2025-03-04 22:43

Industry#AITradingAffectsForex

AI and Forex Gap Trading Prediction

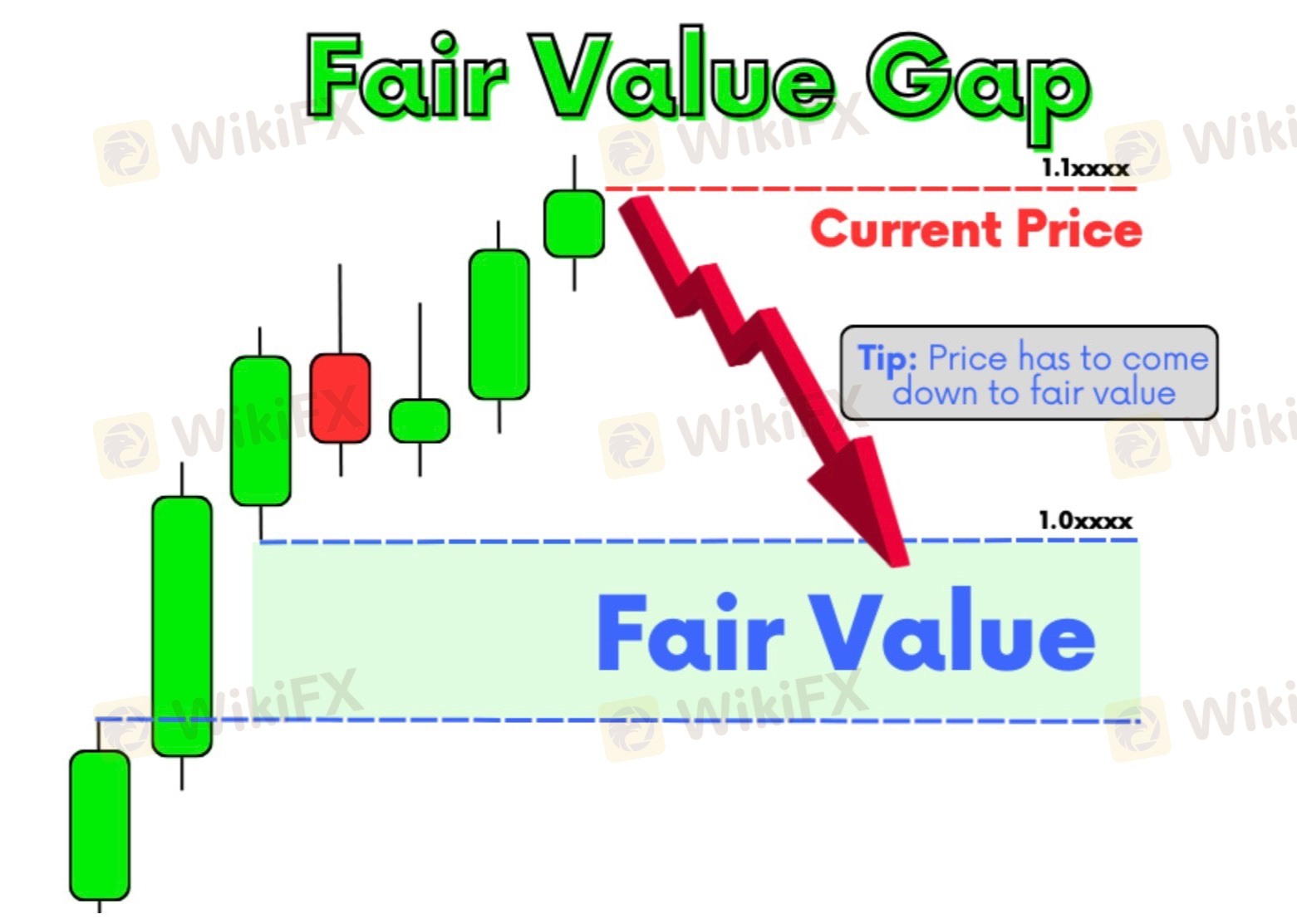

Gap trading in Forex refers to a strategy that aims to profit from price gaps that occur between two trading sessions. A price gap happens when the price of a currency pair opens significantly higher or lower than its previous closing price, leaving a “gap” on the price chart. These gaps are often the result of economic news, geopolitical events, or significant market reactions that occur outside regular trading hours. Gap trading strategies attempt to capitalize on the tendency for gaps to either fill (the price returns to the previous level) or continue in the direction of the gap.

AI can enhance gap trading predictions by analyzing vast amounts of historical data, identifying patterns related to gap occurrences, and predicting the likelihood of a gap’s continuation or closure.

1. Understanding Forex Gaps

Forex price gaps occur due to several factors, such as:

• Economic Events: Major announcements like interest rate decisions, GDP releases, or employment reports can trigger gaps.

• Geopolitical Events: Political instability, wars, or significant news affecting global markets can create sharp price moves.

• Market Sentiment Shifts: Large-scale shifts in market sentiment, such as changes in investor confidence, can also cause gaps.

• Weekend Gaps: Since Forex operates 24 hours a day, gaps commonly occur when markets open on Monday after the weekend break.

There are two primary types of gaps:

• Up Gaps (Bullish Gaps): Occur when the opening price is higher than the previous closing price, signaling strong bullish sentiment.

• Down Gaps (Bearish Gaps): Occur when the opening price is lower than the previous closing price, signaling strong bearish sentiment.

The key goal in gap trading is to predict whether the gap will be filled (reversal) or continue (trend continuation).

2. How AI Enhances Forex Gap Trading

AI models leverage a variety of techniques, including machine learning, deep learning, and natural language processing, to predict the behavior of price gaps in Forex markets. Here’s how AI enhances gap trading strategies:

a. Pattern Recognition in Historical Data

AI can analyze vast historical datasets of Forex gaps and detect patterns that often precede either a gap continuation or a gap closure. By examining the characteristics of past gaps (such as size, time of occurrence, market conditions, and price movement), AI can create models that predict the likelihood of future gaps following similar patterns.

• Deep Learning Models: Neural networks like Convolutional Neural Networks (CNNs) and Recurrent Neural Networks (RNNs) can learn complex relationships in time-series data, identifying recurring patterns related to price gaps. For example, a CNN can detect visual patterns in price charts, while RNNs (including LSTMs) can model the temporal dependencies in price movements.

• Clustering Algorithms: Algorithms like K-Means can be used to cluster historical gap data into groups based on certain characteristics (gap size, market volatility, trading volume, etc.). These clusters help identify the probability of gap behavior, such as whether it will fill or continue.

b. Sentiment and News Analysis

AI models can analyze news articles, economic reports, and social media sentiment to identify potential triggers for price gaps. Natural Language Processing (NLP) techniques are used to assess whether news events are likely to generate large market movements, which could cause gaps.

• Sentiment Analysis: By analyzing public sentiment, AI can predict the likelihood of market-moving news (positive or negative), which could influence the direction of the gap. For instance, if there’s overwhelmingly positive news about an economy, the AI model might predict an up gap with a higher chance of continuing in the bullish direction.

• News Clustering and Event Detection: NLP can be used to cluster news events that are associated with past gaps. If similar news has previously resulted in a gap, AI can use that information to forecast future gaps and their behavior.

c. Time-Series Forecasting

AI excels at time-series forecasting, which is crucial for predicting how a gap will behave over time. By examining historical price data and understanding the statistical relationships between different time periods, AI can predict whether the gap will be filled or continued.

• LSTM Models (Long Short-Term Memory): LSTM models are a type of RNN specifically designed for sequential data like Forex price movements. LSTMs can capture long-term dependencies in price movements, making them ideal for predicting gap closures or continuations based on historical patterns.

• ARIMA (AutoRegressive Integrated Moving Average): ARIMA models, often combined with machine learning methods, can be used for modeling time-series data and forecasting the likely closing price levels post-gap.

d. Market Behavior and Volatility Analysis

AI can analyze market volatility and other technical indicato

Like 0

FX1338163728

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

#AITradingAffectsForex

India | 2025-03-04 22:43

India | 2025-03-04 22:43AI and Forex Gap Trading Prediction

Gap trading in Forex refers to a strategy that aims to profit from price gaps that occur between two trading sessions. A price gap happens when the price of a currency pair opens significantly higher or lower than its previous closing price, leaving a “gap” on the price chart. These gaps are often the result of economic news, geopolitical events, or significant market reactions that occur outside regular trading hours. Gap trading strategies attempt to capitalize on the tendency for gaps to either fill (the price returns to the previous level) or continue in the direction of the gap.

AI can enhance gap trading predictions by analyzing vast amounts of historical data, identifying patterns related to gap occurrences, and predicting the likelihood of a gap’s continuation or closure.

1. Understanding Forex Gaps

Forex price gaps occur due to several factors, such as:

• Economic Events: Major announcements like interest rate decisions, GDP releases, or employment reports can trigger gaps.

• Geopolitical Events: Political instability, wars, or significant news affecting global markets can create sharp price moves.

• Market Sentiment Shifts: Large-scale shifts in market sentiment, such as changes in investor confidence, can also cause gaps.

• Weekend Gaps: Since Forex operates 24 hours a day, gaps commonly occur when markets open on Monday after the weekend break.

There are two primary types of gaps:

• Up Gaps (Bullish Gaps): Occur when the opening price is higher than the previous closing price, signaling strong bullish sentiment.

• Down Gaps (Bearish Gaps): Occur when the opening price is lower than the previous closing price, signaling strong bearish sentiment.

The key goal in gap trading is to predict whether the gap will be filled (reversal) or continue (trend continuation).

2. How AI Enhances Forex Gap Trading

AI models leverage a variety of techniques, including machine learning, deep learning, and natural language processing, to predict the behavior of price gaps in Forex markets. Here’s how AI enhances gap trading strategies:

a. Pattern Recognition in Historical Data

AI can analyze vast historical datasets of Forex gaps and detect patterns that often precede either a gap continuation or a gap closure. By examining the characteristics of past gaps (such as size, time of occurrence, market conditions, and price movement), AI can create models that predict the likelihood of future gaps following similar patterns.

• Deep Learning Models: Neural networks like Convolutional Neural Networks (CNNs) and Recurrent Neural Networks (RNNs) can learn complex relationships in time-series data, identifying recurring patterns related to price gaps. For example, a CNN can detect visual patterns in price charts, while RNNs (including LSTMs) can model the temporal dependencies in price movements.

• Clustering Algorithms: Algorithms like K-Means can be used to cluster historical gap data into groups based on certain characteristics (gap size, market volatility, trading volume, etc.). These clusters help identify the probability of gap behavior, such as whether it will fill or continue.

b. Sentiment and News Analysis

AI models can analyze news articles, economic reports, and social media sentiment to identify potential triggers for price gaps. Natural Language Processing (NLP) techniques are used to assess whether news events are likely to generate large market movements, which could cause gaps.

• Sentiment Analysis: By analyzing public sentiment, AI can predict the likelihood of market-moving news (positive or negative), which could influence the direction of the gap. For instance, if there’s overwhelmingly positive news about an economy, the AI model might predict an up gap with a higher chance of continuing in the bullish direction.

• News Clustering and Event Detection: NLP can be used to cluster news events that are associated with past gaps. If similar news has previously resulted in a gap, AI can use that information to forecast future gaps and their behavior.

c. Time-Series Forecasting

AI excels at time-series forecasting, which is crucial for predicting how a gap will behave over time. By examining historical price data and understanding the statistical relationships between different time periods, AI can predict whether the gap will be filled or continued.

• LSTM Models (Long Short-Term Memory): LSTM models are a type of RNN specifically designed for sequential data like Forex price movements. LSTMs can capture long-term dependencies in price movements, making them ideal for predicting gap closures or continuations based on historical patterns.

• ARIMA (AutoRegressive Integrated Moving Average): ARIMA models, often combined with machine learning methods, can be used for modeling time-series data and forecasting the likely closing price levels post-gap.

d. Market Behavior and Volatility Analysis

AI can analyze market volatility and other technical indicato

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.