2025-03-04 22:47

Industry#AITradingAffectsForex

AI for Forex Arbitrage Opportunity Identification

Forex arbitrage refers to the strategy of exploiting price discrepancies between different Forex markets or related financial instruments. The core idea is to buy a currency at a lower price in one market and sell it at a higher price in another market, generating a risk-free profit from the difference. Arbitrage opportunities typically arise from inefficiencies in the market or delays in pricing updates across different platforms, brokers, or exchanges. AI plays a significant role in detecting these opportunities faster and more accurately than traditional methods, improving efficiency in executing arbitrage strategies.

1. Types of Forex Arbitrage

Forex arbitrage strategies can be broadly classified into the following categories:

• Spatial Arbitrage (Geographical Arbitrage):

In this type of arbitrage, traders exploit price differences between two or more currency markets in different locations. For example, a currency pair might be priced slightly differently in London and New York due to time zone differences and liquidity.

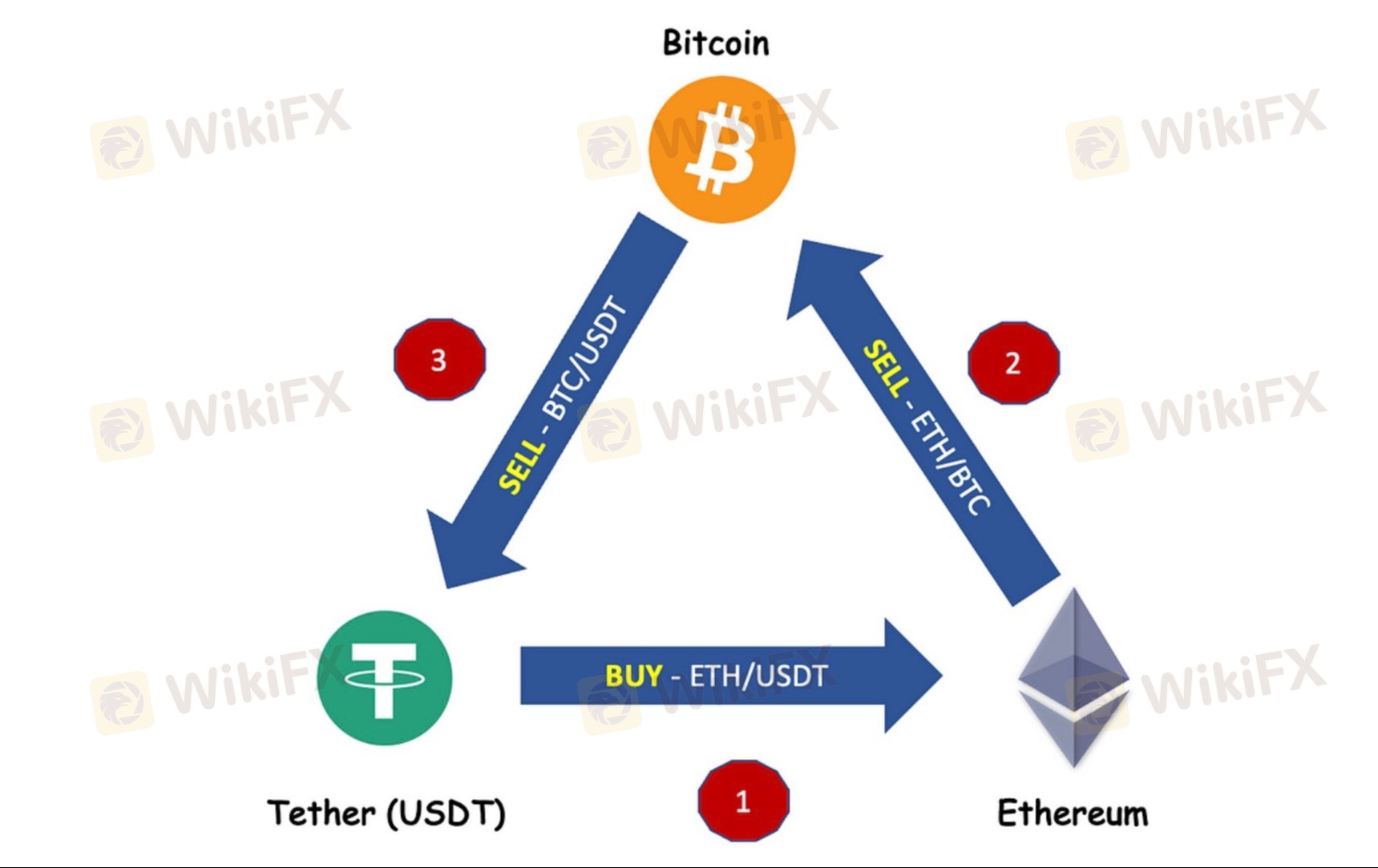

• Triangular Arbitrage:

This strategy involves exploiting discrepancies in the exchange rates between three different currencies. A trader can buy one currency, convert it to a second currency, then convert that currency to a third, and finally back to the original currency, pocketing the difference in exchange rates.

• Statistical Arbitrage:

Statistical arbitrage uses mathematical models and algorithms to find opportunities where the market’s price behavior deviates from a predicted pattern. This form of arbitrage is often implemented through high-frequency trading (HFT) strategies.

2. Role of AI in Identifying Arbitrage Opportunities

AI can improve the speed, efficiency, and accuracy of detecting arbitrage opportunities in Forex markets. It processes vast amounts of market data in real-time, finds hidden inefficiencies, and can act quickly to execute trades, which is essential in arbitrage due to the short-lived nature of price discrepancies.

a. Real-Time Data Analysis

AI can process and analyze real-time data from multiple Forex exchanges or brokers to identify discrepancies in currency pair prices. The speed at which AI can process and react to data enables it to spot arbitrage opportunities before they disappear.

• Big Data Processing: AI can ingest and analyze massive amounts of data, including prices, bid-ask spreads, order books, and transaction volumes, from multiple exchanges, identifying small pricing discrepancies that could lead to profitable arbitrage opportunities.

• Multi-Market Monitoring: AI can monitor multiple Forex markets simultaneously, detecting discrepancies in real-time. This is crucial because arbitrage opportunities often appear briefly and across different exchanges or platforms.

b. Machine Learning Algorithms

Machine learning (ML) is critical for detecting arbitrage opportunities, especially when prices across markets deviate due to non-obvious reasons (e.g., latency, market sentiment). By using supervised and unsupervised learning, AI can identify patterns and correlations between price movements.

• Supervised Learning: In supervised learning, AI algorithms can be trained on historical data, including past arbitrage opportunities, to learn how pricing discrepancies arise. After training, the model can predict future arbitrage opportunities based on input data.

• Unsupervised Learning: Unsupervised models like K-means clustering and Principal Component Analysis (PCA) can identify hidden patterns and group similar pricing discrepancies that often lead to arbitrage opportunities. These models can work without labeled data, finding patterns that humans might not have explicitly identified.

c. Time-Series Forecasting

AI-based time-series forecasting models, such as Long Short-Term Memory (LSTM) networks, are particularly useful in predicting how prices of currency pairs will behave over time. These models help AI systems predict when an arbitrage opportunity is likely to emerge and how long it will last.

• LSTM Models: LSTM networks can model the sequential dependencies in Forex prices, learning how historical price movements and volatility contribute to future price changes. AI can then use these predictions to detect when currency prices across different markets are misaligned and predict when they are likely to converge.

• ARIMA and GARCH Models: Autoregressive Integrated Moving Average (ARIMA) models and Generalized Autoregressive Conditional Heteroskedasticity (GARCH) models can forecast future price volatility and predict periods when arbitrage opportunities are most likely.

d. High-Frequency Trading (HFT) Algorithms

In arbitrage trading, the window for exploiting pricing inefficiencies is often very narrow. AI-powered high-frequency trading algorithms can execute trades at lightning speed, enabling traders to capitalize on arbitrage opportunities that exist for only a fraction of a

Like 0

FX9518388942

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

#AITradingAffectsForex

India | 2025-03-04 22:47

India | 2025-03-04 22:47AI for Forex Arbitrage Opportunity Identification

Forex arbitrage refers to the strategy of exploiting price discrepancies between different Forex markets or related financial instruments. The core idea is to buy a currency at a lower price in one market and sell it at a higher price in another market, generating a risk-free profit from the difference. Arbitrage opportunities typically arise from inefficiencies in the market or delays in pricing updates across different platforms, brokers, or exchanges. AI plays a significant role in detecting these opportunities faster and more accurately than traditional methods, improving efficiency in executing arbitrage strategies.

1. Types of Forex Arbitrage

Forex arbitrage strategies can be broadly classified into the following categories:

• Spatial Arbitrage (Geographical Arbitrage):

In this type of arbitrage, traders exploit price differences between two or more currency markets in different locations. For example, a currency pair might be priced slightly differently in London and New York due to time zone differences and liquidity.

• Triangular Arbitrage:

This strategy involves exploiting discrepancies in the exchange rates between three different currencies. A trader can buy one currency, convert it to a second currency, then convert that currency to a third, and finally back to the original currency, pocketing the difference in exchange rates.

• Statistical Arbitrage:

Statistical arbitrage uses mathematical models and algorithms to find opportunities where the market’s price behavior deviates from a predicted pattern. This form of arbitrage is often implemented through high-frequency trading (HFT) strategies.

2. Role of AI in Identifying Arbitrage Opportunities

AI can improve the speed, efficiency, and accuracy of detecting arbitrage opportunities in Forex markets. It processes vast amounts of market data in real-time, finds hidden inefficiencies, and can act quickly to execute trades, which is essential in arbitrage due to the short-lived nature of price discrepancies.

a. Real-Time Data Analysis

AI can process and analyze real-time data from multiple Forex exchanges or brokers to identify discrepancies in currency pair prices. The speed at which AI can process and react to data enables it to spot arbitrage opportunities before they disappear.

• Big Data Processing: AI can ingest and analyze massive amounts of data, including prices, bid-ask spreads, order books, and transaction volumes, from multiple exchanges, identifying small pricing discrepancies that could lead to profitable arbitrage opportunities.

• Multi-Market Monitoring: AI can monitor multiple Forex markets simultaneously, detecting discrepancies in real-time. This is crucial because arbitrage opportunities often appear briefly and across different exchanges or platforms.

b. Machine Learning Algorithms

Machine learning (ML) is critical for detecting arbitrage opportunities, especially when prices across markets deviate due to non-obvious reasons (e.g., latency, market sentiment). By using supervised and unsupervised learning, AI can identify patterns and correlations between price movements.

• Supervised Learning: In supervised learning, AI algorithms can be trained on historical data, including past arbitrage opportunities, to learn how pricing discrepancies arise. After training, the model can predict future arbitrage opportunities based on input data.

• Unsupervised Learning: Unsupervised models like K-means clustering and Principal Component Analysis (PCA) can identify hidden patterns and group similar pricing discrepancies that often lead to arbitrage opportunities. These models can work without labeled data, finding patterns that humans might not have explicitly identified.

c. Time-Series Forecasting

AI-based time-series forecasting models, such as Long Short-Term Memory (LSTM) networks, are particularly useful in predicting how prices of currency pairs will behave over time. These models help AI systems predict when an arbitrage opportunity is likely to emerge and how long it will last.

• LSTM Models: LSTM networks can model the sequential dependencies in Forex prices, learning how historical price movements and volatility contribute to future price changes. AI can then use these predictions to detect when currency prices across different markets are misaligned and predict when they are likely to converge.

• ARIMA and GARCH Models: Autoregressive Integrated Moving Average (ARIMA) models and Generalized Autoregressive Conditional Heteroskedasticity (GARCH) models can forecast future price volatility and predict periods when arbitrage opportunities are most likely.

d. High-Frequency Trading (HFT) Algorithms

In arbitrage trading, the window for exploiting pricing inefficiencies is often very narrow. AI-powered high-frequency trading algorithms can execute trades at lightning speed, enabling traders to capitalize on arbitrage opportunities that exist for only a fraction of a

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.