2025-02-15 01:45

IndustryTECHNICAL ANALYSIS TECHNIQUES FOR POTENTIAL LOSS

#firstdealofthenewyearastylz

In technical analysis, identifying potential losses is just as important as spotting opportunities for gains. Here are some key techniques to help detect and manage potential losses in trading:

1. Stop-Loss Orders

A predetermined price level where you exit a trade to limit losses.

Can be fixed (e.g., 5% below entry price) or trailing (moves with price action).

2. Support & Resistance Levels

Breaking support (a key level where price previously bounced) may indicate further downside.

If a stock fails to break resistance multiple times, it may signal weakness and a potential downturn.

3. Trend Analysis

Moving Averages: A drop below the 200-day moving average can signal a long-term downtrend.

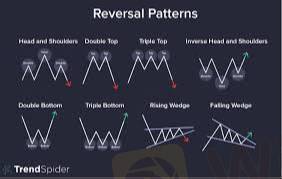

Trendlines: A break below an upward trendline may indicate a reversal and potential loss.

4. Candlestick Patterns

Bearish engulfing, shooting star, or hanging man patterns suggest potential downside.

Doji followed by a strong red candle indicates uncertainty turning into selling pressure.

5. Volume Analysis

High volume on down days signals strong selling pressure, which may indicate further losses.

Divergences between price and volume (e.g., price rising but volume decreasing) can signal weakness.

6. Relative Strength Index (RSI)

Overbought (>70) may indicate a reversal or correction.

Bearish divergence (price makes a new high, but RSI doesn’t) suggests weakening momentum.

7. Moving Average Convergence Divergence (MACD)

A bearish crossover (MACD line crossing below the signal line) signals downside risk.

A divergence (price rising but MACD falling) warns of trend weakness.

8. Bollinger Bands

Price touching the upper band and reversing may indicate a pullback.

Break below the lower band with high volume suggests strong selling pressure.

9. Fibonacci Retracements

If price fails to hold key retracement levels (e.g., 61.8%), further downside is likely.

10. Market Sentiment Indicators

Fear & Greed Index: Extreme greed can indicate a coming correction.

Put/Call Ratio: A high ratio suggests bearish sentiment.

Risk Management Tips

Always set a risk-reward ratio (e.g., 1:3) to cut losses quickly.

Diversify your portfolio to reduce risk.

Avoid revenge trading after a loss.

Like 0

Babatunde5040

Broker

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

TECHNICAL ANALYSIS TECHNIQUES FOR POTENTIAL LOSS

Hong Kong | 2025-02-15 01:45

Hong Kong | 2025-02-15 01:45#firstdealofthenewyearastylz

In technical analysis, identifying potential losses is just as important as spotting opportunities for gains. Here are some key techniques to help detect and manage potential losses in trading:

1. Stop-Loss Orders

A predetermined price level where you exit a trade to limit losses.

Can be fixed (e.g., 5% below entry price) or trailing (moves with price action).

2. Support & Resistance Levels

Breaking support (a key level where price previously bounced) may indicate further downside.

If a stock fails to break resistance multiple times, it may signal weakness and a potential downturn.

3. Trend Analysis

Moving Averages: A drop below the 200-day moving average can signal a long-term downtrend.

Trendlines: A break below an upward trendline may indicate a reversal and potential loss.

4. Candlestick Patterns

Bearish engulfing, shooting star, or hanging man patterns suggest potential downside.

Doji followed by a strong red candle indicates uncertainty turning into selling pressure.

5. Volume Analysis

High volume on down days signals strong selling pressure, which may indicate further losses.

Divergences between price and volume (e.g., price rising but volume decreasing) can signal weakness.

6. Relative Strength Index (RSI)

Overbought (>70) may indicate a reversal or correction.

Bearish divergence (price makes a new high, but RSI doesn’t) suggests weakening momentum.

7. Moving Average Convergence Divergence (MACD)

A bearish crossover (MACD line crossing below the signal line) signals downside risk.

A divergence (price rising but MACD falling) warns of trend weakness.

8. Bollinger Bands

Price touching the upper band and reversing may indicate a pullback.

Break below the lower band with high volume suggests strong selling pressure.

9. Fibonacci Retracements

If price fails to hold key retracement levels (e.g., 61.8%), further downside is likely.

10. Market Sentiment Indicators

Fear & Greed Index: Extreme greed can indicate a coming correction.

Put/Call Ratio: A high ratio suggests bearish sentiment.

Risk Management Tips

Always set a risk-reward ratio (e.g., 1:3) to cut losses quickly.

Diversify your portfolio to reduce risk.

Avoid revenge trading after a loss.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.