2025-02-15 00:52

IndustryUnderstanding forex market volatility and loss

#firstdealofthenewyearastylz

Forex market volatility and loss are inherent risks in trading. Here's a comprehensive guide to understanding and managing these risks:

Understanding Forex Market Volatility

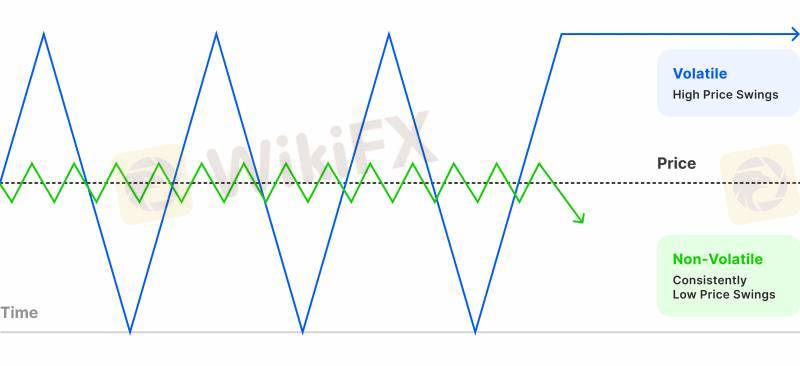

1. *What is volatility?*: Volatility refers to the fluctuations in currency prices, measured by the standard deviation of price movements.

2. *Causes of volatility*: Volatility can arise from various factors, including:

1. Economic indicators and news events

2. Central bank decisions and monetary policy changes

3. Geopolitical tensions and conflicts

4. Market sentiment and trader behavior

3. *Types of volatility*: There are two main types:

1. *Historical volatility*: Measures past price movements

2. *Implied volatility*: Reflects market expectations of future price movements

Understanding Forex Loss

1. *Types of losses*: There are two main types:

1. *Realized losses*: Actual losses incurred when a trade is closed

2. *Unrealized losses*: Potential losses that have not yet been realized

2. *Causes of losses*: Losses can arise from various factors, including:

1. Poor trading decisions

2. Inadequate risk management

3. Market volatility and unexpected events

3. *Managing losses*: Strategies to manage losses include:

1. *Stop-loss orders*: Automatically close trades when losses reach a certain level

2. *Position sizing*: Manage trade sizes to limit potential losses

3. *Risk-reward ratios*: Set realistic profit targets and stop-loss levels

Managing Forex Market Volatility and Loss

1. *Risk management strategies*: Implement strategies to manage risk, such as:

1. Diversification

2. Hedging

3. Scaling

2. *Trade planning*: Develop a trading plan, including:

1. Clear goals and objectives

2. Entry and exit strategies

3. Risk management parameters

3. *Market analysis*: Stay informed about market conditions, using:

1. Technical analysis

2. Fundamental analysis

3. Sentiment analysis

4. *Emotional control*: Manage emotions, avoiding impulsive decisions based on fear or greed

Best Practices for Managing Volatility and Loss

1. *Stay informed*: Continuously educate yourself on market analysis, risk management, and trading strategies.

2. *Develop a trading plan*: Create a comprehensive plan, including risk management parameters and trade planning.

3. *Use proper risk management*: Implement risk management strategies, such as stop-loss orders and position sizing.

4. *Monitor and adjust*: Continuously monitor market conditions and adjust your trading plan as needed.

By understanding Forex market volatility and loss, and implementing effective risk management strategies, traders can minimize potential losses and maximize gains.

Like 0

Aishatu6323

Broker

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Understanding forex market volatility and loss

Hong Kong | 2025-02-15 00:52

Hong Kong | 2025-02-15 00:52#firstdealofthenewyearastylz

Forex market volatility and loss are inherent risks in trading. Here's a comprehensive guide to understanding and managing these risks:

Understanding Forex Market Volatility

1. *What is volatility?*: Volatility refers to the fluctuations in currency prices, measured by the standard deviation of price movements.

2. *Causes of volatility*: Volatility can arise from various factors, including:

1. Economic indicators and news events

2. Central bank decisions and monetary policy changes

3. Geopolitical tensions and conflicts

4. Market sentiment and trader behavior

3. *Types of volatility*: There are two main types:

1. *Historical volatility*: Measures past price movements

2. *Implied volatility*: Reflects market expectations of future price movements

Understanding Forex Loss

1. *Types of losses*: There are two main types:

1. *Realized losses*: Actual losses incurred when a trade is closed

2. *Unrealized losses*: Potential losses that have not yet been realized

2. *Causes of losses*: Losses can arise from various factors, including:

1. Poor trading decisions

2. Inadequate risk management

3. Market volatility and unexpected events

3. *Managing losses*: Strategies to manage losses include:

1. *Stop-loss orders*: Automatically close trades when losses reach a certain level

2. *Position sizing*: Manage trade sizes to limit potential losses

3. *Risk-reward ratios*: Set realistic profit targets and stop-loss levels

Managing Forex Market Volatility and Loss

1. *Risk management strategies*: Implement strategies to manage risk, such as:

1. Diversification

2. Hedging

3. Scaling

2. *Trade planning*: Develop a trading plan, including:

1. Clear goals and objectives

2. Entry and exit strategies

3. Risk management parameters

3. *Market analysis*: Stay informed about market conditions, using:

1. Technical analysis

2. Fundamental analysis

3. Sentiment analysis

4. *Emotional control*: Manage emotions, avoiding impulsive decisions based on fear or greed

Best Practices for Managing Volatility and Loss

1. *Stay informed*: Continuously educate yourself on market analysis, risk management, and trading strategies.

2. *Develop a trading plan*: Create a comprehensive plan, including risk management parameters and trade planning.

3. *Use proper risk management*: Implement risk management strategies, such as stop-loss orders and position sizing.

4. *Monitor and adjust*: Continuously monitor market conditions and adjust your trading plan as needed.

By understanding Forex market volatility and loss, and implementing effective risk management strategies, traders can minimize potential losses and maximize gains.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.