2025-02-18 04:30

IndustryEMERGING MARKET CURRENCIES RISK AND OPPORTUNITIES

#firstdealofthenewyearastylz

Emerging market currencies present a fascinating landscape of both risks and opportunities for investors and businesses. Let's break down some of the key aspects:

Risks

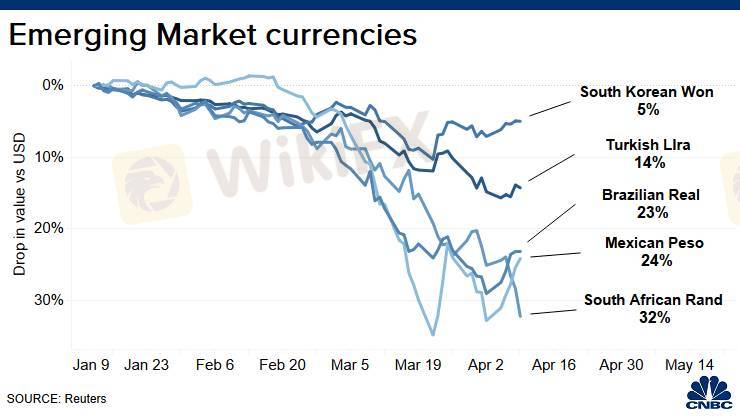

Volatility: Emerging market currencies often experience significant fluctuations due to political instability, economic changes, and shifts in investor sentiment. This volatility can lead to substantial losses if not managed properly.

Political Risk: Changes in government, policy shifts, or civil unrest can dramatically affect currency values. For instance, a sudden election result or a coup can lead to a rapid depreciation of a currency.

Economic Fundamentals: Many emerging markets are susceptible to economic shocks, such as commodity price fluctuations, inflation, and changes in interest rates. For example, countries that rely heavily on oil exports may see their currencies weaken if oil prices drop.

Liquidity Issues: Some emerging market currencies may have lower liquidity compared to developed market currencies, making it harder to execute large trades without impacting the market price.

Foreign Debt: Countries with high levels of foreign-denominated debt can face currency risk if their local currency depreciates, making it more expensive to service that debt.

Opportunities

Higher Returns: Emerging market currencies can offer higher yields compared to developed markets, attracting investors seeking better returns. This is often due to higher interest rates set by central banks in these countries.

Diversification: Investing in emerging market currencies can provide diversification benefits to a portfolio. They often have different economic drivers compared to developed markets, which can help mitigate risk.

Growth Potential: Many emerging markets are experiencing rapid economic growth, driven by factors such as urbanization, a growing middle class, and technological advancements. This growth can lead to appreciation of their currencies over time.

Trade Opportunities: As global trade dynamics shift, businesses may find opportunities in emerging markets. A weaker currency can make exports cheaper and more competitive, potentially boosting economic growth.

Technological Adoption: Emerging markets are often at the forefront of adopting new technologies, particularly in finance (like mobile banking and fintech). This can lead to increased economic activity and currency appreciation.

Strategies for Navigating Risks and Opportunities

Hedging: Investors and businesses can use financial instruments like options and futures to hedge against currency risk.

Research and Analysis: Staying informed about political and economic developments in emerging markets is crucial. Understanding local conditions can help in making informed investment decisions.

Diversification: Spreading investments across multiple emerging markets can reduce the impact of adverse events in any single country.

Long-term Perspective: While short-term volatility can be daunting, a long-term investment strategy may yield better results as economies grow and stabilize.

Engagement with Local Experts: Collaborating with local financial experts or institutions can provide valuable insights and help navigate the complexities of emerging markets.

In summary, while emerging market currencies come with their share of risks, they also offer unique opportunities for those willing to engage with them thoughtfully. Balancing risk management with a keen eye for growth potential can lead to rewarding outcomes.

Like 0

Va²tyough

Broker

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

EMERGING MARKET CURRENCIES RISK AND OPPORTUNITIES

Hong Kong | 2025-02-18 04:30

Hong Kong | 2025-02-18 04:30#firstdealofthenewyearastylz

Emerging market currencies present a fascinating landscape of both risks and opportunities for investors and businesses. Let's break down some of the key aspects:

Risks

Volatility: Emerging market currencies often experience significant fluctuations due to political instability, economic changes, and shifts in investor sentiment. This volatility can lead to substantial losses if not managed properly.

Political Risk: Changes in government, policy shifts, or civil unrest can dramatically affect currency values. For instance, a sudden election result or a coup can lead to a rapid depreciation of a currency.

Economic Fundamentals: Many emerging markets are susceptible to economic shocks, such as commodity price fluctuations, inflation, and changes in interest rates. For example, countries that rely heavily on oil exports may see their currencies weaken if oil prices drop.

Liquidity Issues: Some emerging market currencies may have lower liquidity compared to developed market currencies, making it harder to execute large trades without impacting the market price.

Foreign Debt: Countries with high levels of foreign-denominated debt can face currency risk if their local currency depreciates, making it more expensive to service that debt.

Opportunities

Higher Returns: Emerging market currencies can offer higher yields compared to developed markets, attracting investors seeking better returns. This is often due to higher interest rates set by central banks in these countries.

Diversification: Investing in emerging market currencies can provide diversification benefits to a portfolio. They often have different economic drivers compared to developed markets, which can help mitigate risk.

Growth Potential: Many emerging markets are experiencing rapid economic growth, driven by factors such as urbanization, a growing middle class, and technological advancements. This growth can lead to appreciation of their currencies over time.

Trade Opportunities: As global trade dynamics shift, businesses may find opportunities in emerging markets. A weaker currency can make exports cheaper and more competitive, potentially boosting economic growth.

Technological Adoption: Emerging markets are often at the forefront of adopting new technologies, particularly in finance (like mobile banking and fintech). This can lead to increased economic activity and currency appreciation.

Strategies for Navigating Risks and Opportunities

Hedging: Investors and businesses can use financial instruments like options and futures to hedge against currency risk.

Research and Analysis: Staying informed about political and economic developments in emerging markets is crucial. Understanding local conditions can help in making informed investment decisions.

Diversification: Spreading investments across multiple emerging markets can reduce the impact of adverse events in any single country.

Long-term Perspective: While short-term volatility can be daunting, a long-term investment strategy may yield better results as economies grow and stabilize.

Engagement with Local Experts: Collaborating with local financial experts or institutions can provide valuable insights and help navigate the complexities of emerging markets.

In summary, while emerging market currencies come with their share of risks, they also offer unique opportunities for those willing to engage with them thoughtfully. Balancing risk management with a keen eye for growth potential can lead to rewarding outcomes.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.