2025-02-17 16:53

IndustryUnderstanding Forex market volatility and loss

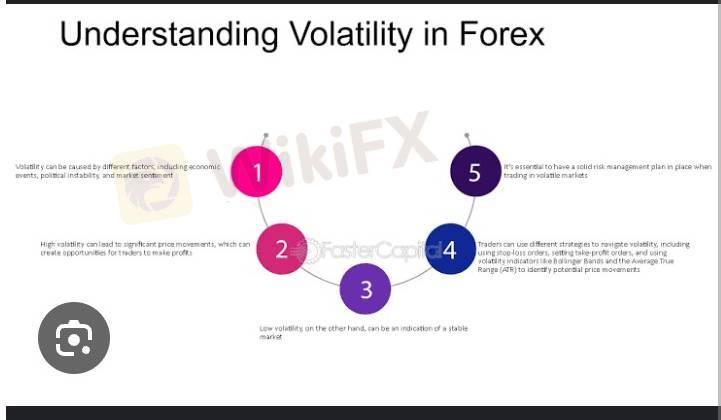

Forex market volatility can be a significant challenge for traders, leading to substantial losses if not managed properly. Here's a comprehensive guide to understanding Forex market volatility and minimizing losses:

Types of Volatility

1. *Implied Volatility*: Expected volatility based on market sentiment and options pricing.

2. *Historical Volatility*: Actual volatility measured over a specific period.

3. *Realized Volatility*: Actual volatility experienced by a trader's portfolio.

Causes of Volatility

1. *Economic Indicators*: GDP, inflation, employment rates, and interest rates.

2. *Central Bank Decisions*: Monetary policy changes, interest rates, and quantitative easing.

3. *Geopolitical Events*: Wars, elections, trade wars, and natural disasters.

4. *Market Sentiment*: Trader emotions, sentiment, and positioning.

Effects of Volatility on Trading

1. *Increased Risk*: Higher volatility increases potential losses.

2. *Wider Spreads*: Brokers may widen spreads during volatile periods.

3. *Slippage*: Trades may be executed at unfavorable prices.

4. *Emotional Decision-Making*: Volatility can lead to impulsive decisions.

Strategies for Managing Volatility

1. *Position Sizing*: Adjust position sizes according to volatility.

2. *Stop Loss and Take Profit*: Set stops and limits to manage risk.

3. *Hedging*: Use derivatives or other instruments to offset risk.

4. *Diversification*: Spread investments across various asset classes.

5. *Risk-Reward Ratio*: Establish a ratio of potential profit to potential loss.

6. *Volatility-Based Trading*: Use volatility as a trading signal.

Best Practices for Trading in Volatile Markets

1. *Stay Informed*: Continuously monitor market news and analysis.

2. *Adjust Strategies*: Adapt trading strategies according to changing market conditions.

3. *Manage Emotions*: Control emotions and avoid impulsive decisions.

4. *Maintain Discipline*: Stick to your trading plan and risk management strategies.

By understanding the causes and effects of Forex market volatility, you can develop effective strategies for managing risk and minimizing losses. Remember to stay informed, adapt to changing market conditions, and maintain discipline in your trading approach.

#firstdealofthenewyearastylz

Like 0

FX1866544709

Broker

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Understanding Forex market volatility and loss

Hong Kong | 2025-02-17 16:53

Hong Kong | 2025-02-17 16:53Forex market volatility can be a significant challenge for traders, leading to substantial losses if not managed properly. Here's a comprehensive guide to understanding Forex market volatility and minimizing losses:

Types of Volatility

1. *Implied Volatility*: Expected volatility based on market sentiment and options pricing.

2. *Historical Volatility*: Actual volatility measured over a specific period.

3. *Realized Volatility*: Actual volatility experienced by a trader's portfolio.

Causes of Volatility

1. *Economic Indicators*: GDP, inflation, employment rates, and interest rates.

2. *Central Bank Decisions*: Monetary policy changes, interest rates, and quantitative easing.

3. *Geopolitical Events*: Wars, elections, trade wars, and natural disasters.

4. *Market Sentiment*: Trader emotions, sentiment, and positioning.

Effects of Volatility on Trading

1. *Increased Risk*: Higher volatility increases potential losses.

2. *Wider Spreads*: Brokers may widen spreads during volatile periods.

3. *Slippage*: Trades may be executed at unfavorable prices.

4. *Emotional Decision-Making*: Volatility can lead to impulsive decisions.

Strategies for Managing Volatility

1. *Position Sizing*: Adjust position sizes according to volatility.

2. *Stop Loss and Take Profit*: Set stops and limits to manage risk.

3. *Hedging*: Use derivatives or other instruments to offset risk.

4. *Diversification*: Spread investments across various asset classes.

5. *Risk-Reward Ratio*: Establish a ratio of potential profit to potential loss.

6. *Volatility-Based Trading*: Use volatility as a trading signal.

Best Practices for Trading in Volatile Markets

1. *Stay Informed*: Continuously monitor market news and analysis.

2. *Adjust Strategies*: Adapt trading strategies according to changing market conditions.

3. *Manage Emotions*: Control emotions and avoid impulsive decisions.

4. *Maintain Discipline*: Stick to your trading plan and risk management strategies.

By understanding the causes and effects of Forex market volatility, you can develop effective strategies for managing risk and minimizing losses. Remember to stay informed, adapt to changing market conditions, and maintain discipline in your trading approach.

#firstdealofthenewyearastylz

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.