2025-03-04 22:50

Industry#AITradingAffectsForex

AI in Forex Statistical Correlation Analysis

Statistical correlation analysis in Forex trading refers to the process of examining relationships between various financial variables, including currency pairs, economic indicators, and other market factors. Identifying correlations allows traders to predict the movement of one currency pair based on the movement of another, and potentially make profitable trading decisions. AI enhances this process by applying advanced algorithms to analyze vast amounts of historical and real-time data, uncovering deeper and more accurate correlations that human traders might miss.

AI can significantly improve the accuracy and efficiency of statistical correlation analysis in Forex by automating the process, analyzing large datasets, and identifying complex, non-linear relationships between currencies, commodities, or market factors.

1. Understanding Statistical Correlation in Forex Trading

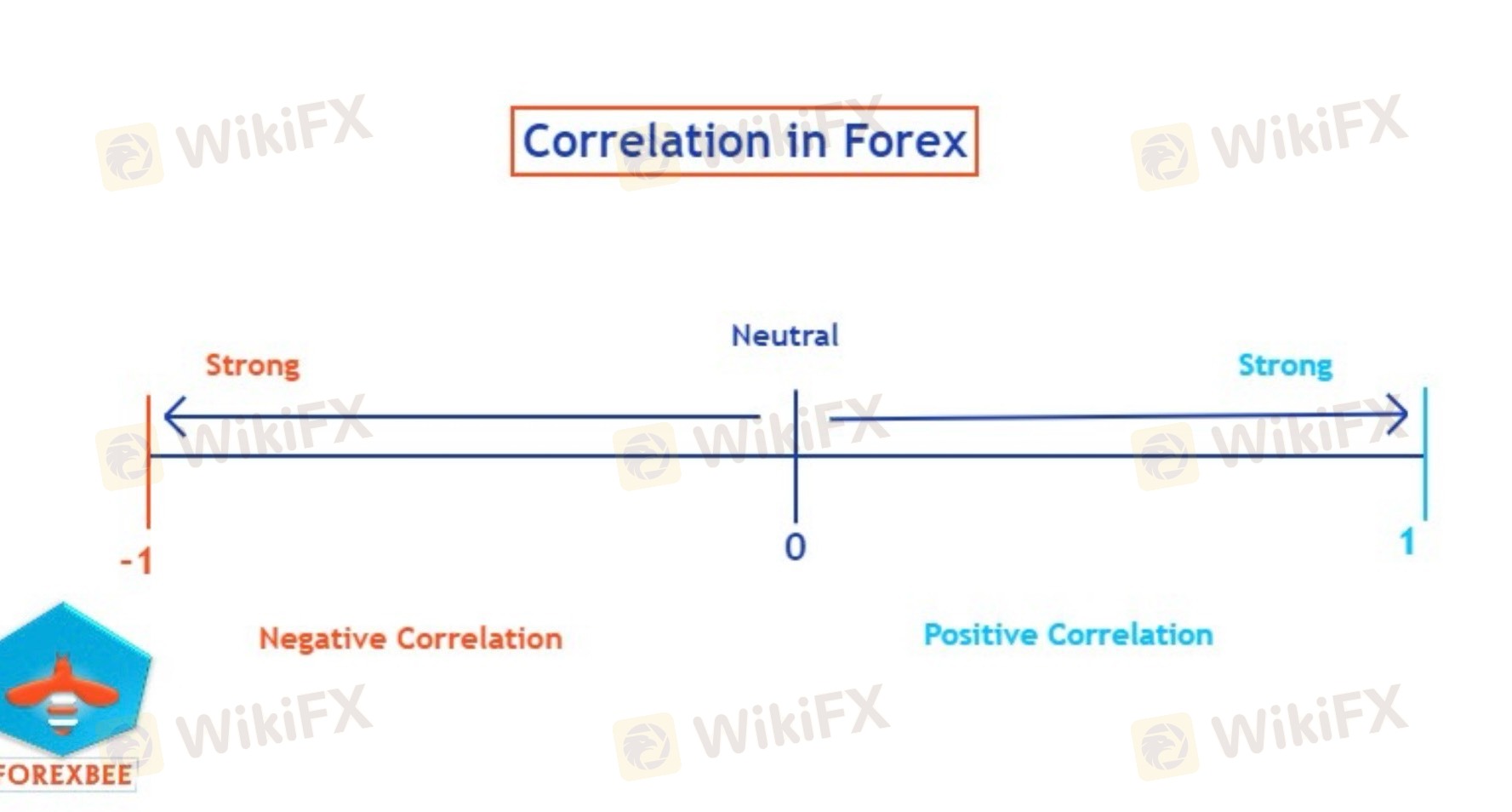

Statistical correlation measures the relationship between two variables. In Forex, it refers to the relationship between the prices of different currency pairs or between a currency pair and an external variable (such as oil prices, interest rates, or economic indicators).

• Positive Correlation: When two assets move in the same direction. For example, if EUR/USD and GBP/USD have a positive correlation, it means that when EUR/USD rises, GBP/USD tends to rise as well.

• Negative Correlation: When two assets move in opposite directions. For instance, USD/JPY and EUR/USD often exhibit a negative correlation, meaning when one moves up, the other tends to move down.

• Zero Correlation: When two assets have no predictable relationship or influence over each other.

Traders use correlation analysis to understand how different currency pairs or markets interact, enabling them to make more informed decisions.

2. Role of AI in Forex Statistical Correlation Analysis

AI enhances Forex statistical correlation analysis by enabling the detection of complex patterns, relationships, and dynamics in large datasets. Unlike traditional methods that rely on linear relationships, AI models can identify both linear and non-linear correlations, making them more robust in dynamic market conditions.

a. Machine Learning Algorithms

Machine learning models are essential in identifying correlations in Forex markets. They learn from historical data, detect patterns, and make predictions about future relationships between currency pairs or other market variables.

• Supervised Learning: In supervised learning, algorithms are trained on historical data with known outcomes (e.g., past price movements and their correlations). After training, the model can identify future correlations between currency pairs or other economic indicators.

• Unsupervised Learning: Unsupervised learning techniques, such as K-means clustering or Principal Component Analysis (PCA), are used to detect hidden patterns or groupings in data without pre-labeled outputs. AI can find unrecognized correlations between currencies, commodities, or economic indicators that might be overlooked by human analysts.

b. Deep Learning Models

Deep learning models, particularly neural networks, can identify very complex patterns and relationships in Forex data that are difficult to detect with traditional statistical methods.

• Feedforward Neural Networks (FNNs): These models analyze past price data, volume, and external factors to understand how currencies move in relation to each other. FNNs can be trained to recognize how certain events or market conditions influence correlations between pairs.

• Recurrent Neural Networks (RNNs): RNNs, particularly Long Short-Term Memory (LSTM) networks, excel at identifying time-series relationships, making them ideal for Forex data. LSTMs are effective for capturing the temporal dependencies in Forex price movements and correlations over time, allowing the model to identify when correlations between currency pairs are likely to strengthen or weaken.

c. Natural Language Processing (NLP) for Sentiment Analysis

AI can also use NLP to analyze textual data such as news articles, financial reports, and social media content to understand how sentiment affects correlations between currency pairs. For example, if there is a news event that affects both EUR/USD and GBP/USD, NLP can help identify whether sentiment is driving a correlation between the two.

• Sentiment Analysis: NLP techniques can assess the sentiment of news articles, social media posts, or financial statements and determine whether positive or negative news correlates with currency movements. AI can then incorporate this information into the correlation analysis.

• Event Impact Detection: AI can use NLP to detect the impact of specific events (like geopolitical news, central bank decisions, or economic reports) on the correlation between currencies.

d. Advanced Statistical Models

AI-based statistical models can also be used to enhance correlation analys

Like 0

sazid1253

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

#AITradingAffectsForex

India | 2025-03-04 22:50

India | 2025-03-04 22:50AI in Forex Statistical Correlation Analysis

Statistical correlation analysis in Forex trading refers to the process of examining relationships between various financial variables, including currency pairs, economic indicators, and other market factors. Identifying correlations allows traders to predict the movement of one currency pair based on the movement of another, and potentially make profitable trading decisions. AI enhances this process by applying advanced algorithms to analyze vast amounts of historical and real-time data, uncovering deeper and more accurate correlations that human traders might miss.

AI can significantly improve the accuracy and efficiency of statistical correlation analysis in Forex by automating the process, analyzing large datasets, and identifying complex, non-linear relationships between currencies, commodities, or market factors.

1. Understanding Statistical Correlation in Forex Trading

Statistical correlation measures the relationship between two variables. In Forex, it refers to the relationship between the prices of different currency pairs or between a currency pair and an external variable (such as oil prices, interest rates, or economic indicators).

• Positive Correlation: When two assets move in the same direction. For example, if EUR/USD and GBP/USD have a positive correlation, it means that when EUR/USD rises, GBP/USD tends to rise as well.

• Negative Correlation: When two assets move in opposite directions. For instance, USD/JPY and EUR/USD often exhibit a negative correlation, meaning when one moves up, the other tends to move down.

• Zero Correlation: When two assets have no predictable relationship or influence over each other.

Traders use correlation analysis to understand how different currency pairs or markets interact, enabling them to make more informed decisions.

2. Role of AI in Forex Statistical Correlation Analysis

AI enhances Forex statistical correlation analysis by enabling the detection of complex patterns, relationships, and dynamics in large datasets. Unlike traditional methods that rely on linear relationships, AI models can identify both linear and non-linear correlations, making them more robust in dynamic market conditions.

a. Machine Learning Algorithms

Machine learning models are essential in identifying correlations in Forex markets. They learn from historical data, detect patterns, and make predictions about future relationships between currency pairs or other market variables.

• Supervised Learning: In supervised learning, algorithms are trained on historical data with known outcomes (e.g., past price movements and their correlations). After training, the model can identify future correlations between currency pairs or other economic indicators.

• Unsupervised Learning: Unsupervised learning techniques, such as K-means clustering or Principal Component Analysis (PCA), are used to detect hidden patterns or groupings in data without pre-labeled outputs. AI can find unrecognized correlations between currencies, commodities, or economic indicators that might be overlooked by human analysts.

b. Deep Learning Models

Deep learning models, particularly neural networks, can identify very complex patterns and relationships in Forex data that are difficult to detect with traditional statistical methods.

• Feedforward Neural Networks (FNNs): These models analyze past price data, volume, and external factors to understand how currencies move in relation to each other. FNNs can be trained to recognize how certain events or market conditions influence correlations between pairs.

• Recurrent Neural Networks (RNNs): RNNs, particularly Long Short-Term Memory (LSTM) networks, excel at identifying time-series relationships, making them ideal for Forex data. LSTMs are effective for capturing the temporal dependencies in Forex price movements and correlations over time, allowing the model to identify when correlations between currency pairs are likely to strengthen or weaken.

c. Natural Language Processing (NLP) for Sentiment Analysis

AI can also use NLP to analyze textual data such as news articles, financial reports, and social media content to understand how sentiment affects correlations between currency pairs. For example, if there is a news event that affects both EUR/USD and GBP/USD, NLP can help identify whether sentiment is driving a correlation between the two.

• Sentiment Analysis: NLP techniques can assess the sentiment of news articles, social media posts, or financial statements and determine whether positive or negative news correlates with currency movements. AI can then incorporate this information into the correlation analysis.

• Event Impact Detection: AI can use NLP to detect the impact of specific events (like geopolitical news, central bank decisions, or economic reports) on the correlation between currencies.

d. Advanced Statistical Models

AI-based statistical models can also be used to enhance correlation analys

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.