2025-02-13 17:56

IndustryEconomic Forecasting: Methods, Challenges, and App

#Firstdealofthenewyearastylz

Economic Forecasting: Methods, Challenges, and Applications

1. Introduction to Economic Forecasting

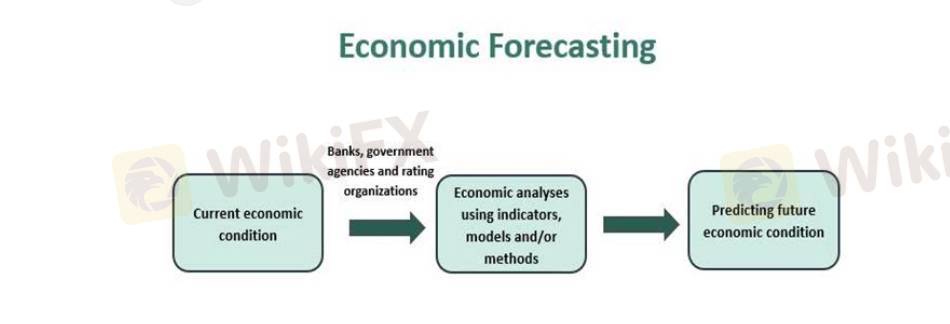

Economic forecasting involves predicting future economic conditions based on the analysis of historical data and current economic trends. These predictions help governments, businesses, and investors make informed decisions.

2. Methods of Economic Forecasting

There are several methods used in economic forecasting, including:

a. Qualitative Methods

Expert Opinion: Involves gathering insights from economists and industry experts.

Delphi Method: A structured communication technique where experts provide forecasts independently, and results are aggregated.

b. Quantitative Methods

Time Series Analysis: Utilizes historical data to identify trends, cycles, and seasonal patterns.

Examples: Moving Averages, ARIMA (Auto-Regressive Integrated Moving Average) models.

Econometric Models: These models use mathematical equations to describe economic relationships.

Examples: Linear regression models, Vector Autoregression (VAR).

Leading Indicators: Analyzes variables that tend to change before the economy as a whole, such as stock market performance, manufacturing orders, and housing starts.

c. Machine Learning and AI-Based Methods

Neural Networks and Deep Learning: These models learn complex patterns in large datasets.

Random Forests and Support Vector Machines (SVMs): Used for non-linear and complex data relationships.

3. Challenges in Economic Forecasting

Data Limitations: Incomplete or inaccurate historical data can lead to incorrect forecasts.

Complex Economic Dynamics: Economic systems are influenced by numerous variables, including political events and natural disasters.

Model Uncertainty: Different models can produce different forecasts, leading to uncertainty.

Behavioral and Structural Changes: Changes in consumer behavior or economic policy can render historical data less relevant.

External Shocks: Unpredictable events such as pandemics, geopolitical tensions, or financial crises disrupt economic patterns.

4. Applications of Economic Forecasting

Government Policy Making: Used to formulate fiscal and monetary policies, including setting interest rates and budget allocations.

Business Strategy and Planning: Helps companies in demand forecasting, inventory management, and investment decisions.

Financial Markets: Assists investors in asset allocation, risk management, and predicting stock market trends.

International Trade and Investment: Forecasts exchange rates, inflation, and global economic conditions to guide trade agreements and investments.

5. Conclusion

Economic forecasting is a crucial tool for decision-making across various sectors. However, the accuracy and reliability of forecasts depend on the methods used, data quality, and the ability to adapt to changing economic dynamics. Continuous advancements in machine learning and data analytics are improving forecasting models, but challenges like uncertainty and external shocks remain significant obstacles.

Like 0

FX2804747192

Brokers

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Economic Forecasting: Methods, Challenges, and App

Hong Kong | 2025-02-13 17:56

Hong Kong | 2025-02-13 17:56#Firstdealofthenewyearastylz

Economic Forecasting: Methods, Challenges, and Applications

1. Introduction to Economic Forecasting

Economic forecasting involves predicting future economic conditions based on the analysis of historical data and current economic trends. These predictions help governments, businesses, and investors make informed decisions.

2. Methods of Economic Forecasting

There are several methods used in economic forecasting, including:

a. Qualitative Methods

Expert Opinion: Involves gathering insights from economists and industry experts.

Delphi Method: A structured communication technique where experts provide forecasts independently, and results are aggregated.

b. Quantitative Methods

Time Series Analysis: Utilizes historical data to identify trends, cycles, and seasonal patterns.

Examples: Moving Averages, ARIMA (Auto-Regressive Integrated Moving Average) models.

Econometric Models: These models use mathematical equations to describe economic relationships.

Examples: Linear regression models, Vector Autoregression (VAR).

Leading Indicators: Analyzes variables that tend to change before the economy as a whole, such as stock market performance, manufacturing orders, and housing starts.

c. Machine Learning and AI-Based Methods

Neural Networks and Deep Learning: These models learn complex patterns in large datasets.

Random Forests and Support Vector Machines (SVMs): Used for non-linear and complex data relationships.

3. Challenges in Economic Forecasting

Data Limitations: Incomplete or inaccurate historical data can lead to incorrect forecasts.

Complex Economic Dynamics: Economic systems are influenced by numerous variables, including political events and natural disasters.

Model Uncertainty: Different models can produce different forecasts, leading to uncertainty.

Behavioral and Structural Changes: Changes in consumer behavior or economic policy can render historical data less relevant.

External Shocks: Unpredictable events such as pandemics, geopolitical tensions, or financial crises disrupt economic patterns.

4. Applications of Economic Forecasting

Government Policy Making: Used to formulate fiscal and monetary policies, including setting interest rates and budget allocations.

Business Strategy and Planning: Helps companies in demand forecasting, inventory management, and investment decisions.

Financial Markets: Assists investors in asset allocation, risk management, and predicting stock market trends.

International Trade and Investment: Forecasts exchange rates, inflation, and global economic conditions to guide trade agreements and investments.

5. Conclusion

Economic forecasting is a crucial tool for decision-making across various sectors. However, the accuracy and reliability of forecasts depend on the methods used, data quality, and the ability to adapt to changing economic dynamics. Continuous advancements in machine learning and data analytics are improving forecasting models, but challenges like uncertainty and external shocks remain significant obstacles.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.