2025-02-17 23:38

IndustryForex Trading Sessions: Market Hours and liquidity

#Firstofthenewyearstylz

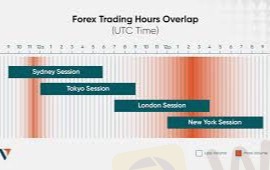

Forex trading sessions are divided into four major sessions, each corresponding to a significant financial hub around the world. These sessions are:

- *Sydney Session*: 10 PM - 7 AM GMT, influenced by the Australian market, with currency pairs like AUD/USD and NZD/USD being most active.

- *Tokyo Session*: 12 AM - 9 AM GMT, dominated by the Japanese market, with USD/JPY and EUR/JPY being popular pairs.

- *London Session*: 8 AM - 5 PM GMT, the largest and most liquid session, with EUR/USD, GBP/USD, and USD/JPY being highly traded.

- *New York Session*: 1 PM - 10 PM GMT, influenced by the US market, with USD/CAD and EUR/USD being popular pairs ¹.

The best time to trade Forex is during the overlap of major trading sessions, such as the London-New York overlap (8:00 AM to 12:00 PM EST), when market activity, liquidity, and volatility are at their peak ².

In terms of liquidity, the Forex market is most liquid during the London and New York sessions, with the London session being the most liquid. The Sydney and Tokyo sessions have relatively lower liquidity ¹.

Keep in mind that Forex market hours can vary depending on daylight saving time (DST) and other factors, so it's essential to stay informed about market hours and plan your trading strategy accordingly ³.

Like 0

Yewande

Brokers

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Forex Trading Sessions: Market Hours and liquidity

Nigeria | 2025-02-17 23:38

Nigeria | 2025-02-17 23:38#Firstofthenewyearstylz

Forex trading sessions are divided into four major sessions, each corresponding to a significant financial hub around the world. These sessions are:

- *Sydney Session*: 10 PM - 7 AM GMT, influenced by the Australian market, with currency pairs like AUD/USD and NZD/USD being most active.

- *Tokyo Session*: 12 AM - 9 AM GMT, dominated by the Japanese market, with USD/JPY and EUR/JPY being popular pairs.

- *London Session*: 8 AM - 5 PM GMT, the largest and most liquid session, with EUR/USD, GBP/USD, and USD/JPY being highly traded.

- *New York Session*: 1 PM - 10 PM GMT, influenced by the US market, with USD/CAD and EUR/USD being popular pairs ¹.

The best time to trade Forex is during the overlap of major trading sessions, such as the London-New York overlap (8:00 AM to 12:00 PM EST), when market activity, liquidity, and volatility are at their peak ².

In terms of liquidity, the Forex market is most liquid during the London and New York sessions, with the London session being the most liquid. The Sydney and Tokyo sessions have relatively lower liquidity ¹.

Keep in mind that Forex market hours can vary depending on daylight saving time (DST) and other factors, so it's essential to stay informed about market hours and plan your trading strategy accordingly ³.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.