2025-02-16 23:58

IndustryBullish Outlook on USD/JPY #ForexValentine

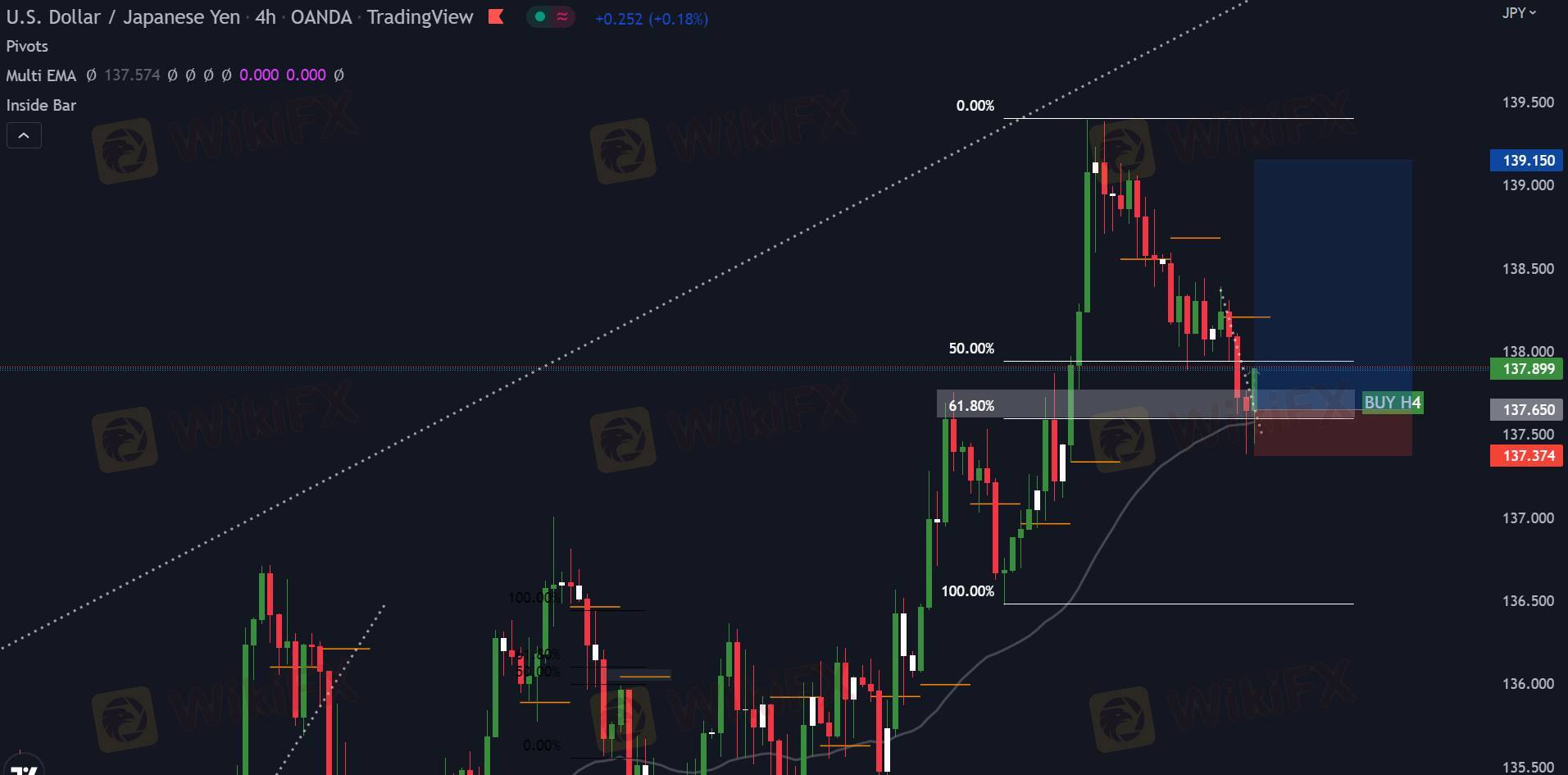

The USD/JPY pair remains bullish, driven by fundamental and technical factors.

Fundamentally, the Bank of Japan (BoJ) continues its ultra-loose monetary policy, keeping interest rates near zero, while the Federal Reserve (Fed), despite potential rate cuts in 2024, still maintains higher interest rates than Japan. This widening yield differential supports USD strength against JPY. Additionally, risk-on sentiment in global markets reduces demand for the safe-haven yen, further boosting USD/JPY.

Technically, the pair is in an uptrend, with higher highs and higher lows. The 50-day SMA remains above the 200-day SMA (Golden Cross), confirming bullish momentum. RSI above 50 and MACD in positive territory suggest continued buying pressure. The pair has broken resistance at 148.00, with the next targets at 150.00 and 152.00, while support lies at 146.00.

If the bullish trend holds, USD/JPY could push toward 152.00 in the medium term.

Like 0

salbaba

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Bullish Outlook on USD/JPY #ForexValentine

| 2025-02-16 23:58

| 2025-02-16 23:58The USD/JPY pair remains bullish, driven by fundamental and technical factors.

Fundamentally, the Bank of Japan (BoJ) continues its ultra-loose monetary policy, keeping interest rates near zero, while the Federal Reserve (Fed), despite potential rate cuts in 2024, still maintains higher interest rates than Japan. This widening yield differential supports USD strength against JPY. Additionally, risk-on sentiment in global markets reduces demand for the safe-haven yen, further boosting USD/JPY.

Technically, the pair is in an uptrend, with higher highs and higher lows. The 50-day SMA remains above the 200-day SMA (Golden Cross), confirming bullish momentum. RSI above 50 and MACD in positive territory suggest continued buying pressure. The pair has broken resistance at 148.00, with the next targets at 150.00 and 152.00, while support lies at 146.00.

If the bullish trend holds, USD/JPY could push toward 152.00 in the medium term.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.