2025-02-12 15:53

IndustryCurrency Pairs: Correlation and Trading Strategies

#Firstdealofthenewyearastylz

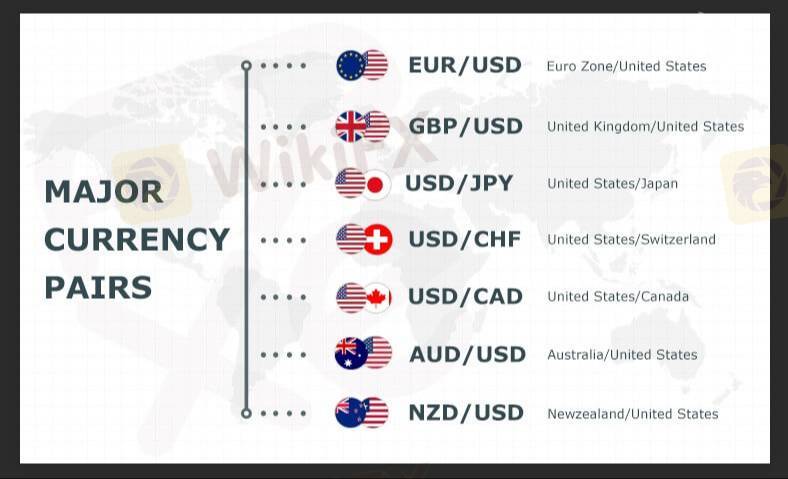

Currency pairs in forex trading represent the value of one currency against another. For instance, in the EUR/USD pair, the euro is the base currency, and the US dollar is the quote currency. The exchange rate tells you how much of the quote currency is needed to buy one unit of the base currency. Understanding currency pair correlation is vital for developing effective trading strategies.

1. Understanding Currency Pair Correlation

Currency pairs can be correlated in various ways. Correlation refers to the relationship between two currency pairs, and how their movements align with one another. In forex trading, correlations help traders predict price movements and reduce risk. There are three main types of correlations:

Positive Correlation: This occurs when two currency pairs move in the same direction. For example, if EUR/USD rises, GBP/USD might also rise because both currencies have a similar relationship to the US dollar.

Negative Correlation: This happens when two currency pairs move in opposite directions. For instance, when EUR/USD rises, USD/CHF might fall because the euro and the Swiss franc tend to have an inverse relationship to the US dollar.

No Correlation: Some currency pairs might not show any correlation, meaning their movements are independent of each other. For example, EUR/USD and AUD/JPY may not be correlated, as they have no strong relationship.

2. Why Correlation Matters in Trading

Understanding correlations helps traders in the following ways:

Risk Management: Traders can use correlations to diversify their portfolio and avoid overexposure to a particular currency. For example, if you're long on EUR/USD, you might avoid trading GBP/USD as it could increase your exposure to the euro.

Hedging: Negative correlations allow traders to hedge their positions. For example, if you're long on EUR/USD, you can go short on USD/CHF to hedge the risk from market movements.

Predicting Price Movements: Understanding correlation can also help traders predict movements. If a currency pair is highly correlated with another, an expected movement in one pair can lead to a similar movement in the other.

3. Common Currency Pairs and Their Correlations

EUR/USD and GBP/USD: Positive correlation (both have the US dollar as the quote currency).

EUR/USD and USD/CHF: Negative correlation (euro vs. US dollar and Swiss franc vs. US dollar).

AUD/USD and NZD/USD: Positive correlation (both Australian and New Zealand dollars are commodities-based currencies).

USD/JPY and EUR/USD: Often negatively correlated, though the relationship can vary depending on global economic conditions.

4. Trading Strategies Using Currency Correlations

Using correlations in trading can offer an advantage, particularly in terms of managing risk and maximizing profits. Here are a few strategies that incorporate currency correlations:

A. Hedging Strategy

Traders use negative correlations to hedge their trades. For example, if a trader is long on EUR/USD and believes there's a risk of the euro weakening, they might go short on USD/CHF, as the two pairs tend to move in opposite directions. The idea is that a loss on one position could be offset by a gain on the other.

B. Diversification Strategy

Traders can use positive correlations to create diversified trades that reduce overall risk. For instance, if a trader is trading EUR/USD and sees a correlated move in GBP/USD, they can open positions in both pairs, expecting the moves to reinforce each other. This approach allows for a greater probability of success when multiple correlated pairs are in the same direction.

C. Convergence/Divergence Strategy

Traders might use the concept of convergence and divergence in correlated pairs. If two highly correlated pairs begin to deviate from their typical relationship, a trader might anticipate a return to the norm. For example, if EUR/USD and GBP/USD usually move together but EUR/USD starts to diverge, the trader could expect GBP/USD to eventually follow suit. This strategy focuses on the potential for "catching up" between correlated pairs.

D. Correlation Breakout Strategy

Sometimes, correlations can break down during periods of high volatility or unexpected market events. A correlation breakout strategy involves identifying pairs that are usually highly correlated but have recently broken that pattern. Traders could take positions based on the expectation that the correlation will either return to its usual pattern or continue to diverge in a predictable direction.

5. Tools for Analyzing Currency Pair Correlations

Several tools and resources can help traders analyze currency pair correlations:

Correlation Matrix: This is a visual tool that shows the correlation coefficients of various currency pairs. It helps traders quickly see which pairs are strongly correlated and which are not.

MetaTrader and Trading Platforms: Many forex trading platforms offer built-in tools to analyze correlation and offer real-time correlation data for different pairs.

Excel/Google Sheets: Traders can input historical price data and calculate correlations manually using spreadsheet software. This method is more advanced but allows for greater customization.

6. Limitations of Currency Correlations

Changing Market Conditions: Correlations can change over time due to changes in global economic conditions, interest rate policies, or market sentiment.

Not Always Predictive: While correlation is a powerful tool, it doesn’t guarantee future price movement. External factors like geopolitical events can cause currencies to deviate from their typical correlation patterns.

Over-reliance: Traders who rely too heavily on correlations might miss important market signals or develop a false sense of security in their trades.

Currency pair correlations are a crucial aspect of forex trading that can provide valuable insights into market behavior. By understanding these correlations, traders can implement effective strategies like hedging, diversification, and identifying potential breakout opportunities. However, like all trading strategies, correlation-based methods should be used cautiously and in conjunction with proper risk management.

Like 0

Asabi5040

Broker

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Currency Pairs: Correlation and Trading Strategies

Hong Kong | 2025-02-12 15:53

Hong Kong | 2025-02-12 15:53#Firstdealofthenewyearastylz

Currency pairs in forex trading represent the value of one currency against another. For instance, in the EUR/USD pair, the euro is the base currency, and the US dollar is the quote currency. The exchange rate tells you how much of the quote currency is needed to buy one unit of the base currency. Understanding currency pair correlation is vital for developing effective trading strategies.

1. Understanding Currency Pair Correlation

Currency pairs can be correlated in various ways. Correlation refers to the relationship between two currency pairs, and how their movements align with one another. In forex trading, correlations help traders predict price movements and reduce risk. There are three main types of correlations:

Positive Correlation: This occurs when two currency pairs move in the same direction. For example, if EUR/USD rises, GBP/USD might also rise because both currencies have a similar relationship to the US dollar.

Negative Correlation: This happens when two currency pairs move in opposite directions. For instance, when EUR/USD rises, USD/CHF might fall because the euro and the Swiss franc tend to have an inverse relationship to the US dollar.

No Correlation: Some currency pairs might not show any correlation, meaning their movements are independent of each other. For example, EUR/USD and AUD/JPY may not be correlated, as they have no strong relationship.

2. Why Correlation Matters in Trading

Understanding correlations helps traders in the following ways:

Risk Management: Traders can use correlations to diversify their portfolio and avoid overexposure to a particular currency. For example, if you're long on EUR/USD, you might avoid trading GBP/USD as it could increase your exposure to the euro.

Hedging: Negative correlations allow traders to hedge their positions. For example, if you're long on EUR/USD, you can go short on USD/CHF to hedge the risk from market movements.

Predicting Price Movements: Understanding correlation can also help traders predict movements. If a currency pair is highly correlated with another, an expected movement in one pair can lead to a similar movement in the other.

3. Common Currency Pairs and Their Correlations

EUR/USD and GBP/USD: Positive correlation (both have the US dollar as the quote currency).

EUR/USD and USD/CHF: Negative correlation (euro vs. US dollar and Swiss franc vs. US dollar).

AUD/USD and NZD/USD: Positive correlation (both Australian and New Zealand dollars are commodities-based currencies).

USD/JPY and EUR/USD: Often negatively correlated, though the relationship can vary depending on global economic conditions.

4. Trading Strategies Using Currency Correlations

Using correlations in trading can offer an advantage, particularly in terms of managing risk and maximizing profits. Here are a few strategies that incorporate currency correlations:

A. Hedging Strategy

Traders use negative correlations to hedge their trades. For example, if a trader is long on EUR/USD and believes there's a risk of the euro weakening, they might go short on USD/CHF, as the two pairs tend to move in opposite directions. The idea is that a loss on one position could be offset by a gain on the other.

B. Diversification Strategy

Traders can use positive correlations to create diversified trades that reduce overall risk. For instance, if a trader is trading EUR/USD and sees a correlated move in GBP/USD, they can open positions in both pairs, expecting the moves to reinforce each other. This approach allows for a greater probability of success when multiple correlated pairs are in the same direction.

C. Convergence/Divergence Strategy

Traders might use the concept of convergence and divergence in correlated pairs. If two highly correlated pairs begin to deviate from their typical relationship, a trader might anticipate a return to the norm. For example, if EUR/USD and GBP/USD usually move together but EUR/USD starts to diverge, the trader could expect GBP/USD to eventually follow suit. This strategy focuses on the potential for "catching up" between correlated pairs.

D. Correlation Breakout Strategy

Sometimes, correlations can break down during periods of high volatility or unexpected market events. A correlation breakout strategy involves identifying pairs that are usually highly correlated but have recently broken that pattern. Traders could take positions based on the expectation that the correlation will either return to its usual pattern or continue to diverge in a predictable direction.

5. Tools for Analyzing Currency Pair Correlations

Several tools and resources can help traders analyze currency pair correlations:

Correlation Matrix: This is a visual tool that shows the correlation coefficients of various currency pairs. It helps traders quickly see which pairs are strongly correlated and which are not.

MetaTrader and Trading Platforms: Many forex trading platforms offer built-in tools to analyze correlation and offer real-time correlation data for different pairs.

Excel/Google Sheets: Traders can input historical price data and calculate correlations manually using spreadsheet software. This method is more advanced but allows for greater customization.

6. Limitations of Currency Correlations

Changing Market Conditions: Correlations can change over time due to changes in global economic conditions, interest rate policies, or market sentiment.

Not Always Predictive: While correlation is a powerful tool, it doesn’t guarantee future price movement. External factors like geopolitical events can cause currencies to deviate from their typical correlation patterns.

Over-reliance: Traders who rely too heavily on correlations might miss important market signals or develop a false sense of security in their trades.

Currency pair correlations are a crucial aspect of forex trading that can provide valuable insights into market behavior. By understanding these correlations, traders can implement effective strategies like hedging, diversification, and identifying potential breakout opportunities. However, like all trading strategies, correlation-based methods should be used cautiously and in conjunction with proper risk management.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.