2025-02-12 06:00

IndustryInflation trends and their influence on currency m

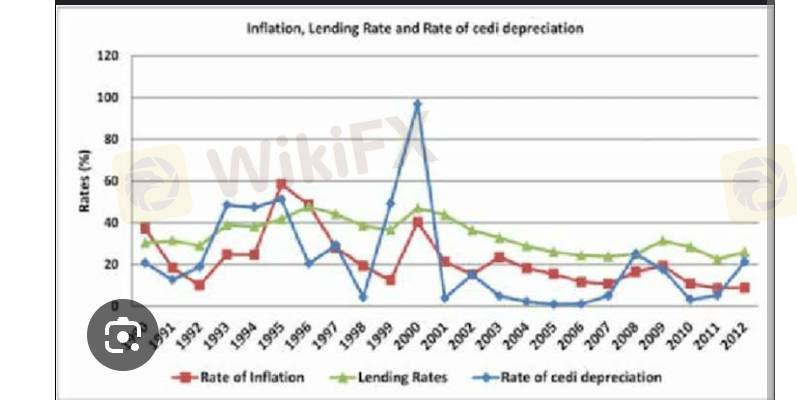

Inflation trends have a significant impact on currency movements. When inflation rises, it can lead to a decrease in the value of a currency. This is because high inflation can erode the purchasing power of a currency, making it less attractive to investors.

On the other hand, low inflation can lead to an increase in the value of a currency. This is because low inflation can increase the purchasing power of a currency, making it more attractive to investors.

The relationship between inflation and currency movements is also influenced by the exchange rate regime. Countries with pegged exchange rates tend to have lower inflation rates, as the fixed exchange rate provides a discipline on monetary policy ¹. However, this can also lead to slower productivity growth, as the fixed exchange rate can prevent relative prices from adjusting.

In contrast, countries with floating exchange rates tend to have higher inflation rates, but also faster productivity growth. This is because the floating exchange rate allows for greater flexibility in monetary policy, but also increases the risk of inflation.

*Key Factors Influencing Inflation and Currency Movements:*

- _Exchange Rate Regime_: The choice of exchange rate regime can influence inflation and currency movements. Pegged exchange rates tend to lead to lower inflation, while floating exchange rates tend to lead to higher inflation.

- _Monetary Policy_: Monetary policy can influence inflation and currency movements. Expansionary monetary policy can lead to higher inflation, while contractionary monetary policy can lead to lower inflation.

- _Economic Growth_: Economic growth can influence inflation and currency movements. Rapid economic growth can lead to higher inflation, while slow economic growth can lead to lower inflation.

Overall, the relationship between inflation and currency movements is complex and influenced by a variety of factors. Understanding these factors is crucial for investors and policymakers seeking to navigate the complexities of the foreign exchange market.

Causes of Inflation

1. *Demand and Supply Imbalance*: When demand exceeds supply, businesses raise prices.

2. *Expansionary Monetary Policy*: Central banks printing more money increases money supply.

3. *Rapid Economic Growth*: Increased demand drives up prices.

Effects of Inflation on Currency Movements

1. *Depreciation*: High inflation reduces currency value.

2. *Appreciation*: Low inflation increases currency value.

3. *Interest Rates*: Inflation expectations influence interest rates, affecting currency movements.

Types of Inflation

1. *Creeping Inflation*: Gradual, persistent inflation.

2. *Hyperinflation*: Extremely high inflation, often leading to currency devaluation.

3. *Stagflation*: High inflation, stagnant economic growth.

Influencing Factors

1. *Central Bank Policies*: Monetary policy decisions.

2. *Government Policies*: Fiscal policy decisions.

3. *Global Events*: Trade wars, natural disasters, economic trends.

Currency Movement Implications

1. *Investment Strategies*: Consider inflation trends when investing.

2. *Currency Hedging*: Mitigate inflation-related risks.

3. *Economic Forecasting*: Accurate forecasting relies on understanding inflation trends.

Key Takeaways

1. Inflation trends significantly impact currency movements.

2. Understanding inflation causes, effects, and types is crucial.

3. Central banks, governments, and global events influence inflation trends.

4. Investors and businesses must consider inflation trends when making decisions.

#firstdealofthenewyearastylz

Like 0

FX1866544709

Brokers

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Inflation trends and their influence on currency m

Hong Kong | 2025-02-12 06:00

Hong Kong | 2025-02-12 06:00Inflation trends have a significant impact on currency movements. When inflation rises, it can lead to a decrease in the value of a currency. This is because high inflation can erode the purchasing power of a currency, making it less attractive to investors.

On the other hand, low inflation can lead to an increase in the value of a currency. This is because low inflation can increase the purchasing power of a currency, making it more attractive to investors.

The relationship between inflation and currency movements is also influenced by the exchange rate regime. Countries with pegged exchange rates tend to have lower inflation rates, as the fixed exchange rate provides a discipline on monetary policy ¹. However, this can also lead to slower productivity growth, as the fixed exchange rate can prevent relative prices from adjusting.

In contrast, countries with floating exchange rates tend to have higher inflation rates, but also faster productivity growth. This is because the floating exchange rate allows for greater flexibility in monetary policy, but also increases the risk of inflation.

*Key Factors Influencing Inflation and Currency Movements:*

- _Exchange Rate Regime_: The choice of exchange rate regime can influence inflation and currency movements. Pegged exchange rates tend to lead to lower inflation, while floating exchange rates tend to lead to higher inflation.

- _Monetary Policy_: Monetary policy can influence inflation and currency movements. Expansionary monetary policy can lead to higher inflation, while contractionary monetary policy can lead to lower inflation.

- _Economic Growth_: Economic growth can influence inflation and currency movements. Rapid economic growth can lead to higher inflation, while slow economic growth can lead to lower inflation.

Overall, the relationship between inflation and currency movements is complex and influenced by a variety of factors. Understanding these factors is crucial for investors and policymakers seeking to navigate the complexities of the foreign exchange market.

Causes of Inflation

1. *Demand and Supply Imbalance*: When demand exceeds supply, businesses raise prices.

2. *Expansionary Monetary Policy*: Central banks printing more money increases money supply.

3. *Rapid Economic Growth*: Increased demand drives up prices.

Effects of Inflation on Currency Movements

1. *Depreciation*: High inflation reduces currency value.

2. *Appreciation*: Low inflation increases currency value.

3. *Interest Rates*: Inflation expectations influence interest rates, affecting currency movements.

Types of Inflation

1. *Creeping Inflation*: Gradual, persistent inflation.

2. *Hyperinflation*: Extremely high inflation, often leading to currency devaluation.

3. *Stagflation*: High inflation, stagnant economic growth.

Influencing Factors

1. *Central Bank Policies*: Monetary policy decisions.

2. *Government Policies*: Fiscal policy decisions.

3. *Global Events*: Trade wars, natural disasters, economic trends.

Currency Movement Implications

1. *Investment Strategies*: Consider inflation trends when investing.

2. *Currency Hedging*: Mitigate inflation-related risks.

3. *Economic Forecasting*: Accurate forecasting relies on understanding inflation trends.

Key Takeaways

1. Inflation trends significantly impact currency movements.

2. Understanding inflation causes, effects, and types is crucial.

3. Central banks, governments, and global events influence inflation trends.

4. Investors and businesses must consider inflation trends when making decisions.

#firstdealofthenewyearastylz

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.