2025-02-15 01:30

IndustryPortfolio Management: Diversification and Risk Man

#Firstdealofthenewyearastylz

Effective portfolio management involves two crucial strategies: diversification and risk management.

Diversification

Diversification is a risk management technique that involves spreading investments across various asset classes, sectors, and geographic regions. This strategy aims to reduce reliance on any single investment, thereby minimizing potential losses.

Benefits of Diversification

1. Reduced risk: By investing in multiple assets, you reduce exposure to individual asset risks.

2. Increased potential returns: Diversification can lead to higher returns over the long term, as different assets perform well at different times.

3. Improved stability: A diversified portfolio tends to be less volatile, providing more stability during market fluctuations.

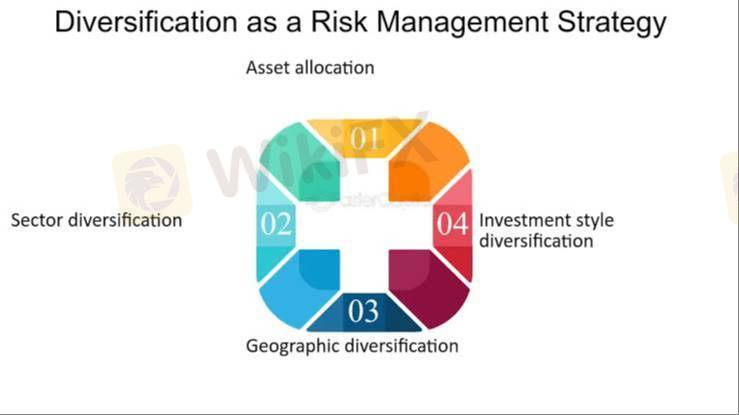

Types of Diversification

1. Asset allocation: Dividing investments among different asset classes, such as stocks, bonds, and real estate.

2. Sector diversification: Investing in various sectors, like technology, healthcare, or finance.

3. Geographic diversification: Investing in different regions or countries to spread risk.

4. Style diversification: Investing in different investment styles, such as value, growth, or dividend-focused strategies.

Like 0

Light568

Broker

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Portfolio Management: Diversification and Risk Man

Hong Kong | 2025-02-15 01:30

Hong Kong | 2025-02-15 01:30#Firstdealofthenewyearastylz

Effective portfolio management involves two crucial strategies: diversification and risk management.

Diversification

Diversification is a risk management technique that involves spreading investments across various asset classes, sectors, and geographic regions. This strategy aims to reduce reliance on any single investment, thereby minimizing potential losses.

Benefits of Diversification

1. Reduced risk: By investing in multiple assets, you reduce exposure to individual asset risks.

2. Increased potential returns: Diversification can lead to higher returns over the long term, as different assets perform well at different times.

3. Improved stability: A diversified portfolio tends to be less volatile, providing more stability during market fluctuations.

Types of Diversification

1. Asset allocation: Dividing investments among different asset classes, such as stocks, bonds, and real estate.

2. Sector diversification: Investing in various sectors, like technology, healthcare, or finance.

3. Geographic diversification: Investing in different regions or countries to spread risk.

4. Style diversification: Investing in different investment styles, such as value, growth, or dividend-focused strategies.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.