2025-02-14 17:56

IndustryTHE IMPACT OF CENTRAL BANK POLICY ON FOREX MARKET.

#firstdealofthenewyearastylz#

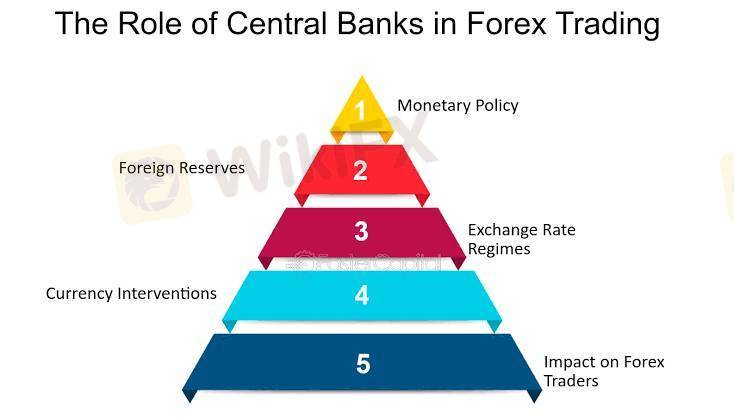

Central bank policies play a crucial role in shaping the forex market by influencing currency values, investor behavior, and global trade dynamics. Interest rate decisions are among the most impactful tools, as higher rates generally attract foreign capital, increasing demand and strengthening the currency, while lower rates can lead to depreciation. For example, when the U.S. Federal Reserve raises interest rates, the U.S. dollar typically appreciates as investors seek better returns. Conversely, rate cuts can weaken the currency as capital flows to more profitable markets.

Monetary policy tools, such as quantitative easing (QE) and tightening, also significantly affect forex markets. QE, which involves purchasing government securities to inject liquidity into the economy, increases money supply and often depreciates the currency. This was seen during the global financial crisis when the U.S. dollar weakened due to extensive QE measures. In contrast, monetary tightening, which reduces money supply, can strengthen the currency by curbing inflation and enhancing investor confidence.

Foreign exchange interventions are another powerful tool. Central banks may buy or sell their currency directly to influence exchange rates, aiming to stabilize markets or achieve economic objectives. For example, the Bank of Japan has historically intervened to prevent excessive yen appreciation, which could hurt exports.

Market expectations and central bank communications also play vital roles. Traders closely analyze statements from central bank officials for hints about future policy changes. Even subtle changes in tone can cause significant currency fluctuations, as seen with the European Central Bank's communication strategy impacting the euro.

In conclusion, central bank policies directly impact forex markets through interest rate adjustments, monetary policy tools, and foreign exchange interventions. By influencing investor behavior, trade balances, and economic stability, these policies shape currency values and global financial dynamics. As central banks navigate complex economic landscapes, their decisions continue to be a key driver of forex market movements.

Like 0

De_.mola_.001

Broker

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

THE IMPACT OF CENTRAL BANK POLICY ON FOREX MARKET.

Nigeria | 2025-02-14 17:56

Nigeria | 2025-02-14 17:56#firstdealofthenewyearastylz#

Central bank policies play a crucial role in shaping the forex market by influencing currency values, investor behavior, and global trade dynamics. Interest rate decisions are among the most impactful tools, as higher rates generally attract foreign capital, increasing demand and strengthening the currency, while lower rates can lead to depreciation. For example, when the U.S. Federal Reserve raises interest rates, the U.S. dollar typically appreciates as investors seek better returns. Conversely, rate cuts can weaken the currency as capital flows to more profitable markets.

Monetary policy tools, such as quantitative easing (QE) and tightening, also significantly affect forex markets. QE, which involves purchasing government securities to inject liquidity into the economy, increases money supply and often depreciates the currency. This was seen during the global financial crisis when the U.S. dollar weakened due to extensive QE measures. In contrast, monetary tightening, which reduces money supply, can strengthen the currency by curbing inflation and enhancing investor confidence.

Foreign exchange interventions are another powerful tool. Central banks may buy or sell their currency directly to influence exchange rates, aiming to stabilize markets or achieve economic objectives. For example, the Bank of Japan has historically intervened to prevent excessive yen appreciation, which could hurt exports.

Market expectations and central bank communications also play vital roles. Traders closely analyze statements from central bank officials for hints about future policy changes. Even subtle changes in tone can cause significant currency fluctuations, as seen with the European Central Bank's communication strategy impacting the euro.

In conclusion, central bank policies directly impact forex markets through interest rate adjustments, monetary policy tools, and foreign exchange interventions. By influencing investor behavior, trade balances, and economic stability, these policies shape currency values and global financial dynamics. As central banks navigate complex economic landscapes, their decisions continue to be a key driver of forex market movements.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.