Jefferies -Some important Details about This Broker

Abstract:Jefferies, recognized as a leading full-service investment banking and capital markets firm, holds three regulatory licenses and delivers an array of services, including Investment Banking, Global Research & Strategy, Equities, Fixed Income, Alternative Asset Management and Wealth Management.

| JefferiesReview Summary | |

| Founded | 1996 |

| Registered Country/Region | United States |

| Regulation | FCA, CIRO |

| Products & Services | Investment Banking, Global Research & Strategy, Equities, Fixed Income, Alternative Asset Management, Wealth Management |

| Trading Platform | / |

| Customer Support | Phone: +12122842300 |

| Email: mediacontact@jefferies.com | |

| Address: 520 Madison Avenue, New York, NY 10022 (Principal Executive Office) | |

Jefferies, recognized as a leading full-service investment banking and capital markets firm, holds three regulatory licenses and delivers an array of services, including Investment Banking, Global Research & Strategy, Equities, Fixed Income, Alternative Asset Management and Wealth Management.

Pros and Cons

| Pros | Cons |

| Regulated by FCA and CIRO | No details of trading platform |

| A range of financial services | |

| Multi-channel support |

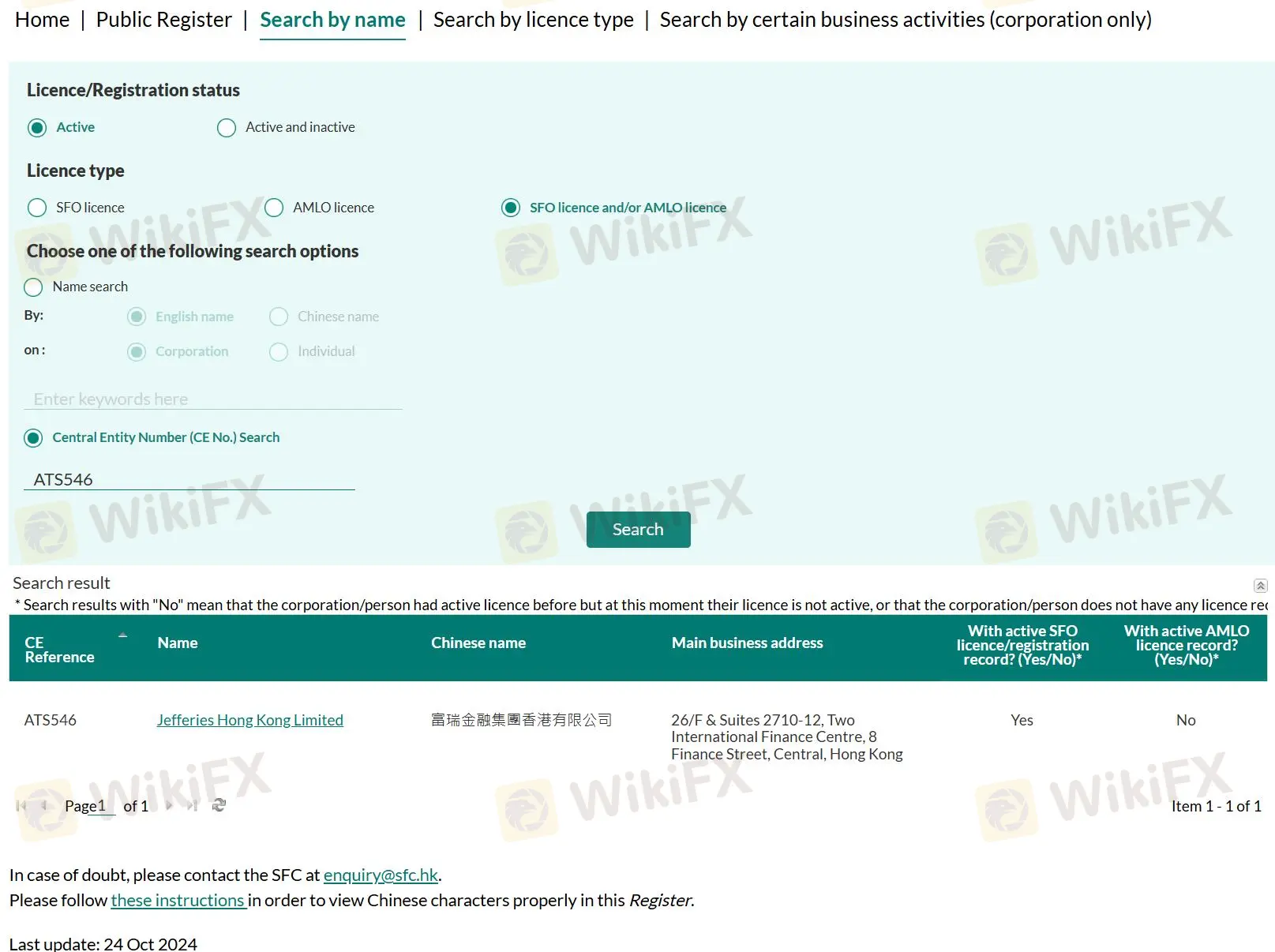

Is Jefferies Legit?

Jefferies has three regulation licenses.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| United Kingdom | Financial Conduct Authority (FCA) | Jefferies International Ltd | Marketing Making (MM) | 139253 | Regulated |

| Canada | Canadian Investment Regulatory Organization (CIRO) | Jefferies Securities, Inc | Marketing Making (MM) | Unreleased | Regulated |

Products & Services

In Jefferies, you can trade on Equities and Fixed Income. Besides, it also offers other financial services including Investment Banking, Global Research&Strategy, Alternative Asset Management and Wealth Management.

Equities: Cash Equities, Electronic Trading, Equity Derivatives, Convertibles, Prime Services, Corporate Access.

Fixed Income: Leveraged Credit, Emerging markets, Investment Grade Corporates, Municipal and Not-for-Profits, Macro Credit, Securitized markets, Global structured solutions, Government & Agency.

Read more

FBK Markets Review 2025: Live & Demo Accounts, Withdrawals to Explore

FBK Markets, a young South African forex broker, targets both beginners and experienced traders within this region. This broker shines at its low minimum deposit required, 100% deposit bonus, and flexible account options, yet we cannot consider it reliable as it operates without any regulation. Furthermore, it features an approximately 70% withdrawal failure rate.

5 Arrested in the TriumphFX Investment Scam Investigation

Malaysian authorities have intensified their investigation into the TriumphFX foreign exchange investment scam, resulting in the arrest of five individuals linked to the fraudulent scheme.

Nifty 50 Index Futures Now Available at Interactive Brokers

Trade Nifty 50 Index Futures with Interactive Brokers. Access India’s top 50 firms, diversify portfolios, and manage risk on a powerful trading platform.

Trade245 Review 2025: Live & Demo Accounts, Withdrawals to Explore

Trade345, a young South African broker, has gained some regional popularity, but lacks an established reputation. Trade245 offers access to FX pairs, indices, stocks and commodities CFDs with operation on both MetaTrader 4 and MetaTrader 5. Although this broker only asks for a modest minimum deposit, it does not shine on trading costs. Besides, this broker heavily relies on bonuses to attract new investors and it does not provide trading signals.

WikiFX Broker

Latest News

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

$13M Pig Butchering Scam: Three Arrested for Money Laundering

FINMA Opens Bankruptcy Proceedings

FCA Issues Warning Against 14 Unregistered Financial Firms

Crypto Scam Exposed: 3 Arrested for Defrauding Investors

Nifty 50 Index Futures Now Available at Interactive Brokers

Grand Unveiling: The Core Reasons Behind the Yen’s Rise

Ethereum’s Shock Drop: What’s The Real Reason?

Rate Calc