broker Restrictions:

- Some brokers may have restrictions or rules that discourage scalping, such as minimum holding periods or high spreads. It's essential to choose a broker who allows scalping without restrictive terms.

Conclusion:

Forex scalping can be highly profitable, especially for skilled traders with fast reflexes and the ability to read the market. However, it comes with significant risks, including high transaction costs, emotional stress, and exposure to market noise. Traders need to carefully consider their risk tolerance, trading strategy, and broker selection before attempting this style of trading.

Like 0

Mywoman

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Forex scalping: strategies and risks

Hong Kong | 2025-02-12 05:30

Hong Kong | 2025-02-12 05:30#Firstdealofthenewyearastylz

What is Forex Scalping?

Forex scalping is a trading strategy focused on making small, quick profits from small price movements. Traders typically open and close positions within a very short timeframe (from a few seconds to minutes). The aim is to exploit tiny price changes, leveraging large amounts of capital to maximize profits on each small move.

Common Scalping Strategies:

1. Momentum Scalping:

- This strategy focuses on trading in the direction of short-term trends. Traders look for a strong momentum signal (using indicators like RSI, MACD, or moving averages) and enter trades that align with the prevailing market movement.

2. Range Scalping:

- Range scalpers capitalize on periods where the market is moving sideways (range-bound). They buy at the support level and sell at the resistance level, repeating this process as long as the price remains within the range.

3. News Scalping:

- Scalpers also capitalize on market volatility caused by economic news releases or geopolitical events. They enter trades immediately after news is released, aiming to profit from the sudden price movement caused by the news.

4. Scalping with Indicators:

- Common indicators used in scalping include Bollinger Bands, moving averages, and the stochastic oscillator. These tools help traders identify overbought or oversold conditions or signals of trend reversals that can be traded quickly.

5. Price Action Scalping:

- This strategy does not rely on indicators. Instead, traders use raw price movements and chart patterns (like candlestick formations) to predict short-term market direction.

Risk Factors of Forex Scalping:

1. High Transaction Costs:

- Scalping typically involves many trades in a short period, which can accumulate high transaction costs (spreads and commissions). If the cost of trading is too high, it can erode the small profits made from each trade

2. Market Noise:

- Forex markets often experience a lot of "noise" — random fluctuations that can confuse or mislead traders. Scalpers rely on precision, and market noise can result in false signals or losses.

3. Leverage Risks:

- Scalpers typically use leverage to amplify their trades. While this can enhance profits, it also increases potential losses. If a small move goes against the trader, losses can be significant, especially when using high leverage.

4. Emotional Stress:

- Scalping requires intense focus and quick decision-making. The fast-paced nature of the strategy can lead to stress and emotional exhaustion, potentially causing traders to make hasty decisions.

5. Liquidity Issues:

- Forex scalping relies on the ability to enter and exit trades quickly. If liquidity is low in a specific currency pair, the trader may face slippage, meaning they cannot execute their trades at the expected price, leading to potential losses.

6. Broker Restrictions:

- Some brokers may have restrictions or rules that discourage scalping, such as minimum holding periods or high spreads. It's essential to choose a broker who allows scalping without restrictive terms.

Conclusion:

Forex scalping can be highly profitable, especially for skilled traders with fast reflexes and the ability to read the market. However, it comes with significant risks, including high transaction costs, emotional stress, and exposure to market noise. Traders need to carefully consider their risk tolerance, trading strategy, and broker selection before attempting this style of trading.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.