2025-02-13 12:16

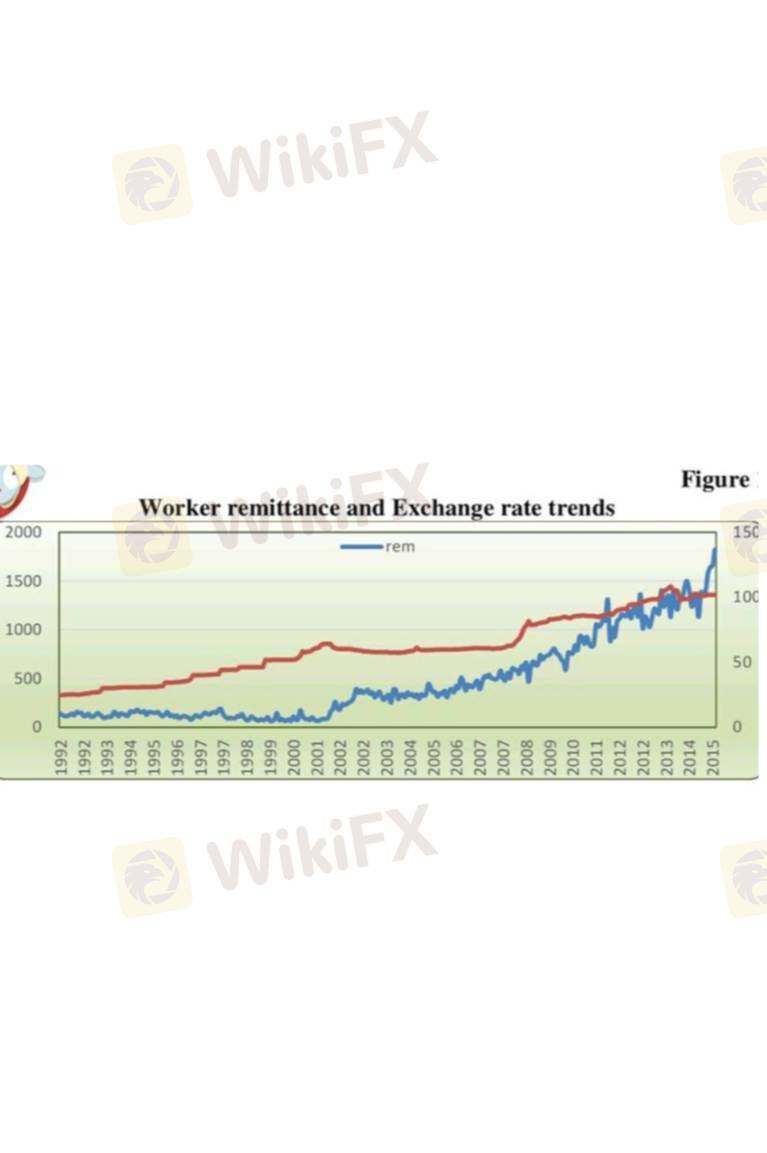

IndustryThe Role Of Remittances In Shaping Forex Trends

#firstdealofthenewyearastylz

Remittances play a significant role in shaping foreign exchange (forex) trends, particularly in countries where they make up a substantial portion of GDP. Here’s how they influence forex markets:

1. Impact on Exchange Rates

Increase in Currency Supply: When migrants send money back home, it increases the supply of foreign currency (e.g., USD, EUR) in the recipient country.

Appreciation of Local Currency: A high inflow of remittances can lead to an appreciation of the local currency because of increased demand for converting foreign currencies into the local currency.

Volatility Reduction: A steady stream of remittances provides a stable source of foreign exchange, reducing volatility in forex markets.

2. Balance of Payments (BoP) Effect

Improved Current Account Balance: Remittances contribute to the current account of the BoP, offsetting trade deficits and reducing reliance on external borrowing.

Foreign Reserve Accumulation: Countries with high remittance inflows build forex reserves, which can stabilize exchange rates and improve credit ratings.

3. Monetary Policy Implications

Inflation Control: Large inflows of foreign currency can influence inflation if they lead to increased money supply and spending.

Interest Rate Adjustments: Central banks may adjust interest rates in response to forex market movements driven by remittances.

4. Sectoral Impacts

Real Estate & Consumption: High remittances often boost consumer spending and real estate demand, affecting economic growth and forex demand.

Investment in Local Businesses: Some remittances are used for investments, influencing capital flows and exchange rate stability.

5. Market Expectations & Speculation

Forex traders monitor remittance trends as a leading indicator of currency strength, influencing forex market sentiment and speculative trading.

Like 0

Aguero

Broker

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

The Role Of Remittances In Shaping Forex Trends

Hong Kong | 2025-02-13 12:16

Hong Kong | 2025-02-13 12:16#firstdealofthenewyearastylz

Remittances play a significant role in shaping foreign exchange (forex) trends, particularly in countries where they make up a substantial portion of GDP. Here’s how they influence forex markets:

1. Impact on Exchange Rates

Increase in Currency Supply: When migrants send money back home, it increases the supply of foreign currency (e.g., USD, EUR) in the recipient country.

Appreciation of Local Currency: A high inflow of remittances can lead to an appreciation of the local currency because of increased demand for converting foreign currencies into the local currency.

Volatility Reduction: A steady stream of remittances provides a stable source of foreign exchange, reducing volatility in forex markets.

2. Balance of Payments (BoP) Effect

Improved Current Account Balance: Remittances contribute to the current account of the BoP, offsetting trade deficits and reducing reliance on external borrowing.

Foreign Reserve Accumulation: Countries with high remittance inflows build forex reserves, which can stabilize exchange rates and improve credit ratings.

3. Monetary Policy Implications

Inflation Control: Large inflows of foreign currency can influence inflation if they lead to increased money supply and spending.

Interest Rate Adjustments: Central banks may adjust interest rates in response to forex market movements driven by remittances.

4. Sectoral Impacts

Real Estate & Consumption: High remittances often boost consumer spending and real estate demand, affecting economic growth and forex demand.

Investment in Local Businesses: Some remittances are used for investments, influencing capital flows and exchange rate stability.

5. Market Expectations & Speculation

Forex traders monitor remittance trends as a leading indicator of currency strength, influencing forex market sentiment and speculative trading.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.