2025-02-18 04:24

IndustryDeveloping a disciplined trading mindset.

#forexrisktip#

Here is a response about developing a disciplined trading mindset:

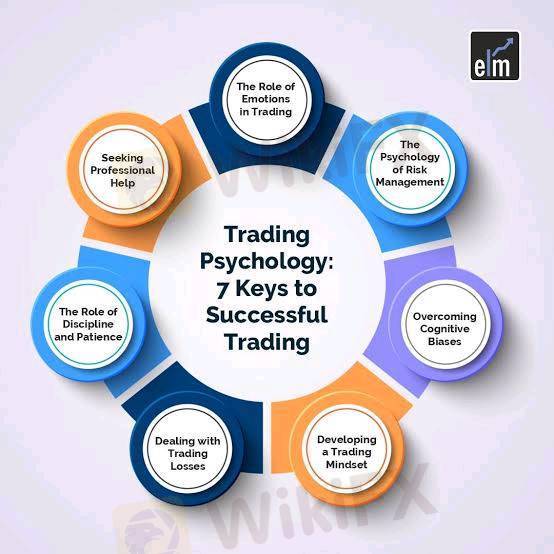

Developing a disciplined trading mindset is crucial for success in the financial markets. It involves cultivating a combination of mental traits and habits that enable traders to make rational decisions, manage risk effectively, and stick to their trading plans. Here are some key aspects of developing a disciplined trading mindset:

1. Define Your Trading Goals and Strategies:

* Clarity of Purpose: Clearly define your financial goals for trading. Are you aiming for long-term wealth accumulation, short-term gains, or a specific income target?

* Trading Plan: Develop a comprehensive trading plan that outlines your entry and exit strategies, risk management rules, and the types of securities you will trade.

* Strategy Selection: Choose trading strategies that align with your goals, risk tolerance, and time commitment.

2. Master Your Emotions:

* Self-Awareness: Recognize and understand your emotional triggers, such as fear, greed, and impatience.

* Emotional Control: Develop techniques to manage your emotions during trading. Avoid making impulsive decisions based on fear or excitement.

* Objectivity: Strive to remain objective and rational when analyzing market conditions and making trading decisions.

3. Practice Risk Management:

* Risk Tolerance: Determine your risk tolerance and never risk more than you can afford to lose.

* Position Sizing: Implement proper position sizing to limit potential losses on any single trade.

* Stop-Loss Orders: Use stop-loss orders to automatically exit trades when prices move against you, limiting your losses.

4. Cultivate Patience and Discipline:

* Stick to Your Plan: Adhere to your trading plan and avoid deviating from it based on emotions or market noise.

* Avoid Overtrading: Resist the urge to trade too frequently. Wait for high-probability setups that align with your strategy.

* Discipline in Execution: Execute your trades precisely as planned, without hesitation or second-guessing.

5. Continuous Learning and Improvement:

* Market Knowledge: Stay informed about market trends, economic news, and factors that can impact your trades.

* Strategy Refinement: Continuously evaluate and refine your trading strategies based on your performance and market conditions.

* Trading Journal: Keep a trading journal to track your trades, analyze your mistakes, and identify areas for improvement.

6. Seek Support and Guidance:

* Mentorship: Consider seeking guidance from experienced traders or mentors who can provide valuable insights and support.

* Community: Join trading communities or forums to connect with other traders, share ideas, and learn from their experiences.

Developing a disciplined trading mindset is an ongoing process that requires dedication, self-reflection, and a willingness to learn from your mistakes. By focusing on these key aspects, you can increase your chances of success in the financial markets.

Like 0

FX4387040712

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Developing a disciplined trading mindset.

India | 2025-02-18 04:24

India | 2025-02-18 04:24#forexrisktip#

Here is a response about developing a disciplined trading mindset:

Developing a disciplined trading mindset is crucial for success in the financial markets. It involves cultivating a combination of mental traits and habits that enable traders to make rational decisions, manage risk effectively, and stick to their trading plans. Here are some key aspects of developing a disciplined trading mindset:

1. Define Your Trading Goals and Strategies:

* Clarity of Purpose: Clearly define your financial goals for trading. Are you aiming for long-term wealth accumulation, short-term gains, or a specific income target?

* Trading Plan: Develop a comprehensive trading plan that outlines your entry and exit strategies, risk management rules, and the types of securities you will trade.

* Strategy Selection: Choose trading strategies that align with your goals, risk tolerance, and time commitment.

2. Master Your Emotions:

* Self-Awareness: Recognize and understand your emotional triggers, such as fear, greed, and impatience.

* Emotional Control: Develop techniques to manage your emotions during trading. Avoid making impulsive decisions based on fear or excitement.

* Objectivity: Strive to remain objective and rational when analyzing market conditions and making trading decisions.

3. Practice Risk Management:

* Risk Tolerance: Determine your risk tolerance and never risk more than you can afford to lose.

* Position Sizing: Implement proper position sizing to limit potential losses on any single trade.

* Stop-Loss Orders: Use stop-loss orders to automatically exit trades when prices move against you, limiting your losses.

4. Cultivate Patience and Discipline:

* Stick to Your Plan: Adhere to your trading plan and avoid deviating from it based on emotions or market noise.

* Avoid Overtrading: Resist the urge to trade too frequently. Wait for high-probability setups that align with your strategy.

* Discipline in Execution: Execute your trades precisely as planned, without hesitation or second-guessing.

5. Continuous Learning and Improvement:

* Market Knowledge: Stay informed about market trends, economic news, and factors that can impact your trades.

* Strategy Refinement: Continuously evaluate and refine your trading strategies based on your performance and market conditions.

* Trading Journal: Keep a trading journal to track your trades, analyze your mistakes, and identify areas for improvement.

6. Seek Support and Guidance:

* Mentorship: Consider seeking guidance from experienced traders or mentors who can provide valuable insights and support.

* Community: Join trading communities or forums to connect with other traders, share ideas, and learn from their experiences.

Developing a disciplined trading mindset is an ongoing process that requires dedication, self-reflection, and a willingness to learn from your mistakes. By focusing on these key aspects, you can increase your chances of success in the financial markets.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.