2025-02-13 15:21

IndustryTHE IMPACT OF ECONOMIC INDICATOR ON FOREX TRADING

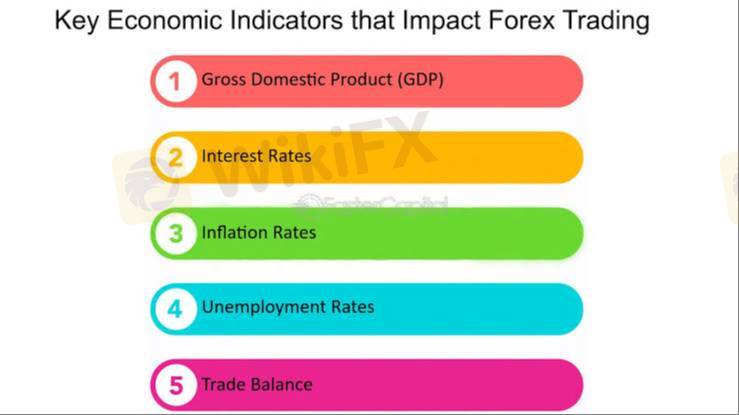

Economic indicators play a crucial role in forex trading as they influence currency values by reflecting a country’s economic health. Traders analyze these indicators to predict market movements and make informed trading decisions. Here’s how key economic indicators impact forex trading:

1. Interest Rates (Central Bank Decisions)

Impact: Higher interest rates attract foreign investment, increasing demand for a currency, while lower rates weaken it.

Example: When the U.S. Federal Reserve raises interest rates, the USD often strengthens.

2. Inflation Rate (CPI - Consumer Price Index & PPI - Producer Price Index)

Impact: Moderate inflation is healthy, but high inflation can devalue a currency as purchasing power decreases.

Example: If the European Central Bank (ECB) struggles to control high inflation, the euro may weaken.

3. GDP (Gross Domestic Product)

Impact: Strong GDP growth signals a healthy economy, attracting investors and boosting currency strength.

Example: If Japan reports higher-than-expected GDP growth, the JPY may appreciate.

4. Employment Data (NFP - Non-Farm Payroll in the U.S.)

Impact: High employment suggests economic strength, supporting the currency, while weak employment data weakens it.

Example: A strong U.S. NFP report often strengthens the USD, while weak data may lead to a sell-off.

5. Trade Balance (Exports vs. Imports)

Impact: A trade surplus strengthens a currency as demand for exports increases, while a trade deficit weakens it.

Example: If China exports more than it imports, demand for the CNY rises, boosting its value.

6. Consumer Confidence & Retail Sales

Impact: Higher consumer confidence and spending indicate a strong economy, supporting the currency.

Example: A rise in U.K. retail sales can strengthen GBP as investors see economic growth.

7. Political & Geopolitical Events

Impact: Political stability supports a strong currency, while instability can lead to sell-offs.

Example: Brexit uncertainty weakened GBP as investors feared economic instability.

8. Federal Reserve & Central Bank Statements

Impact: Hawkish (tightening) policy strengthens the currency, while dovish (loosening) policy weakens it.

Example: If the Federal Reserve signals future rate hikes, USD gains strength.

How to Use Economic Indicators in Forex Trading

Monitor economic calendars to track key data releases.

Compare actual results with market expectations to anticipate price moves.

Understand the correlation between indicators and currency pairs (e.g., USD strengthens when NFP is positive).

Combine economic data with technical analysis for better decision-making.

#firstdealofthenewyearastylz

Like 0

Faithy2753

Broker

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

THE IMPACT OF ECONOMIC INDICATOR ON FOREX TRADING

Hong Kong | 2025-02-13 15:21

Hong Kong | 2025-02-13 15:21Economic indicators play a crucial role in forex trading as they influence currency values by reflecting a country’s economic health. Traders analyze these indicators to predict market movements and make informed trading decisions. Here’s how key economic indicators impact forex trading:

1. Interest Rates (Central Bank Decisions)

Impact: Higher interest rates attract foreign investment, increasing demand for a currency, while lower rates weaken it.

Example: When the U.S. Federal Reserve raises interest rates, the USD often strengthens.

2. Inflation Rate (CPI - Consumer Price Index & PPI - Producer Price Index)

Impact: Moderate inflation is healthy, but high inflation can devalue a currency as purchasing power decreases.

Example: If the European Central Bank (ECB) struggles to control high inflation, the euro may weaken.

3. GDP (Gross Domestic Product)

Impact: Strong GDP growth signals a healthy economy, attracting investors and boosting currency strength.

Example: If Japan reports higher-than-expected GDP growth, the JPY may appreciate.

4. Employment Data (NFP - Non-Farm Payroll in the U.S.)

Impact: High employment suggests economic strength, supporting the currency, while weak employment data weakens it.

Example: A strong U.S. NFP report often strengthens the USD, while weak data may lead to a sell-off.

5. Trade Balance (Exports vs. Imports)

Impact: A trade surplus strengthens a currency as demand for exports increases, while a trade deficit weakens it.

Example: If China exports more than it imports, demand for the CNY rises, boosting its value.

6. Consumer Confidence & Retail Sales

Impact: Higher consumer confidence and spending indicate a strong economy, supporting the currency.

Example: A rise in U.K. retail sales can strengthen GBP as investors see economic growth.

7. Political & Geopolitical Events

Impact: Political stability supports a strong currency, while instability can lead to sell-offs.

Example: Brexit uncertainty weakened GBP as investors feared economic instability.

8. Federal Reserve & Central Bank Statements

Impact: Hawkish (tightening) policy strengthens the currency, while dovish (loosening) policy weakens it.

Example: If the Federal Reserve signals future rate hikes, USD gains strength.

How to Use Economic Indicators in Forex Trading

Monitor economic calendars to track key data releases.

Compare actual results with market expectations to anticipate price moves.

Understand the correlation between indicators and currency pairs (e.g., USD strengthens when NFP is positive).

Combine economic data with technical analysis for better decision-making.

#firstdealofthenewyearastylz

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.