2025-02-18 03:53

Industry How fear and greed affect risk management.

#forexrisktip#

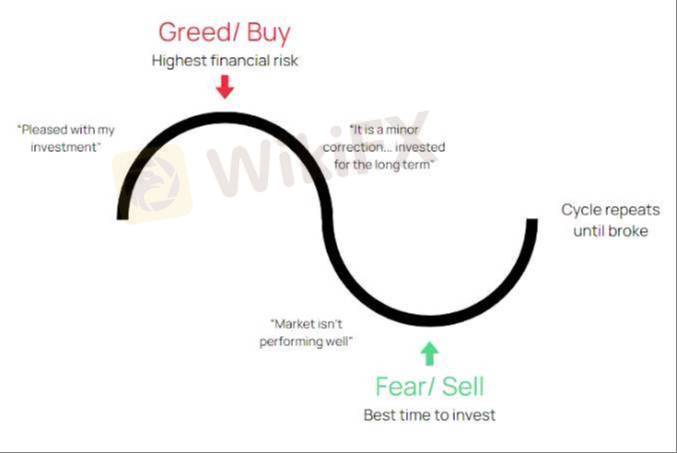

Fear and greed are powerful emotions that can significantly impact risk management, often leading to irrational decision-making and potentially harmful outcomes. Here's how:

Fear:

* Excessive Risk Aversion: Fear can cause individuals or organizations to become overly cautious, avoiding potentially profitable opportunities due to the perceived risk. This can lead to missed gains and hinder growth.

* Panic Selling/Withdrawal: In financial markets, fear can trigger panic selling, leading to significant losses as individuals rush to exit their positions. This can also happen in other contexts, such as businesses withdrawing from promising projects due to fear of failure.

* Analysis Paralysis: Fear can lead to overthinking and excessive analysis, delaying crucial decisions and potentially causing missed opportunities.

Greed:

* Excessive Risk-Taking: Greed can drive individuals or organizations to take on too much risk in pursuit of higher returns or gains. This can lead to significant losses if the market or situation turns unfavorable.

* Ignoring Warning Signs: Greed can blind individuals to warning signs and potential risks, leading them to make poor decisions based on wishful thinking rather than objective analysis.

* Overconfidence: Greed can foster overconfidence, leading individuals to overestimate their abilities and underestimate the risks involved. This can result in reckless behavior and costly mistakes.

Impact on Risk Management:

* Distorted Risk Assessment: Fear and greed can distort the perception of risk, making some risks seem greater than they are and others seem smaller. This can lead to flawed risk assessments and inappropriate risk management strategies.

* Emotional Decision-Making: When fear and greed take over, decisions are often driven by emotions rather than rational analysis. This can result in impulsive and poorly thought-out actions that can have negative consequences.

* Lack of Discipline: Effective risk management requires discipline and adherence to a well-defined plan. Fear and greed can undermine discipline, leading individuals to deviate from their strategies and make impulsive decisions.

Mitigating the Impact:

* Awareness: Recognizing the influence of fear and greed is the first step in mitigating their impact.

* Objective Analysis: Rely on data and objective analysis rather than emotions when assessing risks and making decisions.

* Disciplined Approach: Develop a well-defined risk management plan and stick to it, even when faced with fear or greed.

* Seek Advice: Consult with trusted advisors or experts to get an objective perspective and avoid emotional decision-making.

By understanding how fear and greed can affect risk management, individuals and organizations can take steps to mitigate their influence and make more rational and informed decisions.

Like 0

FX9372012632

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

How fear and greed affect risk management.

India | 2025-02-18 03:53

India | 2025-02-18 03:53#forexrisktip#

Fear and greed are powerful emotions that can significantly impact risk management, often leading to irrational decision-making and potentially harmful outcomes. Here's how:

Fear:

* Excessive Risk Aversion: Fear can cause individuals or organizations to become overly cautious, avoiding potentially profitable opportunities due to the perceived risk. This can lead to missed gains and hinder growth.

* Panic Selling/Withdrawal: In financial markets, fear can trigger panic selling, leading to significant losses as individuals rush to exit their positions. This can also happen in other contexts, such as businesses withdrawing from promising projects due to fear of failure.

* Analysis Paralysis: Fear can lead to overthinking and excessive analysis, delaying crucial decisions and potentially causing missed opportunities.

Greed:

* Excessive Risk-Taking: Greed can drive individuals or organizations to take on too much risk in pursuit of higher returns or gains. This can lead to significant losses if the market or situation turns unfavorable.

* Ignoring Warning Signs: Greed can blind individuals to warning signs and potential risks, leading them to make poor decisions based on wishful thinking rather than objective analysis.

* Overconfidence: Greed can foster overconfidence, leading individuals to overestimate their abilities and underestimate the risks involved. This can result in reckless behavior and costly mistakes.

Impact on Risk Management:

* Distorted Risk Assessment: Fear and greed can distort the perception of risk, making some risks seem greater than they are and others seem smaller. This can lead to flawed risk assessments and inappropriate risk management strategies.

* Emotional Decision-Making: When fear and greed take over, decisions are often driven by emotions rather than rational analysis. This can result in impulsive and poorly thought-out actions that can have negative consequences.

* Lack of Discipline: Effective risk management requires discipline and adherence to a well-defined plan. Fear and greed can undermine discipline, leading individuals to deviate from their strategies and make impulsive decisions.

Mitigating the Impact:

* Awareness: Recognizing the influence of fear and greed is the first step in mitigating their impact.

* Objective Analysis: Rely on data and objective analysis rather than emotions when assessing risks and making decisions.

* Disciplined Approach: Develop a well-defined risk management plan and stick to it, even when faced with fear or greed.

* Seek Advice: Consult with trusted advisors or experts to get an objective perspective and avoid emotional decision-making.

By understanding how fear and greed can affect risk management, individuals and organizations can take steps to mitigate their influence and make more rational and informed decisions.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.