BDSWISS Review 2026: Comprehensive Safety Assessment

BDSWISS holds a low safety score of 3.48 with a heavy volume of user complaints regarding withdrawal failures and account access. While regulated offshore by the Seychelles FSA, the broker faces significant scrutiny due to regulatory warnings and reported liquidity risks.

FTSE 100 Hits Record Highs as BoE Policy Scan Intensifies

UK equities surge to record highs led by energy stocks, while FX traders navigate potential volatility from upcoming Bank of England policy cues.

South African Markets: Rand Stabilizes on $8bn Afreximbank Inflow Amid Trade & Jobs Data

South Africa secures a massive $8 billion financing commitment from Afreximbank, bolstering the economic outlook even as structural unemployment and AGOA trade debates persist.

Power Trading Review 2026: Is this Forex Broker Legit or a Scam?

Power Trading is a high-risk broker with a low WikiFX Score of 2.11 and an unverified regulatory status in Australia. Numerous user reports cite severe issues such as denied withdrawals, account deletion, and unexplained profit deductions.

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

The South African Rand (ZAR) faces potential volatility as Democratic Alliance leader John Steenhuisen addresses the nation amidst rumors of his resignation, threatening the stability of the Government of National Unity.

Geopolitical Flashpoint: Libya's Stability in Focus as Gaddafi's Son Killed

Oil markets face renewed geopolitical risk following the confirmed death of Saif al-Islam Gaddafi in Libya, raising concerns over stability in the OPEC nation.

Geopolitical Risk Returns: Gold Rallies on US-Iran Tensions

Escalating geopolitical friction between the US and Iran has triggered a renewed flight to safety, propelling Gold prices higher as market risk appetite diminishes.

Nigeria Secures $8 Billion Energy Investment; Regulators Eye 180 TCF Gas Gap

President Bola Tinubu confirms over $8 billion in Final Investment Decisions for Nigeria's oil and gas sector, signaling a supply-side boost. Meanwhile, regulators warn that policy fragmentation is stalling the development of 180 TCF in untapped gas reserves.

Power Trading Review: The Digital Abattoir Where Profits Go to Die

Power Trading is a regulatory mirage, operating with a 'Not Verified' ASIC license while systemic complaints reveal a consistent pattern of account deletions and profit theft. With a disastrous 'D' grade trading environment and 31 formal complaints, this broker is a graveyard for retail capital.

LONG ASIA Exposure: Traders Report Fund Losses & Long Withdrawal Blocks

Long Asia Group, a Saint Vincent and the Grenadines-based forex broker, has come under increasing scrutiny as a growing number of traders report troubling experiences with the broker’s operations. User feedback highlights recurring issues such as delayed or blocked withdrawals, sudden communication breakdowns, and a lack of clear accountability once funds are deposited. Several traders claim that while small withdrawals may initially go through, larger payout requests often face unexplained obstacles. More concerning are allegations suggesting that the broker may no longer be operating transparently, with users reporting prolonged silence, unresolved complaints and suspected fund mishandling. These patterns have raised serious questions about Long Asia Group’s reliability and overall legitimacy, prompting traders to exercise extreme caution before engaging with the broker. For more details, keep reading this LONG ASIA review article, where we have elaborated on the traders’ pain wit

No Global Recession In 2026, But Period Of Poor Growth Continues

The IMF estimates for 2026 show no signs of recession. However, the global economy remains in a peri

Toyar Carson Limited Regulatory Status: A Complete Guide to Their Licenses and Business Registration

If you're looking up information on Toyar Carson Limited Regulation, you probably want to know if they're safe and legitimate. Let's get straight to the point. Our detailed research shows that Toyar Carson Limited works without any supervision from trusted financial regulators. This lack of regulation is the biggest warning sign any trader can see. Public records show they have a business rating of only 1.46 out of 10, which means they have serious problems with how they operate and keep clients safe. In this article, we'll share facts based on evidence from public business records, visits to their location, and feedback from users. Our aim is to give you the clear facts you need to understand the major risks of working with this company and help you make a smart decision to protect your money.

The MBI Pyramid Scheme: Its Unfinished Aftermath, Eight Years On

Eight years after the collapse of the MBI pyramid scheme, newly disclosed asset seizures reveal the vast scale of the fraud.

MY MAA MARKETS Review: Are Withdrawal Blocks and Regulation Gaps Real?

Has your MY MAA MARKETS forex trading experience been nothing short of a financial misery? Do you fail to gain the forex broker’s approval for fund withdrawals? Were you denied withdrawals on the grounds of fake accusations concerning system abuse and hedging? Does the broker deliberately cause you unwarranted slippage as you start executing winning trades? Do you feel the broker is unregulated? Your concerns seem genuine, as many traders have accused the broker of serious financial misconduct. In this MY MAA MARKETS review article, we have investigated some trader complaints. Take a look!

AssetsFX Scam Alert: 5 Warning Signs Traders Should Know

AssetsFX exposure reveals 5 scam‑like warning signs: unregulated operations, shaky fund safety, and alarming trader complaints you can’t afford to ignore.

TradeFxP Regulation Status: Understanding an Unregulated Broker

For any trader thinking about TradeFxP, the most important question is about safety and TradeFxP Regulation. The answer to this question decides whether your money is protected or at dangerous levels of risk. Our research shows that TradeFxP does not have any valid, high-quality financial regulation, putting it in a high-risk category for investors. This conclusion is based on facts and data, not just opinions, and comes from studying how the broker operates.

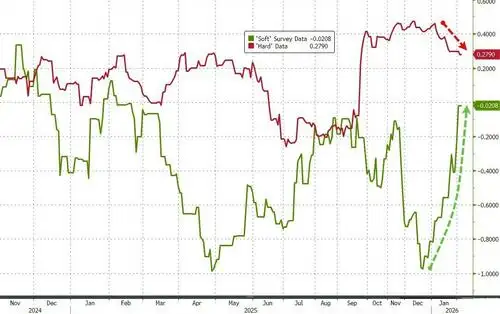

US Services Sector Surveys Signal Solid Growth In January, But...

Following the dramatic rebound in US Manufacturing survey data - driven by a surge in new orders - '

PRCBroker Exposed: Hong Kong Traders Say Profits Blocked, Withdrawals Refused

PRCBroker is accused of withholding $1.13M in profits and freezing withdrawals. Read the details and decide if this broker is right for you.

Kudotrade Exposed: A Risky, Unregulated Broker Targeting New Traders

Kudotrade’s flashy promises hide real risks for new traders. Learn why this unregulated broker isn’t safe before you invest—protect your funds today.

Inside the Elite Committee: Talk with Tom

Join forex expert Tom as he shares his journey, trading wisdom, and thoughts on AI and the future of forex in WikiFX’s inspiring “Inside the Elite” interview.