IronBeam-Overview of Minimum Deposit, Spreads & Leverage

Abstract:IronBeam is a futures broker, platform, and FCM (a registered Futures Commission Merchant) providing cutting-edge tech, support, and clearing services to traders worldwide. IronBeam offers multiple trading platforms and products and have exclusive access to the firetip trading platform.

General Information

IronBeam is a futures broker, platform, and FCM (a registered Futures Commission Merchant) providing cutting-edge tech, support, and clearing services to traders worldwide. IronBeam offers multiple trading platforms and products and have exclusive access to the firetip trading platform.

Account Types

Here IronBeam offers quite a few trading accounts to satisfy different investors trading needs and strategies. See the following account types:

Individual Accounts

Joint Account

IRA

Corporate/LLC

Trust Accounts

Partnership Accounts

Margins

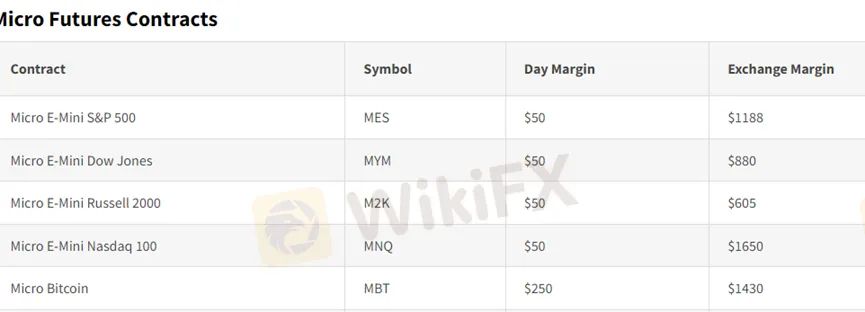

The day margin is set by Ironbeam. This is the amount required per contract to trade on an intraday basis. Day margins are in effect during all market hours except the last 10 minutes preceding the market close. The exchange margin is set by the exchange, and it is the amount required to carry a position past the market close. Exchange margins are believed to be accurate but can change without notice. Exchange margins last updated 02/07/2022. Here we take Micro Futures Contracts as an example:

Commission Rates

Ironbeams rates are determined by a number of factors including volume, risk, and leverage. For a detailed commission rate you can reached a licensed account specialist at 312-765-7200 or email them at sales@ironbeam.com.

Trading Platforms

When it comes to trading platforms available,Ironbeam offers quite a few platform in addition to its proprietary platform-The Ironbeam platform (which was built for the modern futures traders). They also include CQG, CTS, TRADINGVIEW, SIERRA CHART, BOOKMAP, MULTICHART, Motivewave, BOOKMAP and more. All of the platforms are offered at-cost. Ironbeam promises that it does not add fees on top of what the vendor charges.

Deposit & Withdrawal

In terms of payment methods, you can deposit funds via wire transfer, ACH, or Checks. Wires are the quickest funding method. Check typically take three business days to clear and ACHs take five business days to clear. You can send funds via a foreign currency however it will be automatically converted by Ironbeams bank upon receiving the funds. There are some fees charged for certain services:

-Wire Transfer Out (Domestic): $40

-Wire Transfer Out (International): $60

-Check Issued Overnight (International) : $60

-Risk Liquidation: $50 per contract

-Stop Payment/ Insufficient Funds/Returned Item fee: $45

-Account Transfer Out: $100

Telephone Orders: $50 per order placed or modified (cancellation is no charge)

Customer Support

Ironbeam customer support hours: 24 hours Monday to Thursday. Closed at 4 pm CST Friday. Opened at 4 PM CST Sundays. They can be reached through 1-800-588-9055, 1-800-341-1941, as well as email: clientservices@ironbeam.com.

Read more

Australian Dollar Surges as Trade Surplus Hits 11-Month High: A Golden Opportunity for Forex Traders

Australia's trade surplus has surged to an 11-month high, reaching $5.62 billion in January 2025. The unexpected boost in trade surplus was primarily driven by a 1.3% month-over-month increase in exports, with non-monetary gold playing a starring role.

ECB Set to Cut Rates, But Future Path Uncertain Amid Global Tensions

- ECB expected to cut interest rates on March 6 - Future rate decisions unclear due to ongoing inflation and global trade issues - Markets expect more cuts, but some ECB officials urge caution

T&D vs AvaTrade: Which Broker Suits Your Trading Needs in 2025?

In this article, we compare these brokers based on basic information, regulatory status, leverage, trading platforms, account types, spreads and commissions, customer service, AI tools, and recent updates. Our goal is to provide an objective overview so you can decide which broker aligns better with your trading style and requirements.

FBK Markets Review 2025: Live & Demo Accounts, Withdrawals to Explore

FBK Markets, a young South African forex broker, targets both beginners and experienced traders within this region. This broker shines at its low minimum deposit required, 100% deposit bonus, and flexible account options, yet we cannot consider it reliable as it operates without any regulation. Furthermore, it features an approximately 70% withdrawal failure rate.

WikiFX Broker

Latest News

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

$13M Pig Butchering Scam: Three Arrested for Money Laundering

FINMA Opens Bankruptcy Proceedings

FCA Issues Warning Against 14 Unregistered Financial Firms

Crypto Scam Exposed: 3 Arrested for Defrauding Investors

Nifty 50 Index Futures Now Available at Interactive Brokers

Grand Unveiling: The Core Reasons Behind the Yen’s Rise

Ethereum’s Shock Drop: What’s The Real Reason?

Rate Calc