Moneytech-Some important Details about This Company

Abstract:Moneytech Ltd. is a company registered in Australia that operates in the financial sector. However, it's important to note that while it claims to be regulated by the Australian Securities and Investments Commission (ASIC), there are suspicions that it may be a clone firm. Clone firms are fraudulent entities that impersonate legitimate companies to deceive investors, so caution is advised when dealing with this company.

| Moneytech Review Summary | |

| Company Name | Moneytech Ltd. |

| Registered Country/Region | Australia |

| Regulation | Regulated by ASIC (Suspicious Clone) |

| Finance Solutions | Trade Finance, Debtor Finance, Term Loan Finance, Equipment Finance, Line of Credit |

| Demo Account | N/A |

| Leverage | N/A |

| Spread | N/A |

| Trading Platform | N/A |

| Minimum Deposit | N/A |

| Regional Restrictions | Only Available to Australian residents in Australia |

| Customer Support | Phone: 1300 858 904; Email: sales@moneytech.com.au; txnqueries@monoova.com; Social Media: Facebook, Twitter, Instagram, LinkedIn; Contact Form |

What is Moneytech?

Moneytech Ltd. is a company registered in Australia that operates in the financial sector. However, it's important to note that while it claims to be regulated by the Australian Securities and Investments Commission (ASIC), there are suspicions that it may be a clone firm. Clone firms are fraudulent entities that impersonate legitimate companies to deceive investors, so caution is advised when dealing with this company.

Pros & Cons

| Pro | Con |

|

|

|

|

|

Pro:

Moneytech offers robust Foreign Exchange services. They feature competitive exchange rates and personalized solutions, making it easier for their clients to manage international trading operations.

Cons:

Moneytech's platform has a confusing and poorly designed user interface. This creates challenges for users navigating the platform, detracting from the overall user experience.

There are suspicions that Moneytech may be a suspicious clone firm. Despite the company claiming regulation by the Australian Securities and Investments Commission (ASIC), these suspicions could pose a potential risk for investors.

Moneytech's services are only available to Australian residents who are in Australia. This geographic restriction limits its client base and decreases accessibility for global users.

Is Moneytech Safe or Scam?

Regulatory Sight: Moneytech is a firm that was identified by the Australian Securities and Investment Commission (ASIC) as a “Suspicious Clone.” The license type is categorized as a Market Making (MM) with the license number 421414.

User Feedback: Users should check the reviews and feedback from other clients to gain a more comprehensive sight of the broker, or look for reviews on reputable websites and forums.

Security Measures: So far we haven't found any information about the security measures for this broker.

Finance Solutions

Moneytech provides a diverse range of financial solutions designed to meet a breadth of business needs. These include:

Trade Finance: This allows businesses to engage in international transactions efficiently. It provides the necessary funds and assurance to both buyers and sellers involved in a trade, thereby promoting seamless business operations.

Debtor Finance: This is a financing mechanism that allows businesses to leverage their debtor's book and secure quick cash, rather than waiting for customers' payments. This can facilitate improved cash flow management.

Term Loan Finance: Moneytech offers term loans, which are loan agreements with a specified repayment schedule and a set maturity date. These are useful for businesses seeking long-term funding for expansion or capital expenditure.

Equipment Finance: This solution is designed to enable businesses to purchase, renew or refit necessary equipment or machinery to boost productivity without making a large upfront investment.

Line of Credit: A flexible financing option that allows businesses to draw from a predetermined amount whenever needed. It functions similar to a credit card, providing cash flow for businesses to cover short-term expenses or seize investment opportunities.

Featured FX

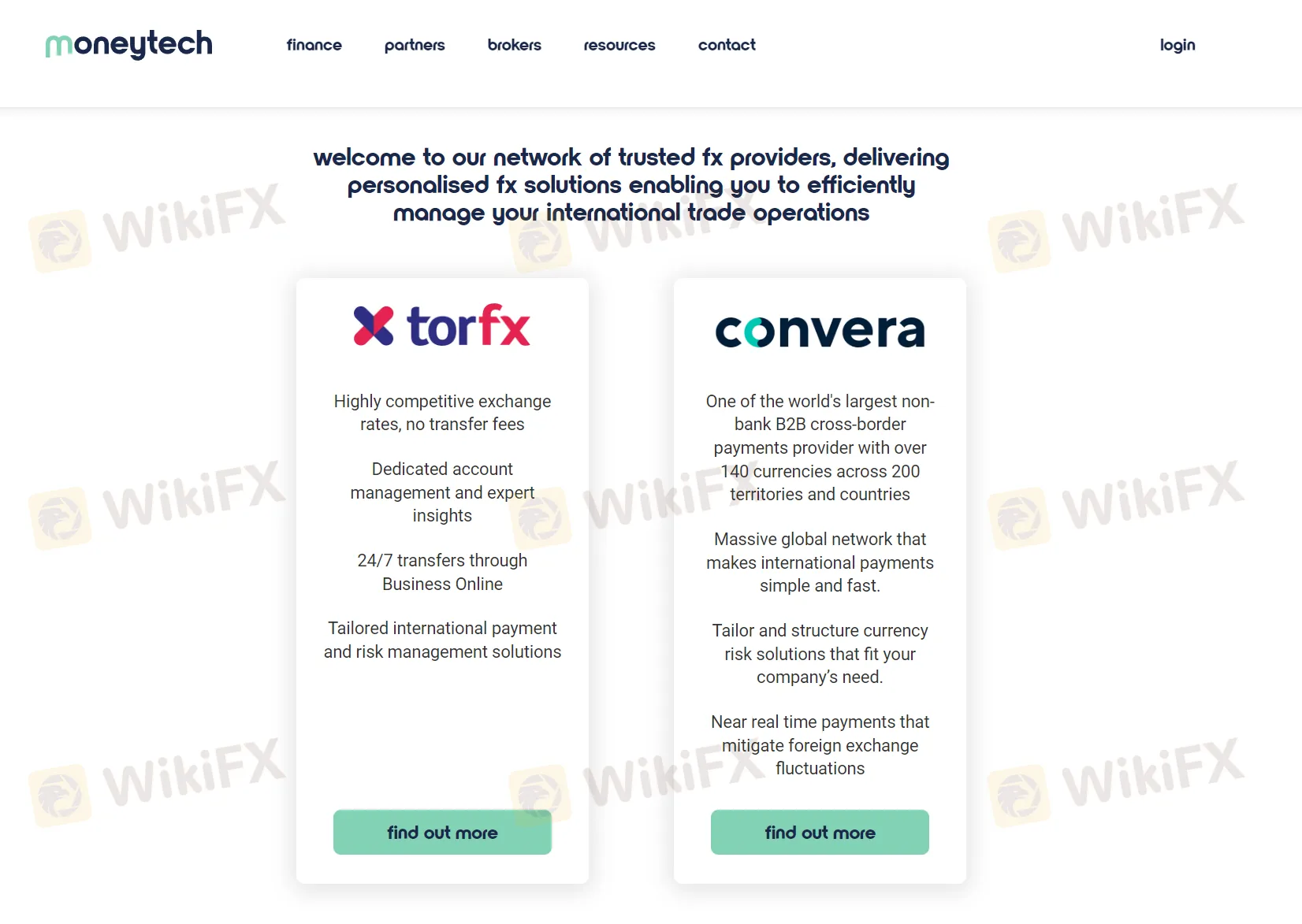

Moneytech's Foreign Exchange (FX) services are a blend of simplicity and efficiency, geared towards effective management of international trade operations. They boast a network of trusted FX providers who present personalized solutions to meet individual client's needs. Two key providers are Torfx and Convera.

Torfx offers highly competitive exchange rates without transfer fees, and the convenience of 24/7 transfers via their Business Online platform. They provide a service of dedicated account management with expert insights and tailored international payment and risk management solutions.

On the other hand, Convera, one of the world's largest non-bank B2B cross-border payment providers, offers a comprehensive service. They support over 140 currencies across 200 territories and countries. Their extensive global network simplifies and expedites international payments. They customize and structure currency risk solutions to individual companies needs and offer near-real-time payments to mitigate foreign exchange fluctuations. Together, these providers contribute to making international trade operations seamless with Moneytech's FX services.

Payments

Moneytech Group's subsidiary, Monoova, specializes in automated payments. Monoova's platform streamlines the procedure of handling business transactions, allowing users to receive, manage, and execute payments in real-time. By integrating with Monoova's API, businesses are equipped with the capabilities to automate their entire payment processes. This suggests a high level of efficiency and streamlined operations for the companies using Monoova's services under Moneytech.

Customer Support

Moneytech offers a comprehensive customer support system for their clients. You can reach them through multiple channels. Customers can call them directly on their phone number, which is 1300 858 904. They also provide support via email; for general support, you can email sales@moneytech.com.au, while for transaction queries, you can reach out to txnqueries@monoova.com. In addition to this, Moneytech maintains a strong presence on social media platforms, including Facebook, Twitter, Instagram, and LinkedIn, providing more avenues for customer interaction. Customers can also get in touch with them using the contact form available on their official website. The varied channels demonstrate their commitment to ensuring customers get the assistance they need, when they need it.

Conclusion

Moneytech is an Australia-based firm offering diverse financial and payment solutions, including Foreign Exchange services and automated payment processes through their subsidiary, Monoova. However, potential concerns arise due to its suspicious clone regulatory status and its services being limited to Australia. It's advised businesses seek further information and take caution due to the potential risks involved.

Frequently Asked Questions (FAQs)

Q: What financial solutions does Moneytech offer?

A: Moneytech provides a broad range of financial solutions including Trade Finance, Debtor Finance, Term Loan Finance, Equipment Finance, and Line of Credit designed to meet varied business needs.

Q: What kind of Foreign Exchange services does Moneytech offer?

A: Moneytech offers comprehensive Foreign Exchange services with a network of trusted FX providers like Torfx and Convera. These providers offer personalized solutions to meet individual client's needs.

Q: What is Monoova?

A: Monoova is a subsidiary of Moneytech that specializes in automating payments, enabling businesses to receive, manage, and execute payments in real-time.

Q: Can international clients avail of Moneytech's services?

A: Currently, Moneytech's services are only available to Australian residents who are in Australia. This limits its accessibility for clients based outside Australia.

Q: What is the regulatory status of Moneytech?

A: Moneytech is currently regulated but the status is “suspicious clone”, which is worth extreme attention.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Read more

Pemaxx Review: Fund Scams & No Withdrawals, Say Traders

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Fortune Prime Global Exposure: Withdrawal Denials & Profit Cancellations Frustrate Traders

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET Analysis Report

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.

Mazi Finance Exposure: Do Traders Find it Hard to Place Trades and Access Withdrawals?

Did Mazi Finance deny withdrawals once you made profits? Did the Saint Lucia-based forex broker deny based on terms and conditions that did not exist while opening a trading account? Do you frequently encounter issues concerning the Mazi Finance App download? Do you fail to place trades due to the server issues on the trading app? These are some problems traders have highlighted while sharing the Mazi Finance review. Read on as we share some complaints against the forex broker.

WikiFX Broker

Latest News

Telegram Investment Scam Wiped Out RM91,000 in Days

SPEC TRADING Review 2026: Is this Forex Broker Legit or a Scam?

Gold Smashes $5,100 Barrier: Dalio Warns of 'Capital Wars'

Fiscal Policy Monitor: Authorities Tighten Tax Compliance Framework

AMBER MARKETS Review 2026 — Is AMBER MARKETS Broker Safe for Forex Trading?

Who are the “Police” Watching Your Forex Broker? (FCA, ASIC, NFA Explained)

Dollar Index Hits Four-Year Low as 'Fed Whisperer' Signals Rate Pause

PayPal Re-enters Inbound Nigerian Market via Paga Partnership

German Capital Flows Heavy into China, Defying Trade War Risks

FIBOGROUP Review: Safety, Regulation & Forex Trading Details

Rate Calc