HighLow-Overview of Minimum Deposit, Spreads & Leverage

Abstract:HighLow is a broker that utilizes its own MarketsPulse trading platform and offers a minimum deposit limit of 50 USD/EUR/GBP (10 AUD for residents of Australia). The broker provides access to a variety of trading instruments across different asset classes, allowing traders to participate in various markets.

| HighLow Review Summary | |

| Founded | 5-10 years |

| Registered Country/Region | Australia |

| Regulation | ASIC (Suspicious clone) |

| Market Instruments | 17 Currency pairs, Indices and Commodities |

| Demo Account | Unavailable |

| Leverage | N/A |

| EUR/USD Spread | N/A |

| Trading Platforms | MarketsPulse platform |

| Minimum Deposit | 50 USD/EUR/GBP (10 AUD for residents of Australia) |

| Customer Support | Phone: 1300-870-442 and 0210-951-847 |

What is HighLow?

HighLow is a broker that utilizes its own MarketsPulse trading platform and offers a minimum deposit limit of 50 USD/EUR/GBP (10 AUD for residents of Australia). The broker provides access to a variety of trading instruments across different asset classes, allowing traders to participate in various markets. However, it has claimed to be regulated by the ASIC, though recent reports suggest that this regulation may be a clone.

If you're interested, we encourage you to stay tuned for an upcoming article where we will conduct a comprehensive evaluation of the broker from multiple perspectives. We will present you with concise and well-structured information, giving you a thorough understanding of the broker's important qualities. At the end of the article, we will provide a condensed summary to provide you with a complete overview of the broker's key features.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

Pros of HighLow:

- Acceptable minimum deposit requirement, making it accessible for traders with different budget sizes.

Cons of HighLow:

- Website functionality issues, which can hinder the trading experience and make it difficult to navigate and execute trades effectively.

- Reports of users being unable to withdraw funds, raising concerns about the broker's reliability and trustworthiness.

- Lack of support for the popular MT4 trading platform, which may be inconvenient for traders who are accustomed to using it or rely on specific features offered by MT4.

- Suspicions surrounding the legitimacy of their claimed ASIC regulation, potentially casting doubt on the broker's credibility and regulatory compliance.

Is HighLow Safe or Scam?

HighLow's claimed regulation (license number: 364264) by the Australia ASIC is suspected to be fraudulent. This means that the broker lacks valid regulation and is not monitored by any government or financial authority. Consequently, investing with HighLow carries significant risk. It is crucial to conduct comprehensive research and carefully evaluate the potential risks and rewards before deciding to invest. Generally, it is advisable to choose regulated brokers to safeguard your funds.

Market Instruments

HighLow offers a diverse range of trading instruments across various asset classes, enabling traders to participate in different markets.

Currenc Pairs

One of the asset classes available on the platform is currency pairs. HighLow provides access to 17 different currency pairs, including popular pairs such as AUD/JPY, AUD/NZD, AUD/USD, CAD/JPY, CHF/JPY, EUR/AUD, EUR/GBP, EUR/JPY, EUR/USD, GBP/AUD, GBP/JPY, GBP/USD, NZD/JPY, NZD/USD, USD/CAD, USD/CHF, and USD/JPY. Traders can take positions on these currency pairs based on their analysis and predictions of the forex market.

Indices

In addition to currency pairs, HighLow also offers indices as trading instruments. Indices represent a basket of stocks from various companies, and trading them allows traders to speculate on the performance of the overall market or specific sectors. HighLow provides access to a range of indices, although the specific indices available may vary. Traders can participate in index trading, including popular indices such as the S&P 500, NASDAQ, FTSE 100, and Nikkei 225, among others.

Commodities

Furthermore, HighLow includes commodities as part of its trading instruments. Commodities are tangible goods or raw materials that are tradable in the financial markets. HighLow offers traders the opportunity to trade commodities such as gold, silver, oil, and natural gas. By trading these commodities, individuals can potentially profit from fluctuations in their prices caused by supply and demand factors or geopolitical events.

Accounts

Customers have the option to initiate a Standard Account on HighLow with a minimum deposit limit of 50 USD/EUR/GBP. Additionally, for residents of Australia, they are provided the opportunity to open an account with a minimum deposit of 10 AUD. This flexibility in deposit requirements allows individuals from different regions to easily access the trading platform and embark on their trading journey. By catering to varying financial capacities, HighLow aims to promote inclusivity and ensure that trading opportunities are available to a wider range of individuals.

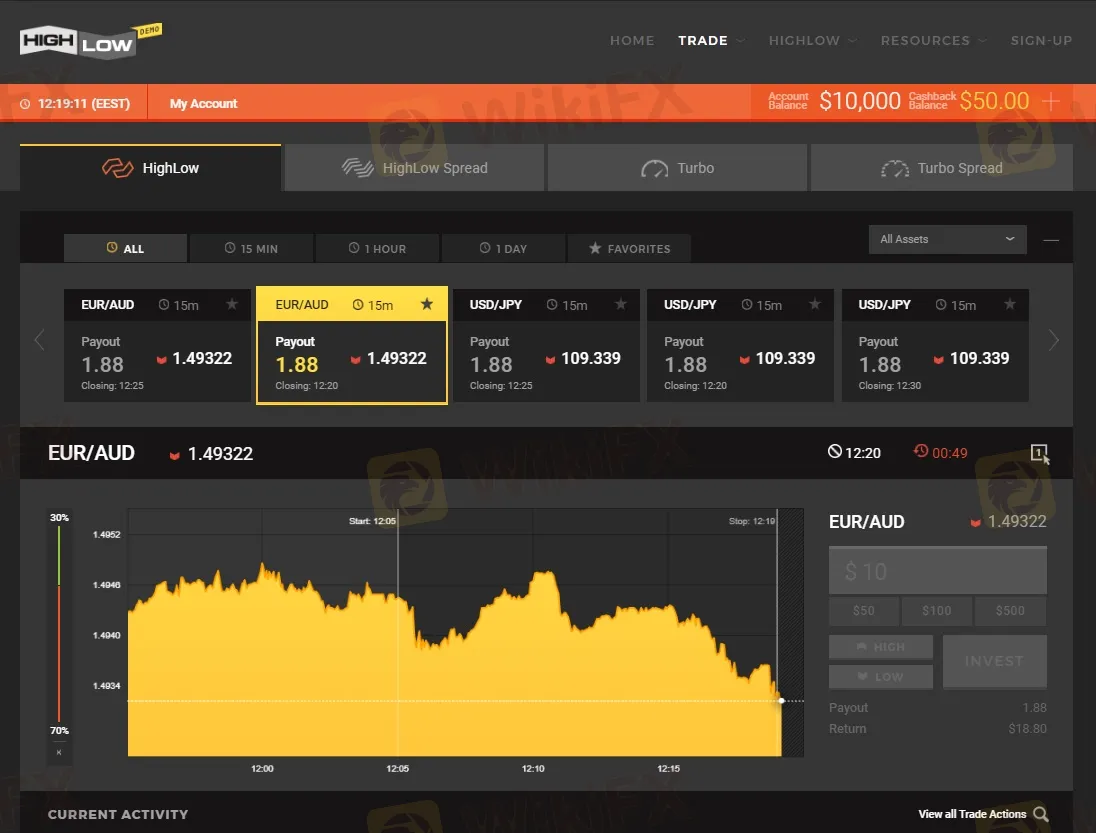

Trading Platform

HighLow utilizes its proprietary MarketsPulse platform, which is also accessible through mobile applications for iPhone/iPad and Android devices. This platform has its unique and user-friendly interface. When a specific asset is chosen, the chart below will automatically update to display the current price levels, trader sentiment, payout rates, and the expiry time. However, it is worth noting that the charts on this platform are relatively simple and do not offer advanced technical analysis features.

Additionally, the platform offers a Trader's Choice feature, which serves as a sentiment indicator. This feature enables users to monitor current trading trends in real time.

Deposits & Withdrawals

HighLow offers extensive support for various payment methods, catering to the diverse needs of its users.

These payment options include Bank Wire Transfer, Credit Cards (VISA/MasterCard), and e-Wallets (Neteller/Poli/Sofort/PaysafeCard/GiroPay/SOPOR Pay). Users have the flexibility to choose the most convenient and suitable method for their transactions.

In terms of withdrawal, the minimum amount allowed is $50, ensuring users can easily access their funds when needed. Additionally, the minimum deposit requirement is set at a low threshold of $50 for Credit Card or Neteller transactions, while Bank Wire Transfer has a minimum deposit limit of $10. These accommodating deposit options aim to provide accessibility and convenience to all users, regardless of their financial capabilities.

User Exposure on WikiFX

Please review the report on our website regarding difficulties with fund withdrawals. It is important for traders to carefully assess the available information and understand the risks involved in trading on an unregulated platform. Before engaging in any trading activities, it is recommended to visit our platform for additional information. If you have come across any fraudulent brokers or have personally experienced such issues, we encourage you to report this in the Exposure section. Your cooperation is greatly appreciated, and our team of experts will make every effort to address and resolve the problem on your behalf.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: 1300-870-442 and 0210-951-847

Conclusion

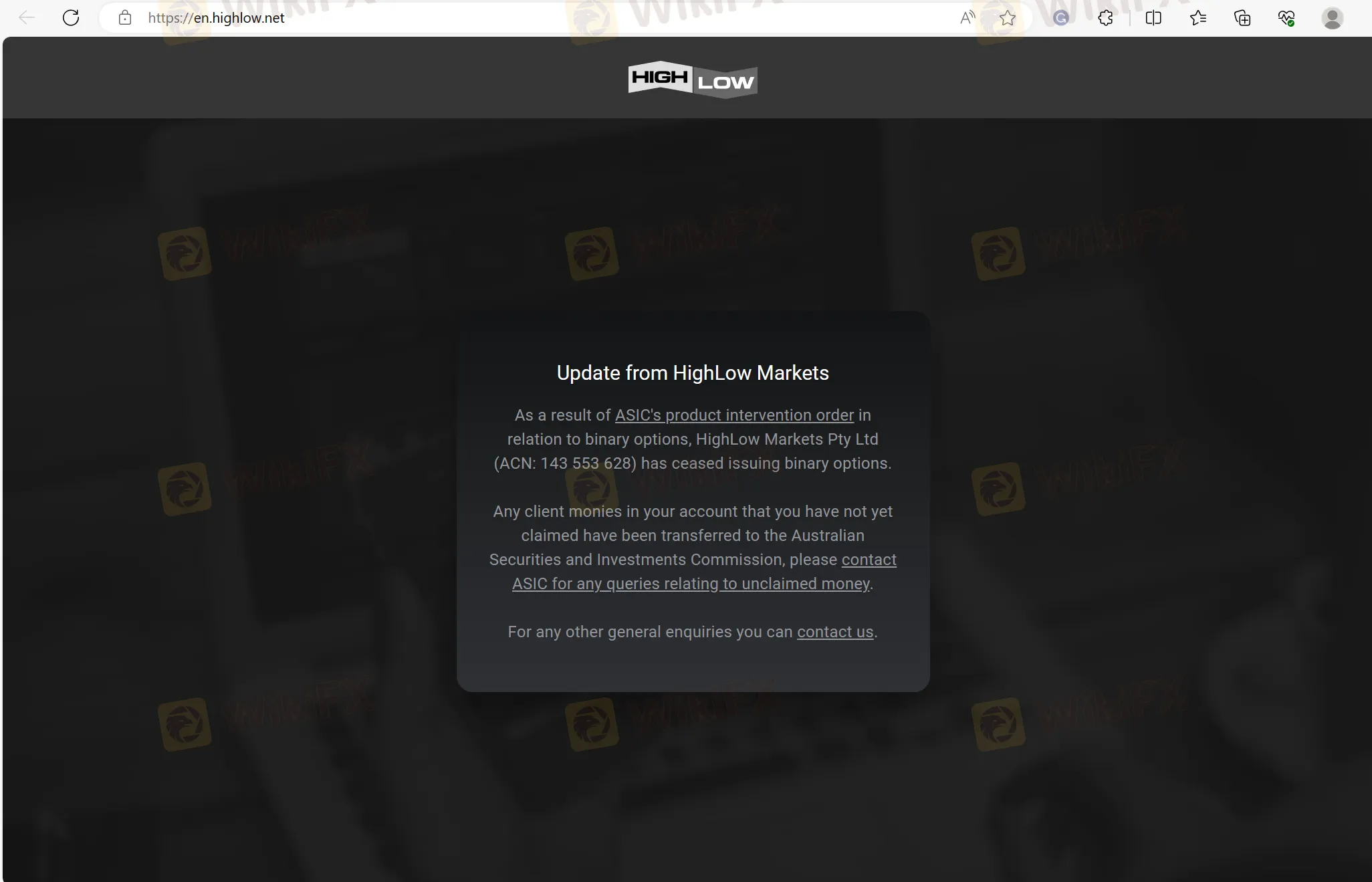

In conclusion, HighLow is a broker that operates on its proprietary MarketsPulse platform and offers a range of trading instruments across different asset classes. However, there are concerns regarding the validity of its claimed regulation by the Australia ASIC, as it is suspected to be a clone. By the way, its website doesnt work. It is recommended to thoroughly research and consider the potential risks before deciding to invest with HighLow. Choosing a well-regulated broker is generally advised to ensure the protection of funds and investments.

Frequently Asked Questions (FAQs)

| Q 1: | Is HighLow regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at HighLow? |

| A 2: | You can contact via phone, 1300-870-442 and 0210-951-847. |

| Q 3: | Does HighLow offer demo accounts? |

| A 3: | No. |

| Q 4: | What is the minimum deposit for HighLow? |

| A 4: | The minimum initial deposit to open an account is 50 USD/EUR/GBP (10 AUD for residents of Australia). |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Read more

The Hidden Tactics Brokers Use to Block Your Withdrawals

In the fast-paced world of online trading, liquidity is everything. Traders and investors must have unrestricted access to their funds at all times. Any broker that imposes unnecessary conditions or delays when it comes to withdrawals is raising a glaring red flag.

Forex Trading: Scam or Real Opportunity?

Meta: Explore forex trading: Is it a scam or real opportunity? Learn how it works, debunk myths, manage risks, and avoid scams with tools like WikiFX App. Start trading safely today!

Trade Nation 2025 Most Comprehensive Review

This article evaluates the broker from multiple dimensions, including a basic introduction, fees, safety, account opening, and trading platforms.

FCA Warns of Trading212 Clone Scam Targeting Investors

FCA alerts investors about a Trading212 clone scam using fake details. Learn how to spot clones and protect your funds with the WikiFX app.

WikiFX Broker

Latest News

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

Deutsche Bank Facing Record Fine from German Watchdog – What’s the Price

Oleg Mukhanov Steps Down as TradingView CEO Amid Leadership Shakeup

Rate Calc