2025-02-13 02:10

IndustryTHE IMPACT OF PANDEMICS IN FOREX MARKET

#firstdealofthenewyearastylz

Pandemics significantly impact the foreign exchange (Forex) market due to their effects on economic stability, investor sentiment, and government policies. The key impacts include:

1. Increased Volatility

During pandemics, uncertainty rises, leading to increased currency fluctuations.

Traders react to news on infections, economic shutdowns, and government responses.

2. Safe-Haven Currencies Appreciate

Investors move funds to "safe-haven" currencies like the U.S. dollar (USD), Swiss franc (CHF), and Japanese yen (JPY) during crises.

For example, during COVID-19, the USD strengthened initially due to its global reserve currency status.

3. Weaker Currencies in Affected Economies

Currencies of countries severely impacted by the pandemic tend to weaken.

Nations dependent on tourism and exports (e.g., emerging markets) saw their currencies depreciate as travel and trade declined.

4. Interest Rate Cuts & Monetary Policy Effects

Central banks lower interest rates to stimulate the economy, making their currencies less attractive.

Quantitative easing (QE) increases money supply, further devaluing the currency.

5. Stock Market Correlation

Forex markets correlate with stock markets; a crash in stocks often leads to forex instability.

Investors seek liquidity, influencing demand for specific currencies.

6. Trade Disruptions & Commodity Price Shocks

Countries reliant on commodity exports (e.g., oil-exporting nations) see currency depreciation when prices fall.

Supply chain disruptions affect trade balance, impacting currency demand.

7. Recovery and Post-Pandemic Trends

As economies recover, forex trends shift depending on fiscal stimulus, interest rates, and investor confidence.

Strong recoveries can lead to currency appreciation, while slow recoveries may keep currencies weak.

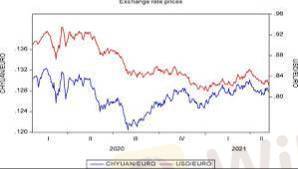

Case Study: COVID-19 Pandemic (2020)

The U.S. dollar initially strengthened due to risk aversion but later weakened due to Federal Reserve stimulus.

The Euro (EUR) and British pound (GBP) fluctuated based on government responses and lockdown measures.

Emerging market currencies (e.g., Brazilian real, South African rand) suffered severe losses due to economic instability.

Conclusion

Pandemics cause short-term currency volatility and long-term shifts based on economic recovery strategies. Traders and investors must watch central bank policies, economic indicators, and risk sentiment to navigate forex markets during such crises.

Like 0

General Solo

Broker

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

THE IMPACT OF PANDEMICS IN FOREX MARKET

Hong Kong | 2025-02-13 02:10

Hong Kong | 2025-02-13 02:10#firstdealofthenewyearastylz

Pandemics significantly impact the foreign exchange (Forex) market due to their effects on economic stability, investor sentiment, and government policies. The key impacts include:

1. Increased Volatility

During pandemics, uncertainty rises, leading to increased currency fluctuations.

Traders react to news on infections, economic shutdowns, and government responses.

2. Safe-Haven Currencies Appreciate

Investors move funds to "safe-haven" currencies like the U.S. dollar (USD), Swiss franc (CHF), and Japanese yen (JPY) during crises.

For example, during COVID-19, the USD strengthened initially due to its global reserve currency status.

3. Weaker Currencies in Affected Economies

Currencies of countries severely impacted by the pandemic tend to weaken.

Nations dependent on tourism and exports (e.g., emerging markets) saw their currencies depreciate as travel and trade declined.

4. Interest Rate Cuts & Monetary Policy Effects

Central banks lower interest rates to stimulate the economy, making their currencies less attractive.

Quantitative easing (QE) increases money supply, further devaluing the currency.

5. Stock Market Correlation

Forex markets correlate with stock markets; a crash in stocks often leads to forex instability.

Investors seek liquidity, influencing demand for specific currencies.

6. Trade Disruptions & Commodity Price Shocks

Countries reliant on commodity exports (e.g., oil-exporting nations) see currency depreciation when prices fall.

Supply chain disruptions affect trade balance, impacting currency demand.

7. Recovery and Post-Pandemic Trends

As economies recover, forex trends shift depending on fiscal stimulus, interest rates, and investor confidence.

Strong recoveries can lead to currency appreciation, while slow recoveries may keep currencies weak.

Case Study: COVID-19 Pandemic (2020)

The U.S. dollar initially strengthened due to risk aversion but later weakened due to Federal Reserve stimulus.

The Euro (EUR) and British pound (GBP) fluctuated based on government responses and lockdown measures.

Emerging market currencies (e.g., Brazilian real, South African rand) suffered severe losses due to economic instability.

Conclusion

Pandemics cause short-term currency volatility and long-term shifts based on economic recovery strategies. Traders and investors must watch central bank policies, economic indicators, and risk sentiment to navigate forex markets during such crises.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.